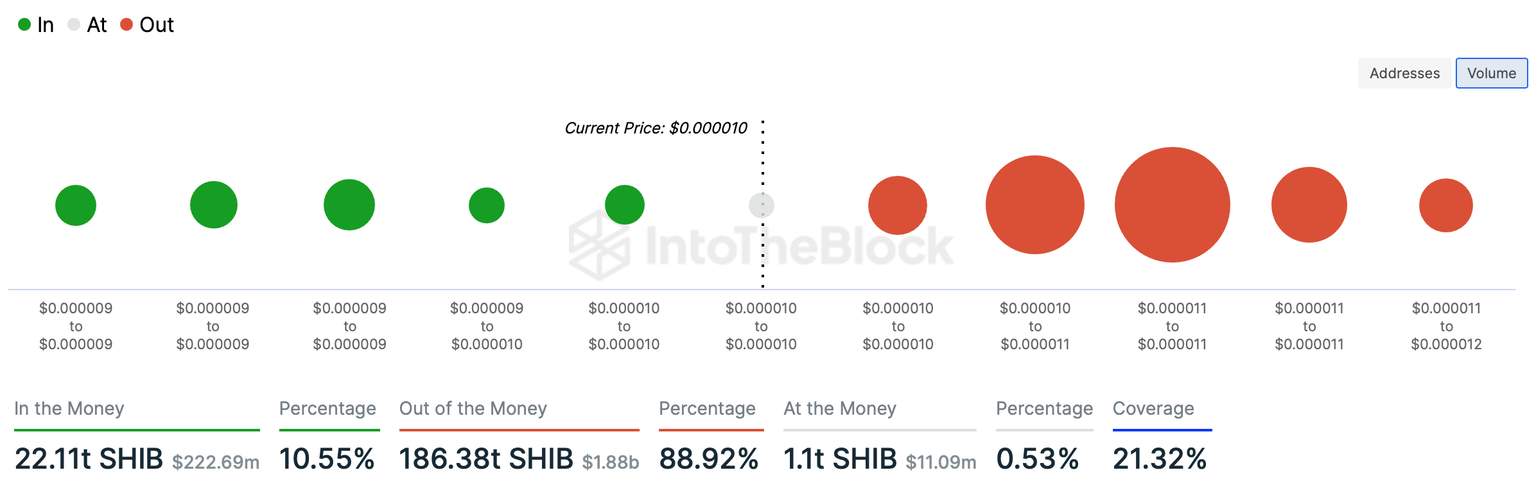

Shiba Inu tokens worth $1.88 billion are underwater as meme coins battle for dominance

- Shiba Inu token holders with 186.38 trillion SHIB holdings are currently underwater as the meme coin battles key resistance at $0.00001011.

- Meme coins like Dogecoin, PEPE, Baby Doge Coin are battling for dominance, with the rise of the meme coin season narrative.

- Expert report by CoinGecko reveals that Shiba Inu is the most popular meme coin in the US, generating 60.7% interest.

Shiba Inu wallet addresses holding nearly 186.38 trillion SHIB tokens are underwater at the current price level of $0.00001011. The meteoric rise in meme coins like PEPE has intensified the battle for dominance among Shiba-Inu-themed assets.

Also read: PEPE holders realise massive profits as Pepe Coin rallies 300% over the weekend

Shiba Inu battles key resistance amidst meme coin battle for dominance

Shiba Inu, the second-largest meme coin in the crypto ecosystem is currently battling key resistance at $0.00001011. Based on data from crypto intelligence tracker IntoTheBlock, 186.38 trillion Shiba Inu tokens held by upwards of 143,000 wallet addresses are currently underwater.

Shiba Inu tokens underwater at $0.00001011

Nearly 143,000 Shiba Inu holders are sitting on unrealized losses as the meme coin struggles with resistance at $0.00001011. Shiba Inu is tackling key resistance at $0.00001100, once the meme coin battles this level, the volume of SHIB underwater will reduce. This would fuel a bullish thesis and recovery in the meme coin.

PEPE Coin’s rise and impact on Shiba-Inu-themed meme coins

PEPE yielded upwards of 300% gains for holders over the weekend and continued its rally this week. With a massive spike in its 24-hour trade volume, PEPE challenged Dogecoin and Shiba Inu’s dominance in the category.

PEPE’s 24-hour trade volume left Dogecoin in the dust, shifting the spotlight from Shiba-Inu-themed meme coins to PEPE Coin.

Despite the current state of meme coins, Shiba Inu has retained its popularity among traders in the US, emerging as the most popular asset in the category.

2/ The most popular meme coin in the US this year is $SHIB, which generated 60.7% of US interest in meme coins.

— CoinGecko (@coingecko) May 3, 2023

Recent trending crypto $PEPE drove another 11.8% of meme coin interest in the US, followed by $BONK and $VOLT.

SHIB generated 60.7% of US interest in meme coins, according to CoinGecko’s report. PEPE drove another 11.8%.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.