Shiba Inu Price Prediction: SHIB to test support at $0.00002435 before next rally

- Shiba Inu price could drop lower to explore critical levels of support before resuming its rally.

- The 21-day SMA at $0.00002435 could offer reliable support for the canine-themed token.

- An increase in bullish sentiment may shift the momentum to the upside, targeting $0.00003736 next.

Shiba Inu price is headed lower as the bulls catch their breath before aiming higher. The prevailing chart pattern suggests that a 27% ascent toward $0.00003736 awaits SHIB after the token discovers reliable support.

Shiba Inu price awaits 27% climb

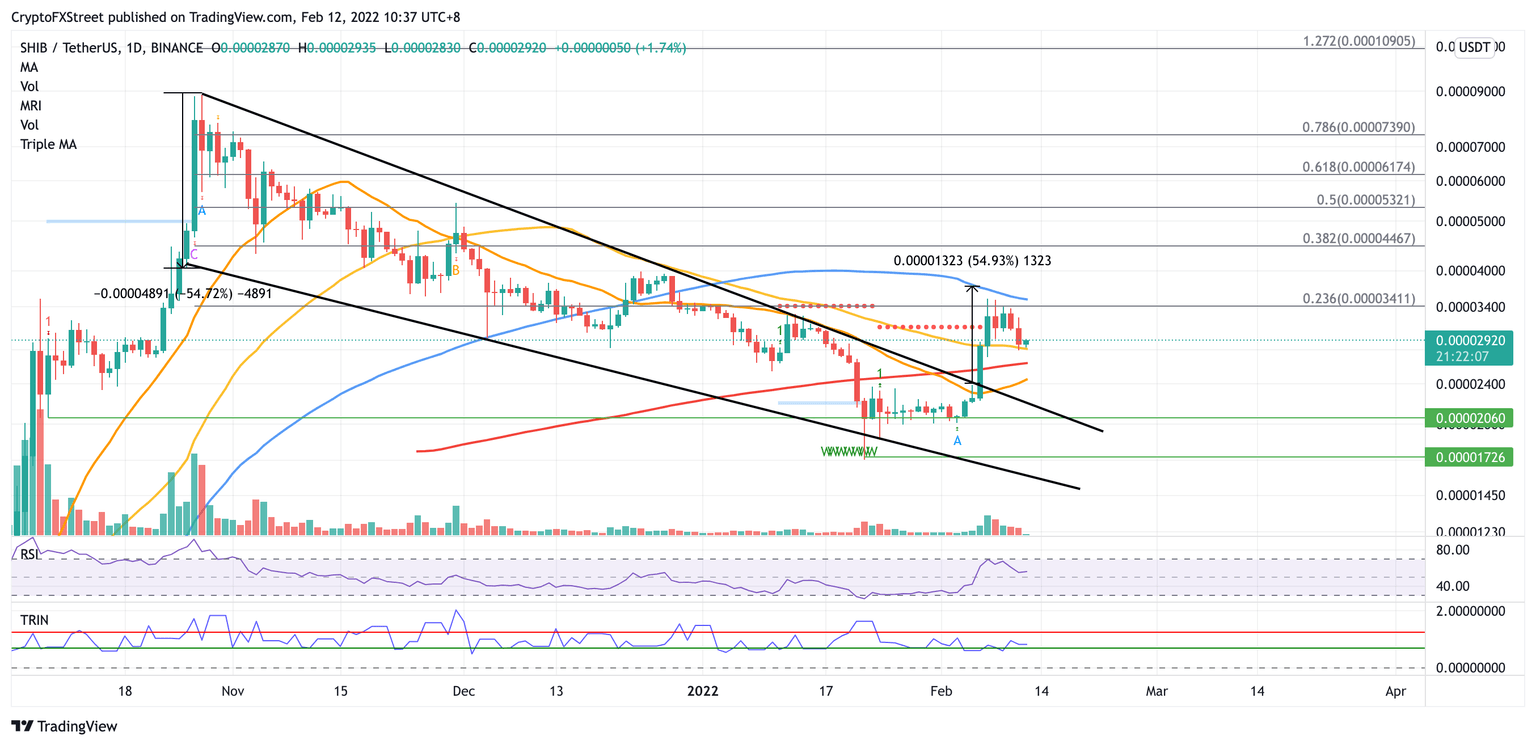

Shiba Inu price has formed a falling wedge pattern, suggesting a bullish outlook for the token after a break above its upper boundary on February 6. However, it appears that SHIB could fall lower to explore critical lines of defense before its next leg up.

The first foothold that will appear for Shiba Inu price is at the 50-day Simple Moving Average (SMA) at $0.00002799. Additional lines of defense for SHIB will emerge at the 200-day SMA at $0.00002617, then at the 21-day SMA at $0.00002435.

If selling pressure continues to rise, Shiba Inu price may drop further toward the upper boundary of the governing technical pattern at $0.00002222, then toward the October 8 low at $0.00002060.

SHIB/USDT daily chart

Lower levels tagged by Shiba Inu price may indicate that the momentum has shifted to the downside, and the bullish outlook would be voided.

However, if buying pressure increases, Shiba Inu price may aim to target the 23.6% Fibonacci retracement level at $0.00003411, then the 100-day SMA at $0.00003509. Additional buyers entering the market may push SHIB higher toward the optimistic target at $0.00003736.

Even bigger aspirations may aim for the 38.2% Fibonacci retracement level at $0.00004467 next, then toward the 50% retracement level at $0.00005321.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.