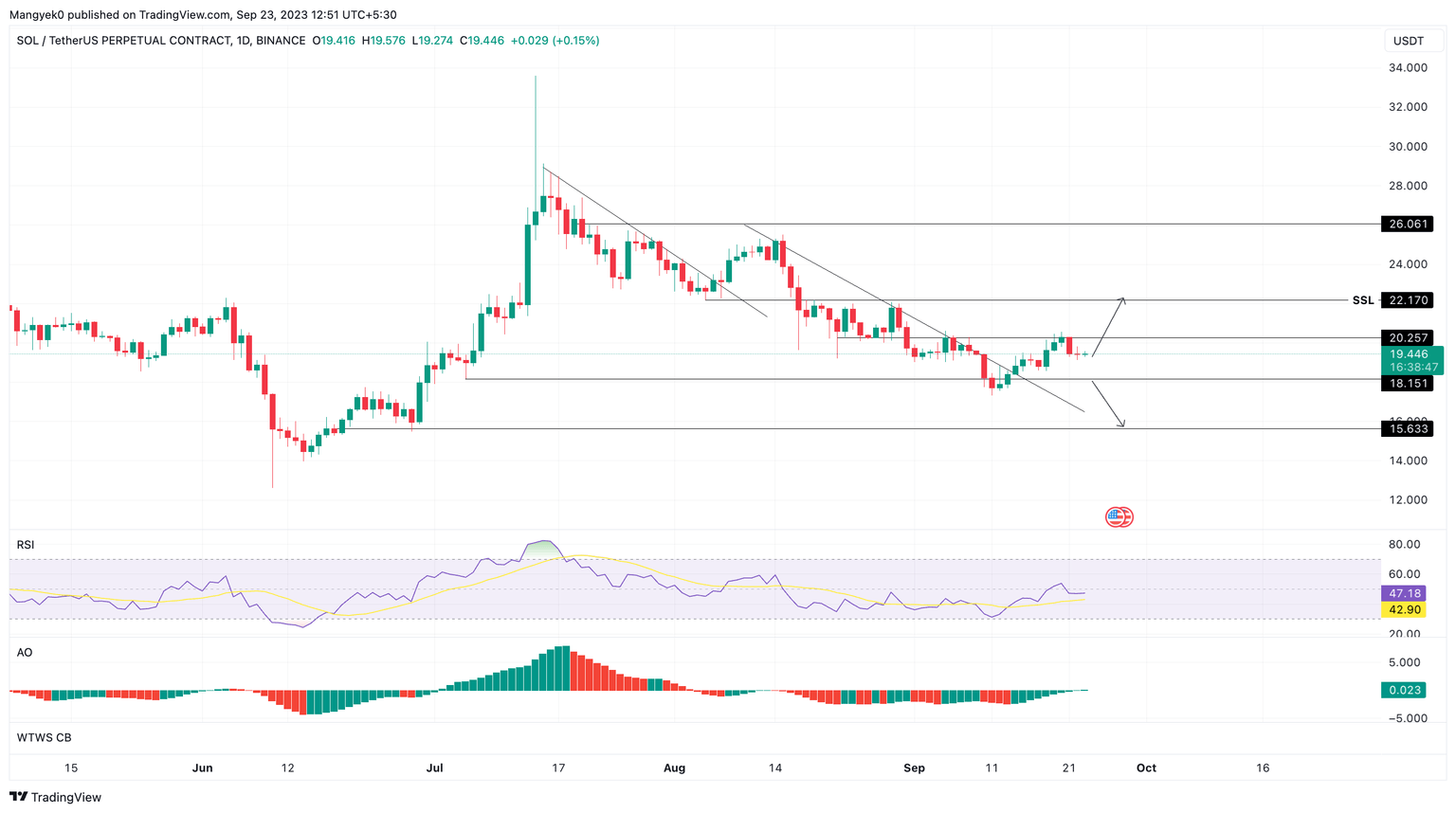

Solana Price Forecast: SOL can rally 14% if RSI can reclaim this level

- Solana price has been struggling to overcome the $20.25 resistance level for nearly three weeks.

- The AO indicator shows bullish development but needs RSI’s recovery above 50 so SOL can kick start its rally.

- Investors can expect the altcoin to trigger a 14% ascent to $22.17 hurdle.

- A breakdown of the $18.15 support barrier will trigger a bearish outlook and potentially catalyze 11% descent to $15.63.

Solana price has attempted many recoveries but all of them have met with a similar fate as sellers pile on. Currently, SOL is in a position to trigger one such bounce, but this move is contingent on the RSI indicator.

Also read: Solana price sustains recovery rally despite falling daily active addresses

Solana price at opportune level

Solana price slipped below the $20.25 level on August 31 and has been attempting to recover above it ever since. But after two rejections SOL currently trades at $19.45. Interestingly enough, the Awesome Oscillator (AO) has recovered above the mean level, suggesting the resurgence of bullish momentum. The Relative Strength Index (RSI), however, is still knocking on the 50 level.

While the outlook for Solana price is bullish, the bounce is contingent on the RSI recovering above the 50. Doing so would indicate that the buyers are back in town. A decisive daily candlestick close above $20.25 would be a secondary confirmation. In such a case, SOL might attempt a quick retest of the $22.17.

This move, in total, would constitute a 14% rally for Solana price.

SOL/USDT 1-day chart

The outlook for Solana price is still on the fence and investors need to be cautious about picking a side. Another rejection at $20.25 is not unlikely. In such a case, SOL needs to hold above $18.51 barrier.

A breakdown of this level would confirm the start of a bearish scenario. In such a case, Solana price could drop 11% and tag the $15.63 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.