Solana leads altcoin pack with $6.1 million in inflows from institutional investors

- Solana leads Polkadot, Cardano, XRP and other altcoins with $6.1 million in institutional capital inflows last week, data from Coinshares shows.

- Digital asset investment products noted $862 million in inflows, with Bitcoin leading and only $18.3 million directed towards altcoins.

- Solana's price lost nearly 6% on the day as on-chain activity declines after the spike seen in the last week of March.

Solana’s (SOL) price falls sharply on Tuesday, influenced by the steep decline in Bitcoin prices, even though the altcoin registered $6.1 million in inflows from institutional investors last week. While the recent meme coin frenzy may have benefited Solana and attracted capital last week, a recent drop in on-chain activity and a slowdown in inflows could be behind the recent price decline.

Solana leads recovery in institutional capital inflow

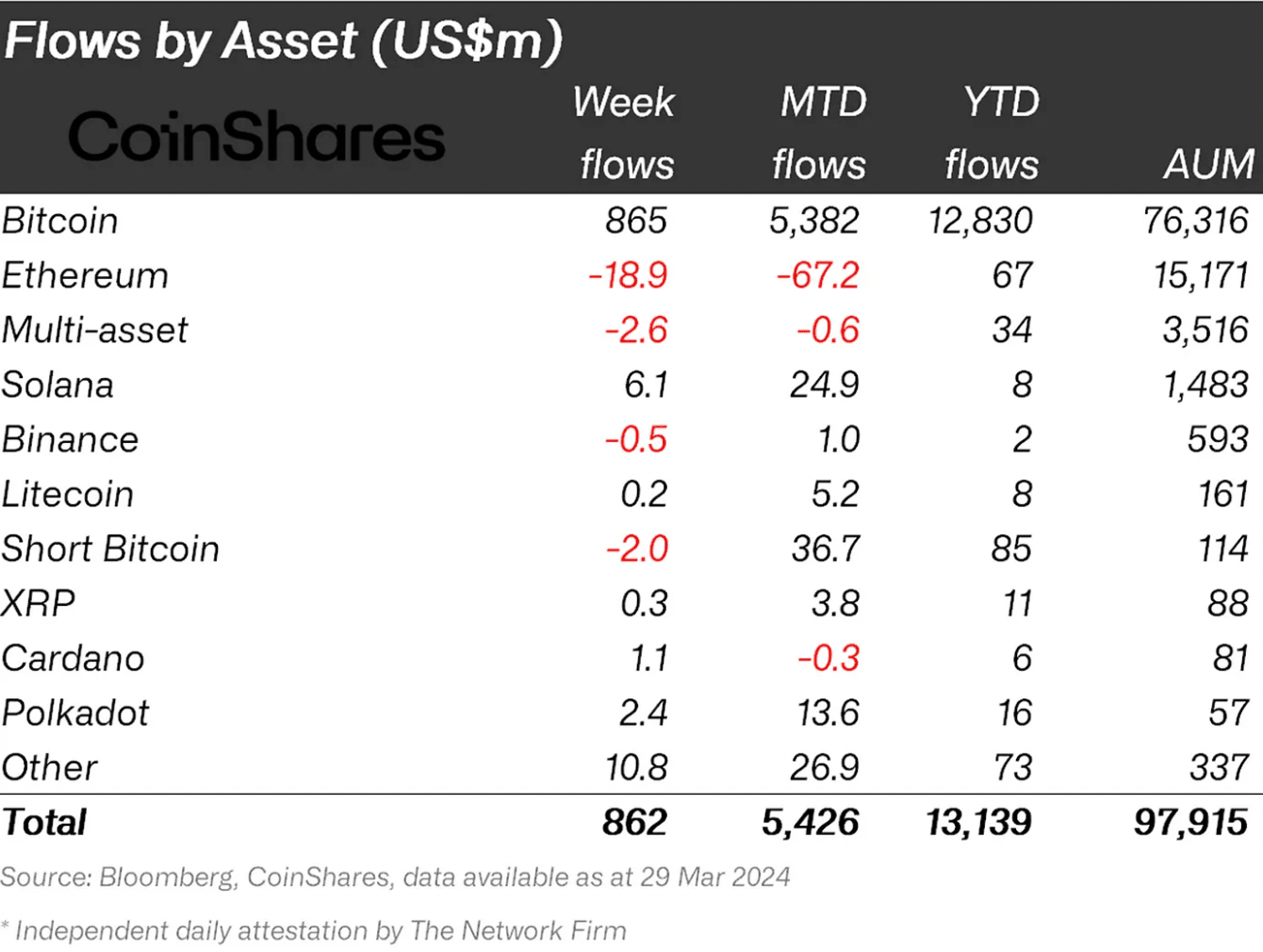

Data from European alternative asset manager CoinShares, shows that digital asset investment products saw a recovery in sentiment last week, with institutional capital inflows totaling $862 million. This marks nearly a complete recovery compared to the prior week’s record $931 million outflows.

