Shiba Inu to provide the last buy opportunity before SHIB price doubles again

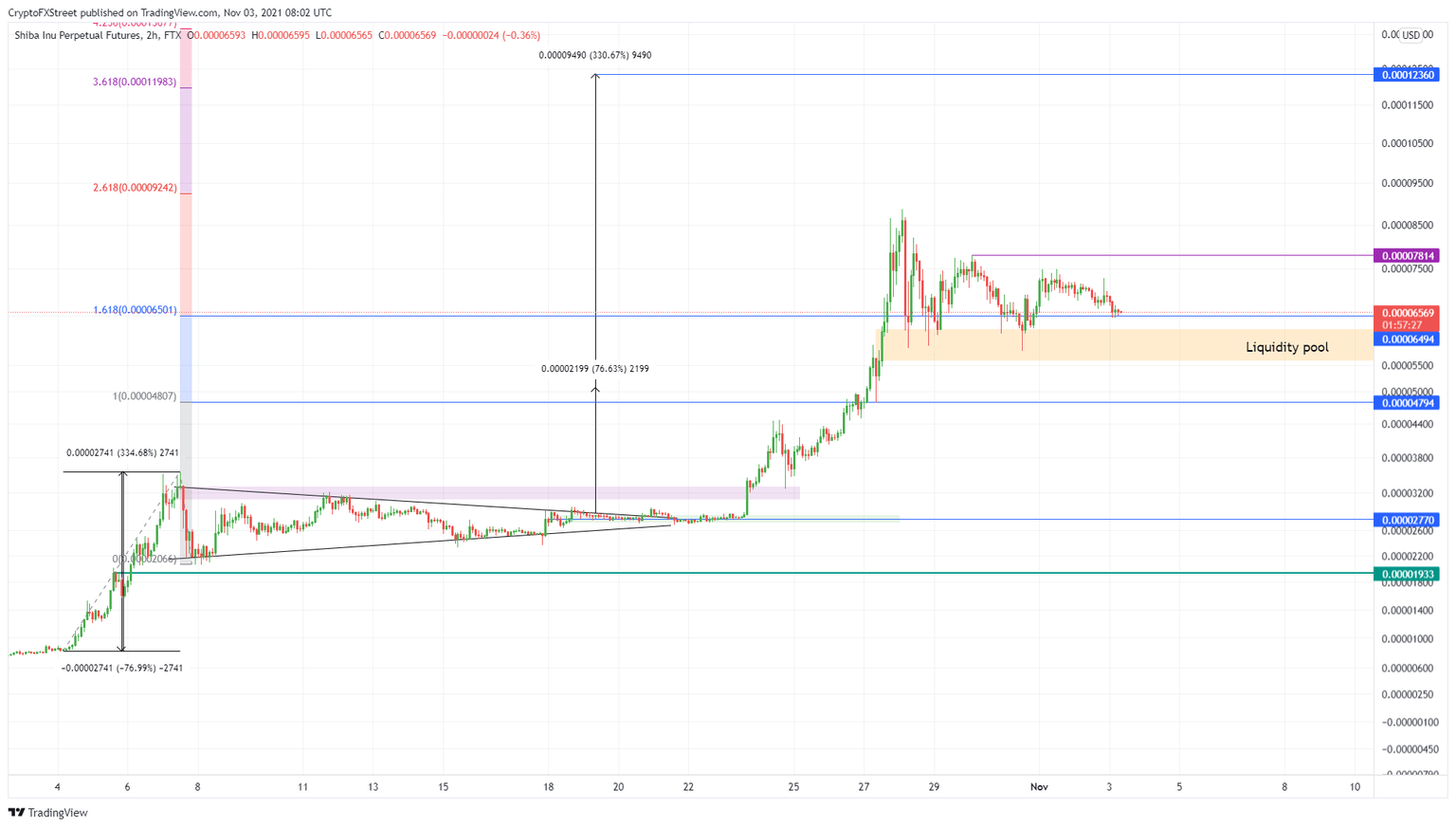

- Shiba Inu price has been bouncing off the $0.0000649 support floor for nearly a week, creating a liquidity pool below it.

- Investors can expect SHIB to dip into this area, ranging from $0.0000559 to $0.0000622 or below it to collect liquidity before rallying higher.

- A recovery is likely to propel the Dogecoin killer to eat another zero and retest $0.000124.

Shiba Inu price has been consolidating since it hit a new all-time high on October 28. So far, SHIB has been hovering around a crucial barrier, showing indecision among buyers and sellers. At this level, market participants can expect the Dogecoin killer to provide another buy opportunity before it blasts off.

Shiba Inu price prepares for new leg-up

Shiba Inu price has set up four lower highs since the new all-time high at $0.0000886. The swing lows of these peaks have sliced through the $0.0000649 support floor multiple times, leaving a pool of liquidity for market makers to collect.

Investors can expect Shiba Inu price to dip into this area, ranging from $0.0000559 to $0.0000622 or slide briefly below it to collect ‘sell stop’ liquidity. Doing so will allow market makers to push SHIB higher.

In such a situation, Shiba Inu price will first encounter the $0.0000781 resistance barrier, followed by the current all-time high at $0.0000886.

Beyond these levels, however, Shiba Inu price will aim for the $0.000124 level, which is the 330% target forecast by the bullish pennant breakout on October 20. This move would set a record high for the Dogecoin killer and indicate a 1,626% return since October 1.

SHIB/USDT 4-hour chart

While things are looking good for Shiba Inu price, the descent or the correction could extend beyond the liquidity pool mentioned above. In a slightly bearish case, SHIB could slide down to the 100% trend-based Fibonacci extension level at $0.0000479.

While this move will not invalidate the bullish outlook, it will delay the bull rally for Shiba Inu price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.