Solana failed transactions exceed 70% as meme coin frenzy attracts bots

- Solana blockchain noted a spike in failed transactions as new tokens attract bots that spam the network.

- Dogwifhat, Myro, Popcat yield double-digit daily gains amidst the meme coin rally.

- Solana price faces risk of nearly 5% correction despite rising user activity.

The Solana blockchain has noted a surge in transaction volume and activity on its chain in response to the recent gains in meme coins. However, the meme coin frenzy has also attracted bots to the SOL network, driving the rate of failed transactions up to 72%.

Also read: Solana-based meme coin SLERF surges more than 3,700% as developer burns $10 million presale tokens

Solana meme coin frenzy raises failed transaction concern

Meme coin rally is led by Solana-based Dogwifhat (WIF), Myro (MYRO), Bonk (BONK), Popcat (POPCAT), among others. These meme tokens have registered double-digits on the daily timeframe.

Solana-based meme coins. Source: CoinGecko

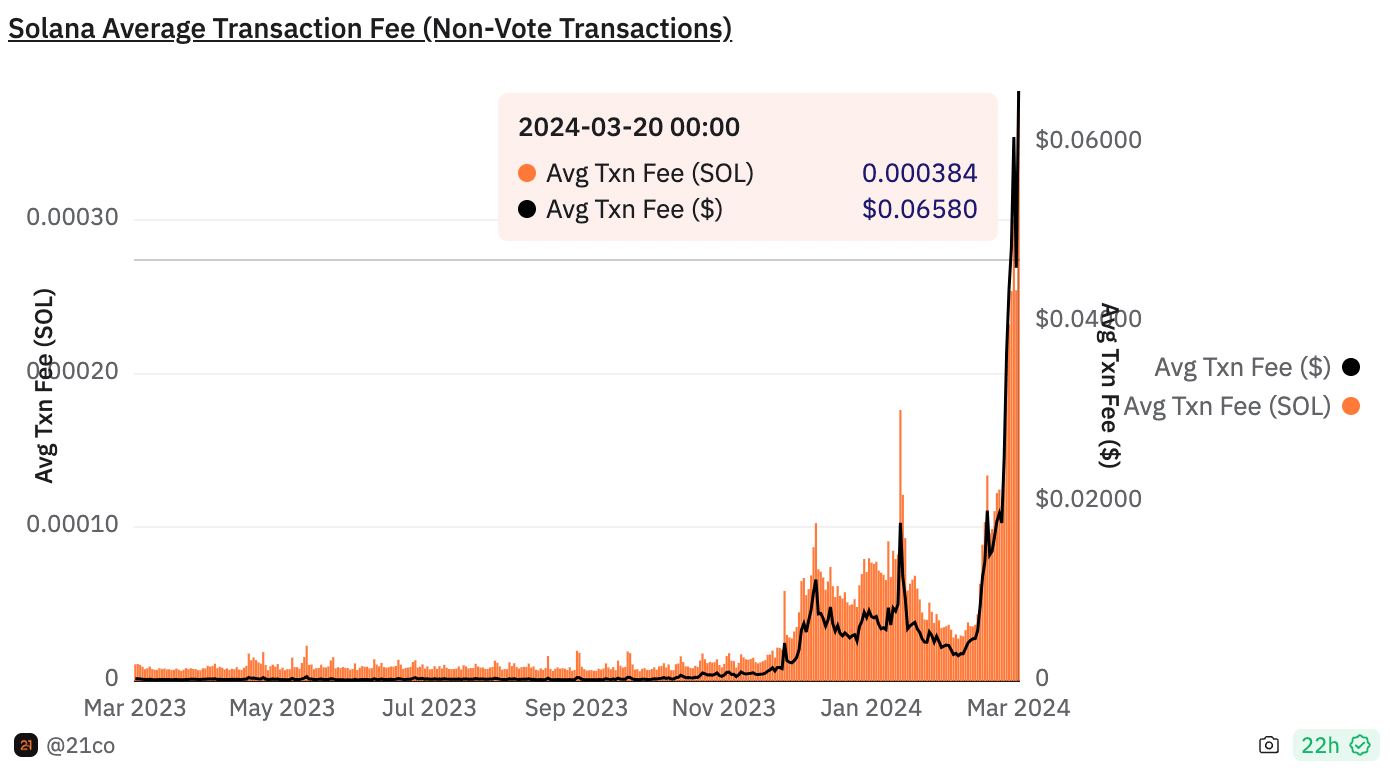

The massive meme coin rally has prompted a rise in the DEX volume on Solana and increased transaction fees by two to three times, according to analytics by 21Shares on Dune.

Solana DEX Volume. Source: 21Shares on Dune

Despite the recent increase, the average transaction fee on Solana is $0.06580, cheaper than most Ethereum Layer 2 chains after the successful execution of the Dencun upgrade.

Solana Average Transaction Fee. Source: 21Shares on Dune

The rise in meme coin tokens and their transactions on the Solana blockchain has attracted bots that spam the SOL network. These bots are looking to capture potential income generation opportunities on the chain and this has caused the network to experience a large volume of failed transactions.

According to data from Dune, 93% of the failed transactions come from bots that are spamming the network whereas organic users have a mere 17% rate of transaction failure.

Solana price risks 5% decline

Solana price is in a short-term downward trend since the altcoin hit its year-to-date peak of $210.18 on Monday. Since then, SOL price declined nearly 12% to $189.26 at the time of writing.

SOL price could rebound after it collects liquidity at the daily support level at $178.35. A drop to this level represents a 5% decline in SOL price. Technical indicators suggest that the altcoin is likely to reattempt a rally to the year-to-date peak of $210.18.

The Moving Average Convergence/Divergence indicator is flashing green bars above the zero line, signaling positive momentum in SOL. The Relative Strength Index (RSI) reads 66.65, out of the overbought zone above 70, signaling there is further room for gains.

SOL could face resistance at $186.28, the 78.6% Fibonacci retracement level, on its way to its target of $210.18.

SOL/USDT 1-day chart

If SOL closes the day below $178.35, the daily support, it could invalidate the thesis of a rebound. In such a case, Solana price could fall to the bullish order block between $140 and $148 to collect liquidity.

SOL price could find support at $141.15 and $124.84, the 38.2% and 23.6% Fibonacci retracement levels, respectively, on the daily chart. Further down, $118.29, the weekly support level, is an important support for SOL.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.