Solana price dips after higher-than-expected payrolls lift dollar

- Solana price takes another step back after the US job numbers as price action drops over 1%.

- SOL price cracks under pressure from the dollar.

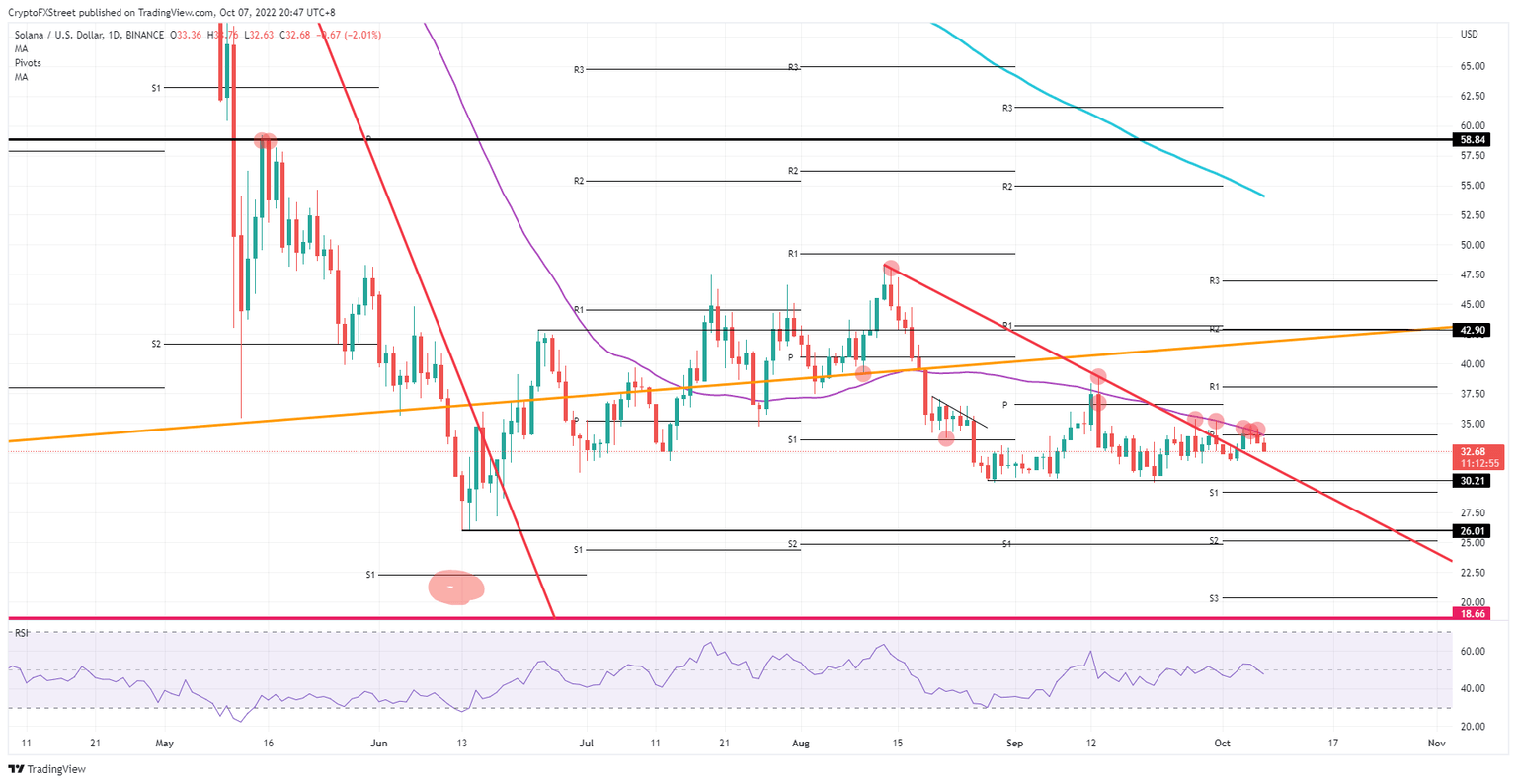

- Expect a drop back toward $30.21 as hopes for some easing evaporate.

Solana (SOL) price action sees job numbers coming in stronger-than-expected. Although not a big beat, more people still joined the labour market in September than economists had forecast, and in more challenging conditions. The Fed will be even more committed to continuing its tightening path to combat still-high inflation, which in its turn supports a stronger dollar and puts SOL price action in the penalty box.

SOL price set to see investors flee before the weekend

Solana price action was at a good point to close the week with gains, but that outlook changes as the US job numbers show yet another beat of expectations. With 263K against 255K, it is not a big defeat, but still, enough for the Fed to keep at it and possibly do even more. Any of those scenarios means a stronger dollar, which means that where there is a winner, there is a loser. In this zero-sum game, Solana price action is the loser.

SOL price is thus set to retrace in full to where price action opened on Monday morning near $31.83. The risk is that the floor under there breaks and collapses to $30.21, with price action falling below the red descending trend line. An additional risk for next week will be that price action drops to $26.01 and tests the low for this year.

SOL/USD Daily chart

Another turnaround into positive territory looks unlikely but not impossible. As the dust settles over the weekend, investors will be back in the market to buy the dip as worked on Monday and Tuesday, with some profit taking on Wednesday. Expect to see the same happening next Monday, when price action could try to jump back to $35.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.