Solana price action will get boring unless one of these levels is broken

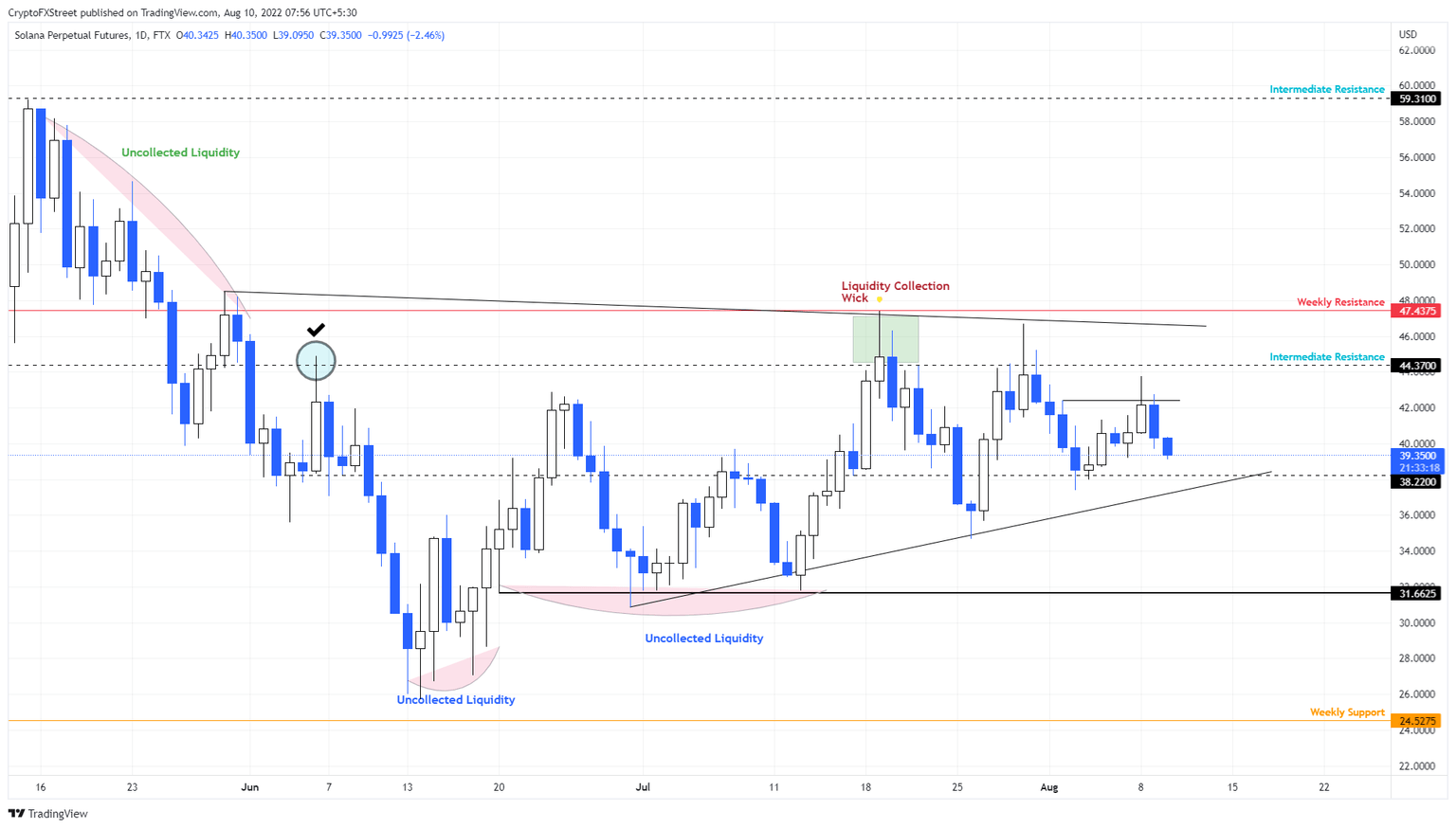

- Solana price is trading inside a symmetrical triangle with liquidity resting on either side of it.

- Although SOL came close to breaking out, it was rejected and pushed into two barriers, where it is likely to consolidate.

- A daily candlestick close below $38.22 will trigger a bearish breakout to $31.66.

Solana price shows a slow takeover of the bears after bulls managed to move the asset higher. Due to Bitcoin’s sudden sell-off, altcoins, including SOL, have taken a major hit. If the momentum does not sway in a particular direction, the so-called “Ethereum-killer” will possibly be stuck ranging within two barriers.

Solana price oscillates with no directional bias

Solana price has produced higher lows and lower highs, indicating a massive squeeze for SOL. However, the recent attempt to move higher set a lower high at $43.77 on August 8. Currently, the altcoin is trading between the $44.37 and $38.22 barriers.

Although there might be an attempt to partially recover the recent losses, the market is currently skewed toward bears. Therefore, investors should prepare for a Solana price consolidation between the aforementioned barriers followed by a breakdown of the $38.22 support level.

Doing this is likely to trigger a 17% crash in SOL, allowing it to revisit the $31.66 foothold. While this level will serve as support, there might be a sweep due to the liquidity resting below it. In a dire case, where this level is broken, Solana price might revisit the $24.52 weekly support level and, in the process, collect the sell-stop liquidity resting below the wicks formed between June 13 and June 19.

SOL/USDT 1-day chart

On the other hand, if Solana price manages to bounce off the $38.22 support level and breach the $47.43 hurdle, it will indicate a breakout and invalidate the bullish thesis. In such a case, SOL price could attempt to collect the buy-stop liquidity resting above the wicks formed between May 15 and May 31.

This development could see Solana price retest and perhaps sweep the $59.31 resistance level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.