Solana meme-coin frenzy pushes network activity, TVL to two-year highs

- Solana has seen a massive spike in its network activity, hitting a two-year peak.

- The total value of assets locked on the Solana chain exceeds $4.14 billion for the first time in nearly two years.

- SOL price climbed nearly 4% on the day, partly recovering from its weekly losses.

The recent surge in meme coins tied to Solana’s ecosystem has led to spike in activity on the SOL chain, with the number of new and active addresses as well as its Total Value Locked (TVL) reaching the highest levels in two years. SOL price resumed gains on Monday after last week’s sell-off, rising by nearly 4% on the day in a session in which the biggest crypto assets are all in the green.

Also read: Solana Price Prediction: SOL likely to fall another 20% before buyers step in

Solana sees rise in address activity, TVL

The meme coin frenzy, reflected in the recent price rallies in SOL-based tokens, has increased Solana’s network activity. Based on metrics from The Block, several key metrics marked near two-year peaks in Solana:

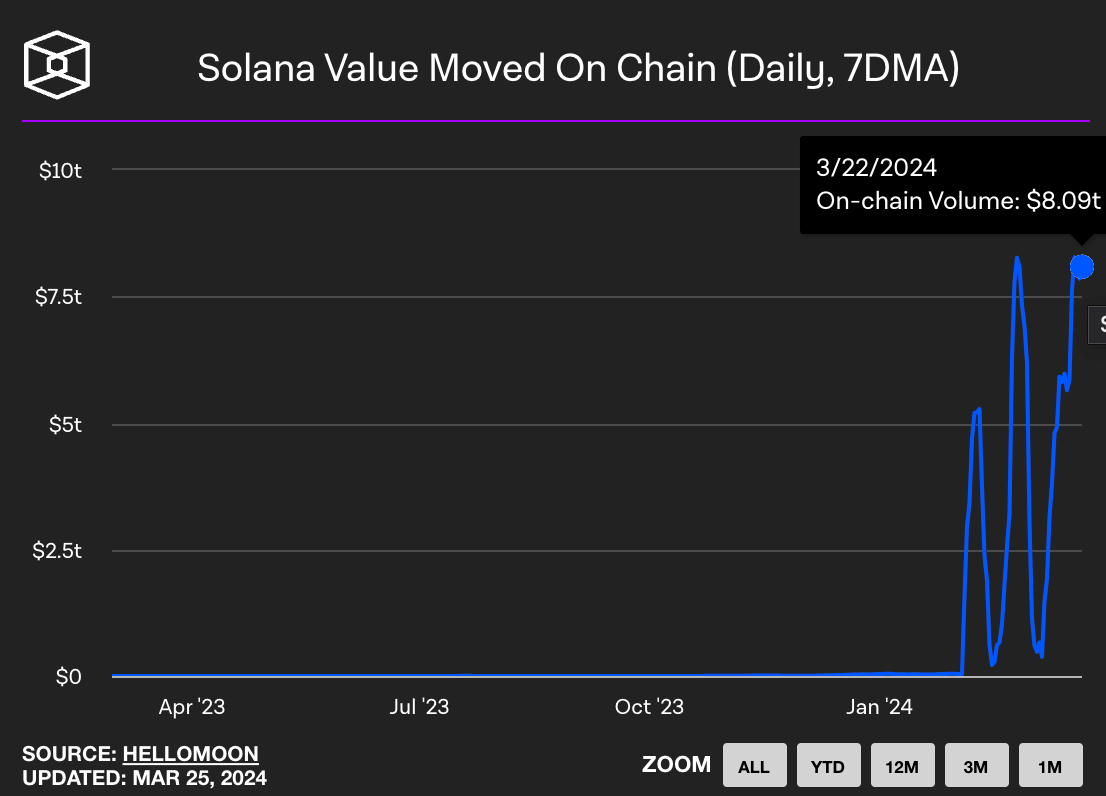

- Solana Value Moved On Chain

SOL value moved on-chain – which represents the utility and demand for the blockchain among market participants – crossed $8.09 trillion on March 22, marking a near two-year peak.

