Shiba Inu struggles to hold support, SHIBA could retest prior range near $0.000020

- Shiba Inu price struggles to hold support against a fundamental Ichimoku support level.

- As SHIBA closes in on a weaker Ichimoku Cloud, price action shows waning bullish momentum.

- A 30% drop to test the $0.000020 value area is increasingly probable.

Shiba Inu price action is currently struggling to hold the Tenkan-Sen as support, even as it approaches conditions where a bullish breakout is easier to achieve. It remains an overperformer in the altcoin market, but that trend could soon change.

Shiba Inu price at a make-or-break moment, bulls and bears equally anxious

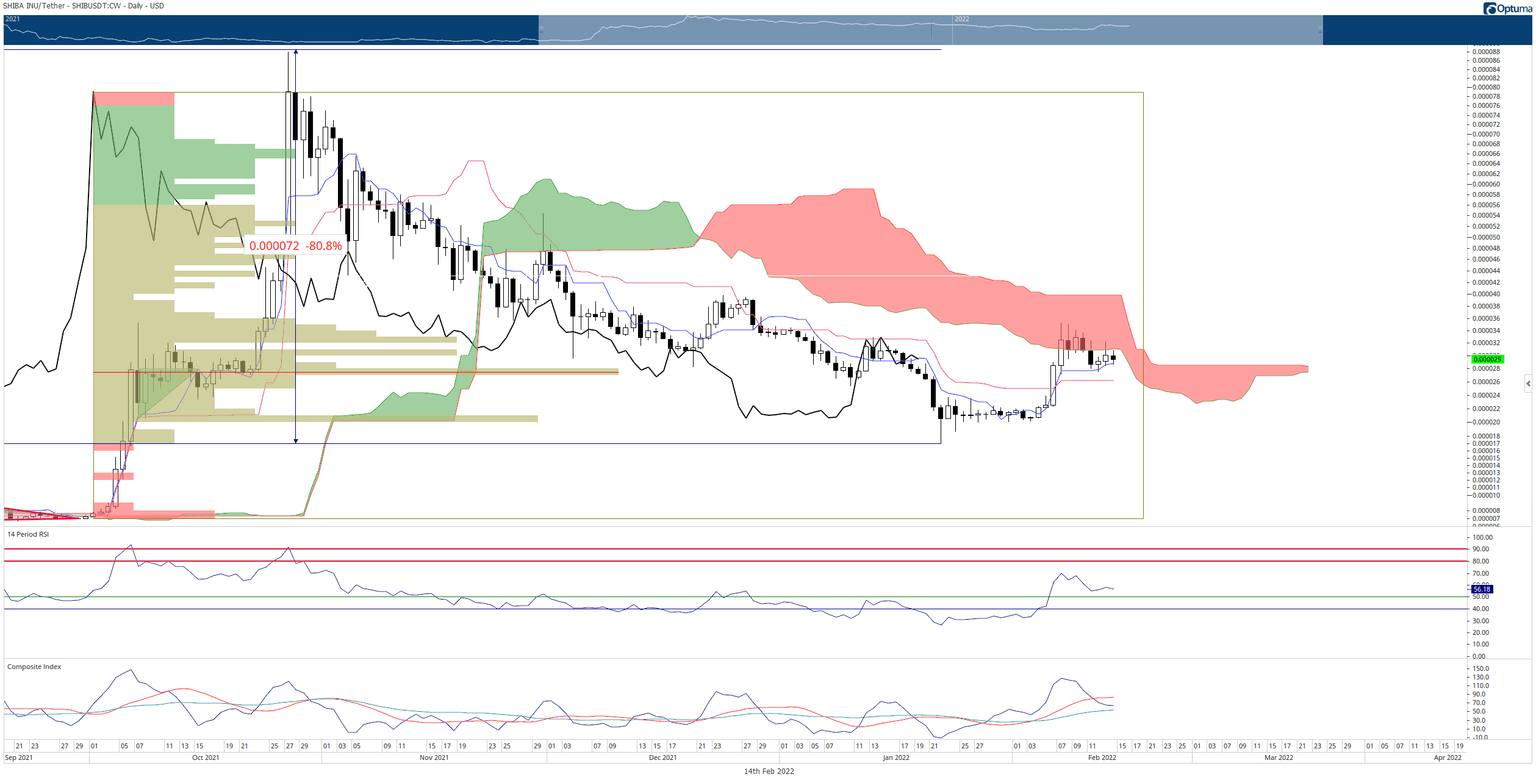

Shiba Inu price is in between two critical Ichimoku levels. The bottom of the Ichimoku Cloud (Senkou Span A) is the current nearby resistance at $0.000031, with the Tenkan-Sen at $0.000029 acting as nearby support. Traders have made multiple attempts to push above and below those two Ichimoku levels for the past four days, with neither bulls nor bears able to complete a close in their desired direction.

The critical price level to watch for bulls may not appear until February 17, when the threshold to achieve an Ideal Bullish Ichimoku Breakout drops from the current $0.000040 to $0.000031. Therefore, sideways trading conditions for Shiba Inu price would be the most likely near-term behavior until February 17.

For bears, the path lower is both more accessible and more complex. Within the Ichimoku system, when the current close is below the Cloud, an automatic bearish bias and weight is given to an instrument – Shiba Inu price action is considered bearish as long as it is below the Cloud. However, to push lower, bears need to cross and close below the Tenkan-Sen and Kijun-Sen. Due to the proximity of the Tenkan-Sen and Kikjun-Sen from one another, it creates a problematic support level for bears to conquer.

SHIBA/USDT Daily Ichimoku Kinko Hyo Chart

If Shiba Inu price closes at or below $0.000026, then a 30% drop to retest the bottom of the prior range at $0.000020 is highly likely.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.