Solana finds support that could catapult SOL to $200

- Solana price bounces off crucial support, negating any near-term bearish breakout concerns.

- Key resistance levels ahead must be broken to continue to new all-time highs.

- Bitcoin's momentum to benefit Solana price action.

Solana price is showing clear rejection by buyers to any threat of downside pressure. However, bulls have responded strongly to launch Solana away from nearby bearish breakout levels.

Solana price rejected lower, looks to continue prior bull market

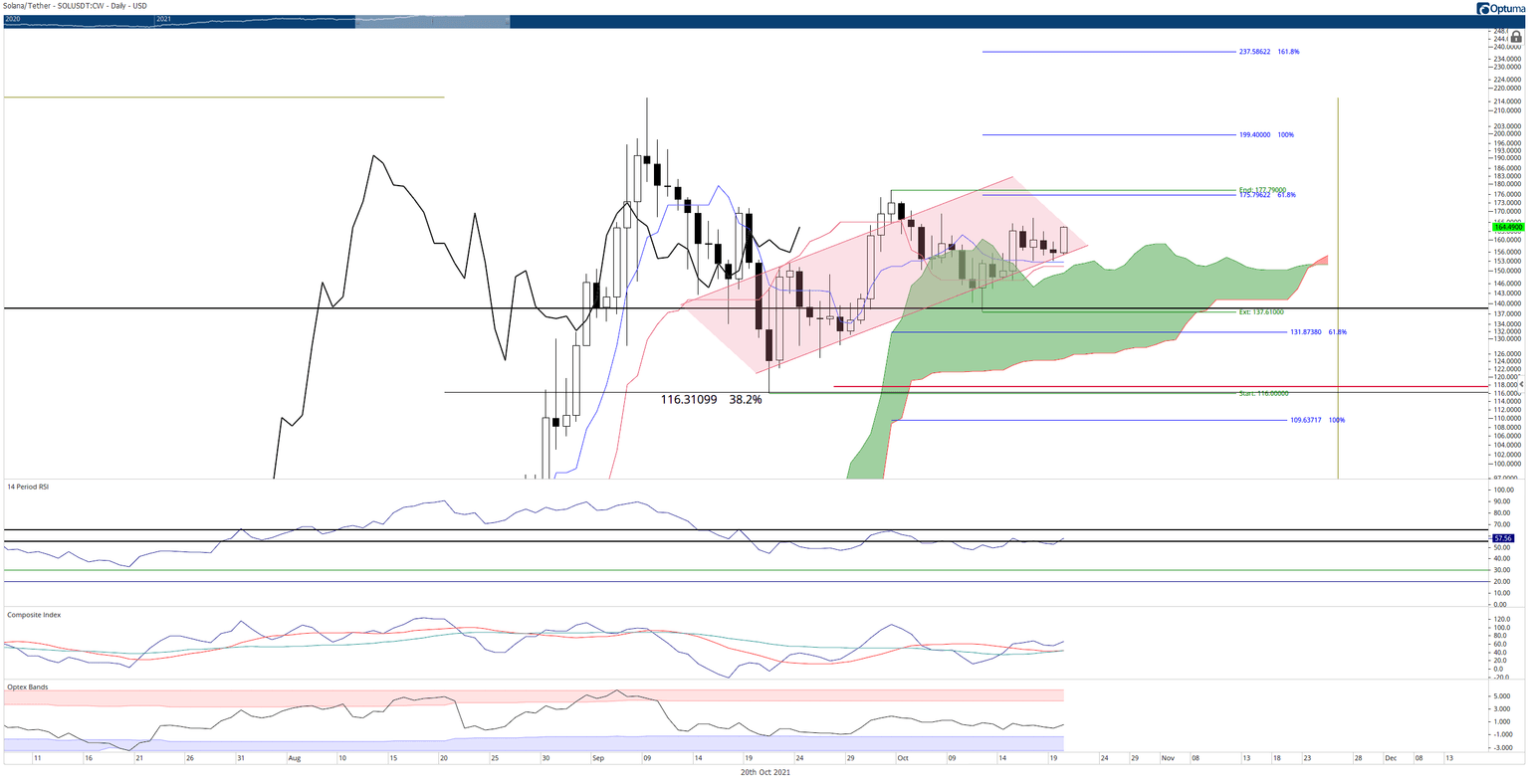

Solana price found significant support within the $150 value area. The bottom of the bear flag, Tenkan-Sen, Kijun-Sen and the top of the Cloud (Senkou Span A) proved to be an area of support to strong for sellers to push through. Instead, that support has acted as a kind of springboard, launching Solana higher.

The momentum may be long-lasting as well. The Relative Strength Index remains in technical bear market conditions but is now crossing above the 55 level. If it moves higher and then crosses above 65, the Relative Strength Index may shift to bull market conditions. Adding to the likelihood of sustained bullish momentum are the Composite Index's neutral level and the Optex Bands' neutral condition. All of the oscillators factors give Solana price lots of room to run higher.

The critical level that Solana price must close at to confirm a sustained move higher is $173. A close at $173 could put the daily candlestick above the body of the last swing high on October 3rd, as well as position the Chikou Span into open space.

SOL/USDT Daily Ichimoku Chart

Buyers should always be cautious of any rug pull or black swan event that could negate the current bullish outlook. Any close that would put Solana price below the collection of support levels previously discussed and into the Cloud ($149) would invalidate all bullish bias.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.