Solana Value Moved On Chain. Source: TheBlock

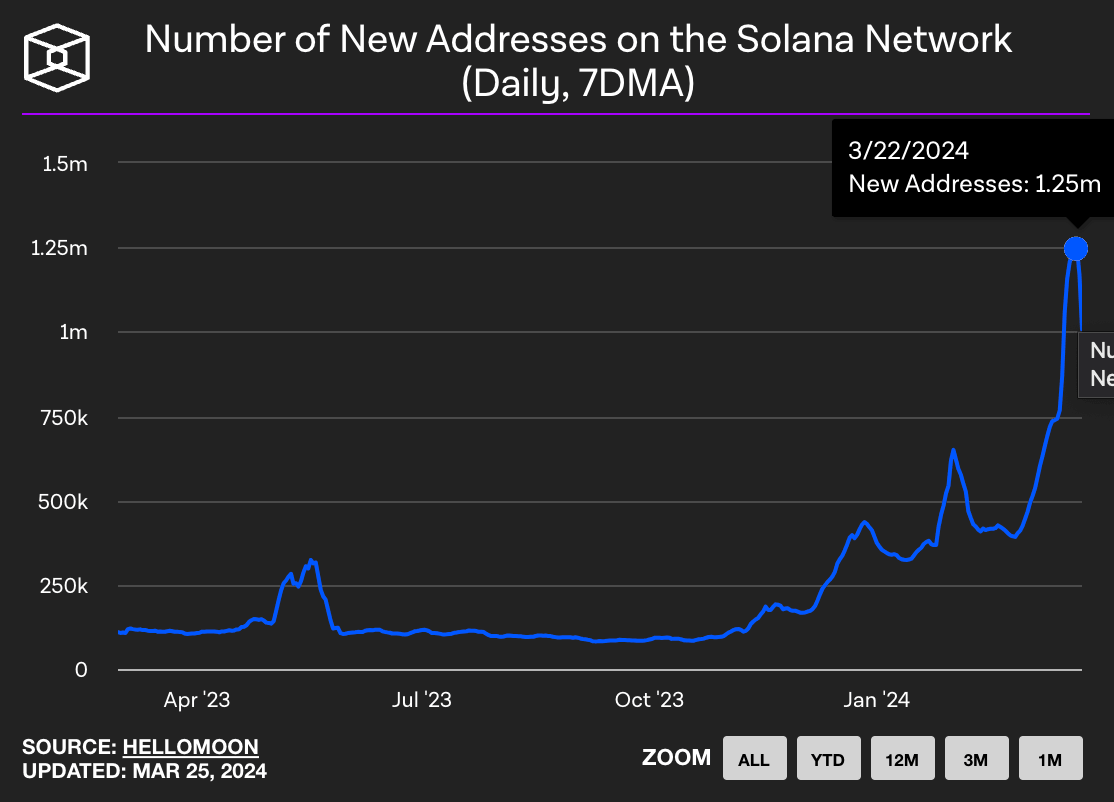

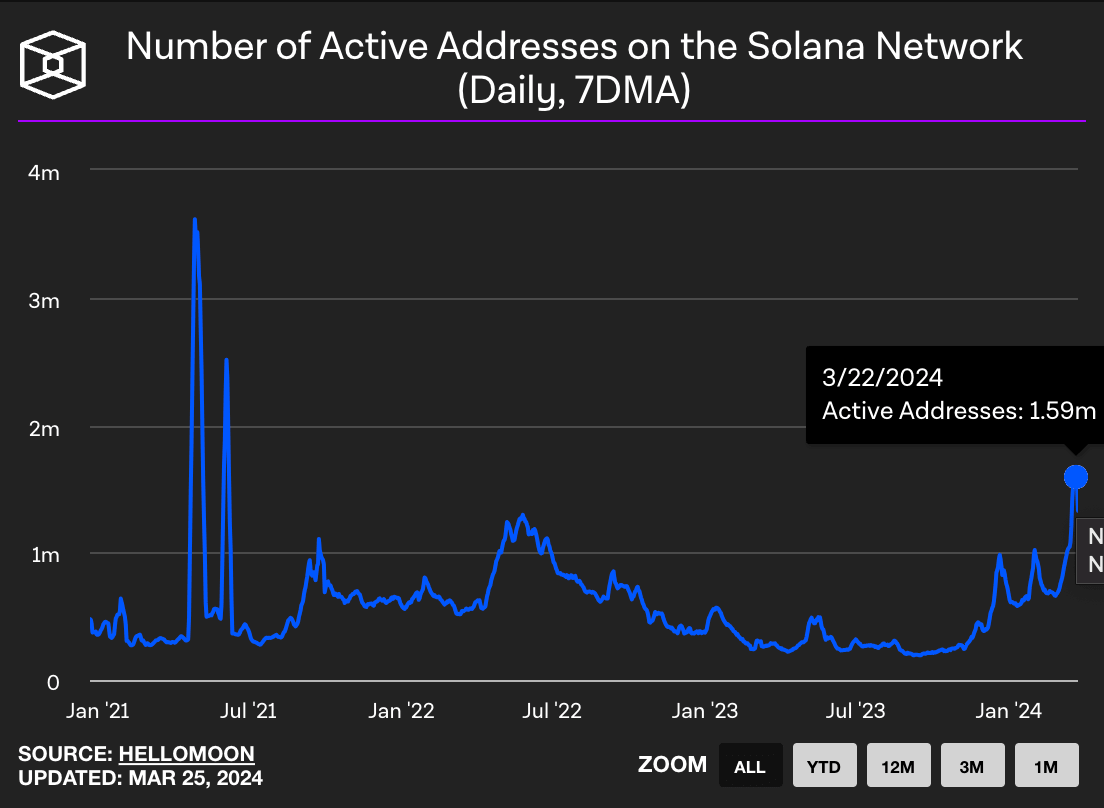

- Number of New Addresses on the Solana Network and Number of Active Addresses on the Solana Network

Address activity is indicative of the utility of a blockchain network. A rise in the number of new and active addresses can likely be attributed to the surge in demand for meme coins and Solana-based assets.

As Bitcoin price rally powered capital rotation into altcoins and meme coins, the number of new and active addresses on the network increased to a peak of 1.25 million and 1.59 million, respectively, on March 22.

Number of New and Active Addresses on the Solana Network. Source:TheBlock

The bullish on-chain metrics come along with an increase in the TVL of the Solana blockchain. DeFiLlama data shows that SOL TVL is $4.414 billion, the highest level since April 5, 2022.

Solana TVL. Source: DeFiLlama

Meme coins and politically-themed tokens have likely contributed to Solana emerging as a favorite among users reeling from high transaction costs on the Ethereum blockchain. The ongoing cycle has seen a spike in demand for Solana, as evidenced by the on-chain metrics and the TVL of the network’s on-chain ecosystem.

Meanwhile, SOL market capitalization broke its all-time high above $87 billion on March 19, according to CoinGecko data. At the time of writing, Solana price is up 4% on the day and the asset is partly recouping its losses on the weekly time frame.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.