Most inflows to cryptocurrency markets were due to Bitcoin, which registered a $865 million capital inflow. Meanwhile, altcoins saw a combined inflow of $18.3 million, with Solana leading the pack ahead of XRP, Chainlink, and Polkadot.

Flows by asset.

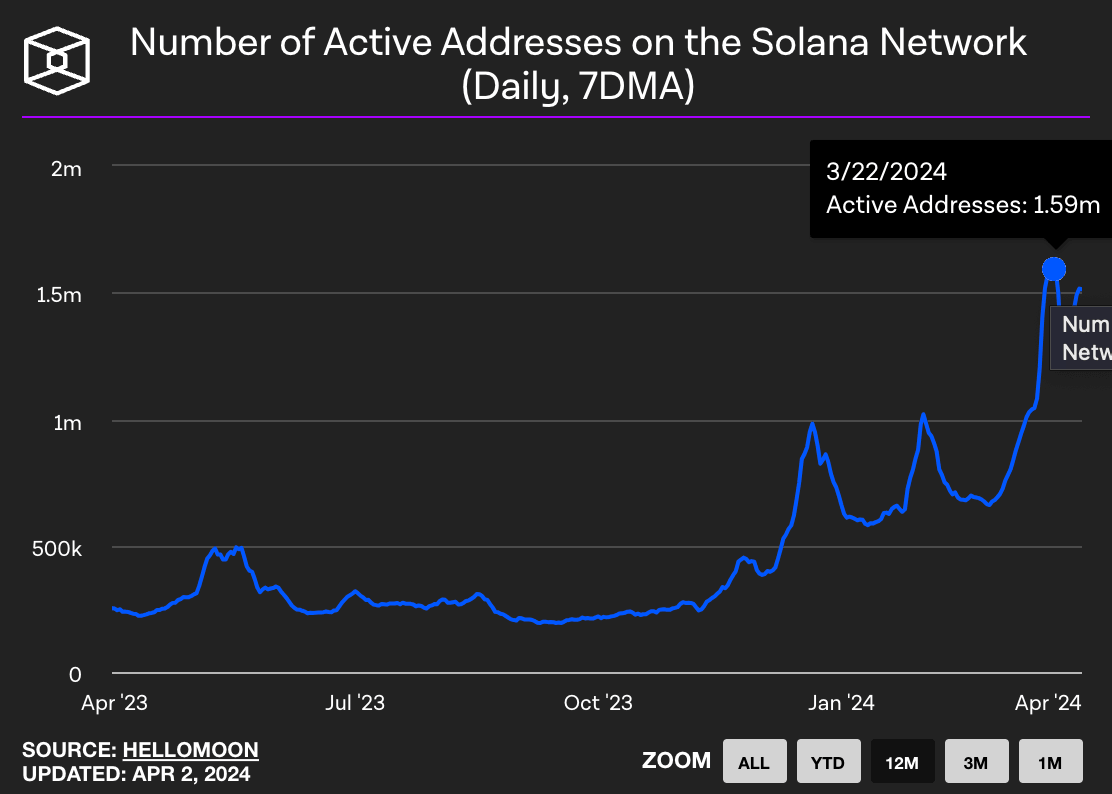

While Solana-based funds observed a $6.1 million weekly inflow, on-chain activity on the chain has registered a sharp decrease. On-chain data from the Block shows that the number of new addresses and active addresses on Solana are in a downward trend since the six-month high seen on March 22.

Number of Active Addresses on Solana

Solana price dips following BTC correction

Bitcoin price suffered a decline to $66,000 early on Tuesday on account of massive liquidations across derivatives exchanges. BTC’s price decline ushered in a correction in large market capitalization assets, including Solana.

Solana price is down nearly 6% on the day despite the Solana based meme coin rallies and user activity in assets like Book of Meme (BOME), Cat in a dogs world (MEW) and Tombili the Fat Cat (FATCAT). Find out more about these assets here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.