Six reasons why Polygon’s MATIC price will make a comeback in 2024

- Polygon price has been hovering below the $1 psychological level for nearly a year.

- MATIC has already flipped the $0.941 resistance level and is eyeing a breakout.

- Investors can expect the Layer 2 token to tag the range high at $1.56 in the long run.

MATIC price could be due for a major rally in the coming weeks for two main reasons: the circulating supply of Polygon’s token is now at 100%, and it is an Ethereum Layer 2 solution, which plays into the ongoing positive narrative for all Ethereum-related entities.

Read more: Polygon inflation ends, MATIC price primed for explosive growth?

Polygon’s likely to come into the spotlight

Polygon’s fundamentals are looking strong for the following reasons.

- Zero Inflation: Polygon’s vesting contract spat out the last 273 million MATIC tokens last week, which effectively means no more inflation.

- Narrative: Additionally, Uniswap’s fee switch announcement has supercharged Ethereum ecosystem tokens, which are noticing massive rallies. Given Polygon’s main selling point is that it is Ethereum’s Layer 2 scaling solution, this is rubbing off on MATIC.

While these two are the main reasons why MATIC price could shoot up, here are four more reasons:

- Reduced selling pressure: The now-defunct Celsius sold the last of its $50 million worth of MATIC tokens in January.

- Restructuring: The change in Polygon’s MATIC token name to POL is also lined up for Q2 of 2024 in the Polygon 2.0 initiative. This development could improve Polygon's social scores and make them more relevant.

- ZK narrative: Additionally, the Zero-Knowledge narrative that began in Q4, 2023 could likely make a comeback in 2024 as Polygon upgrades its Proof-of-Stake (POS) chain to zkEVM (Ethereum Virtual Machine).

- Airdrop: Lastly, POL stakers could have an opportunity to get selected for a potential airdrop, quite similar to what occurred with the recently launched Celestia’s TIA token.

Considering the above, MATIC price seems primed for a bull rally from a fundamental perspective. The altcoin is at a critical juncture, clearing it could trigger a massive rally.

Also read: Uniswap fee distribution incentive could bode well for Ethereum-based tokens

MATIC price primed for a bull run

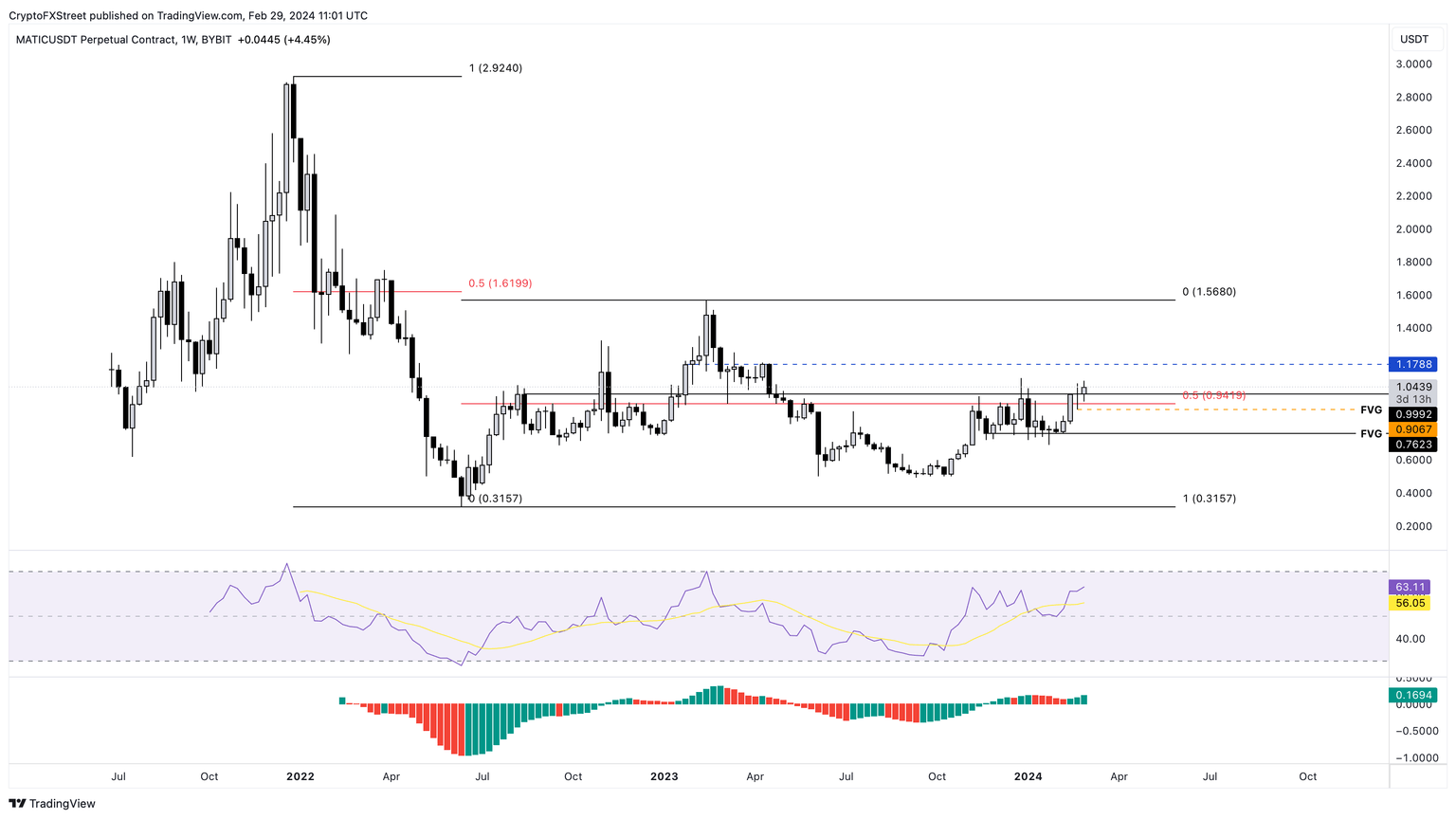

MATIC price has recently flipped above the $0.315 to $1.56 range’s midpoint at $0.941 and turned it into a support floor. This development comes as the weekly Relative Strength Index solidifies itself above the mean level. Considering that the Awesome Oscillator is also comfortably sitting above the zero level, it suggests a dominance in bullish momentum from a high time-frame perspective.

This week’s candlestick close is very key for MATIC price. If the altcoin manages to produce a decisive close above $1.000, it would signal the start of a massive move to the upside.

The first target would be $1.170, following which Polygon bulls could propel the altcoin to retest the range high at $1.560. This move would constitute a 50% ascent from the current position of $0.999.

MATIC/USDT 1-week chart

On the other hand, if MATIC price fails to close above $1.000 and slips below $0.941, it would signal a weakness in the crypto markets. In such a case, the altcoin could revisit the $0.906 level, where buyers could begin to buy the dip.

A weekly candlestick close below $0.762 would invalidate the bullish thesis by producing a lower low.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.