Solana meme coin BOME leads meme rally with 300% daily gains and nearly $1 billion market cap

- Solana ecosystem’s meme coin BOME observed 292% daily gains in its price and the market cap hit $996 million.

- A wallet address exchanged 12,721 SOL tokens for 314 million BOME on Friday, the investment has more than doubled.

- Binance’s listing announcement catalyzed further gains in BOME price.

Meme coin market sees renewed enthusiasm as Solana-based BOME leads the rally. Binance officially announced the Book of Meme (BOME) listing on its spot market, after introducing the meme coin in the futures market, earlier.

Also read: Solana-based Jupiter posts hefty returns amidst meme coin rally

BOME meme coin rallies nearly 300% overnight

Solana based meme coin BOME price witnessed a massive surge on Saturday after Binance’s official listing announcement. The meme coin is currently leading a rally of SOL ecosystem based tokens, after climbing nearly 300% on Saturday.

The meme coin added $996 million in market capitalization within two days of trading and was listed on Binance and Bybit futures within the same time.

A wallet address tracked by Spotonchain exchanged 12,721 SOL for 314 million BOME tokens. The wallet address more than doubled their investment, $2.3 million in SOL changed to $5.69 million in BOME.

SOL exchanged for BOME. Source: Spotonchain

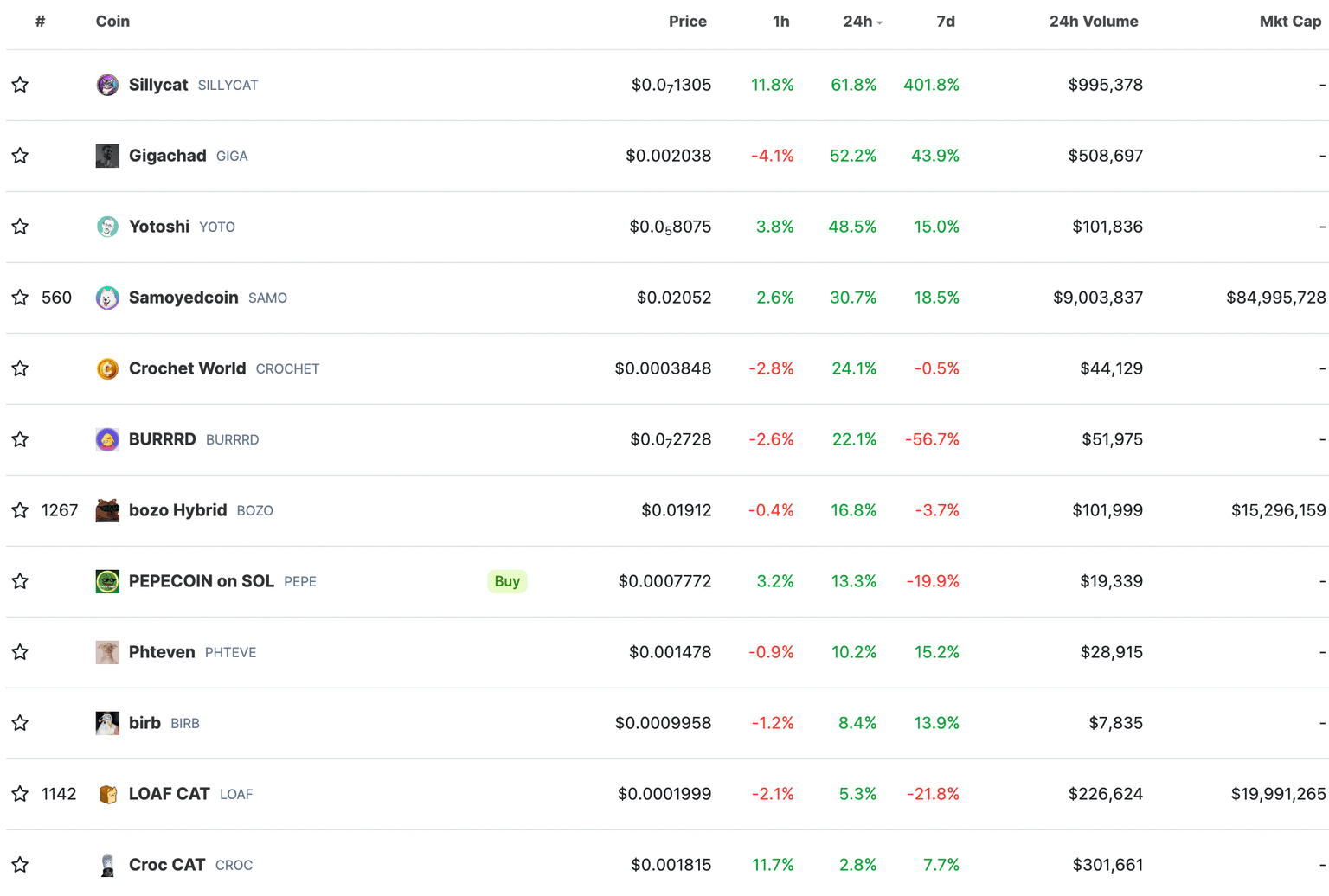

BOME is leading the meme coin rally in the Solana ecosystem, with assets like Sillycat (SILLYCAT), Gigachad (GIGA), Samoyedcoin (SAMO), Pepecoin on Solana (PEPE) and Loaf Cat (LOAF) yielded gains for holders in the past day.

Solana meme coin. Source: CoinGecko

At the time of writing, BOME price is $0.0190 according to CoinGecko data.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.