Shiba Inu price takes another jab at $0.0000112 as ShibaSwap rewards program delays

- Shiba Inu price shows a resurgence in buying pressure, indicating a 28% upswing potential.

- The developers of the ShibaSwap DEX have announced a delay in handing out weekend rewards.

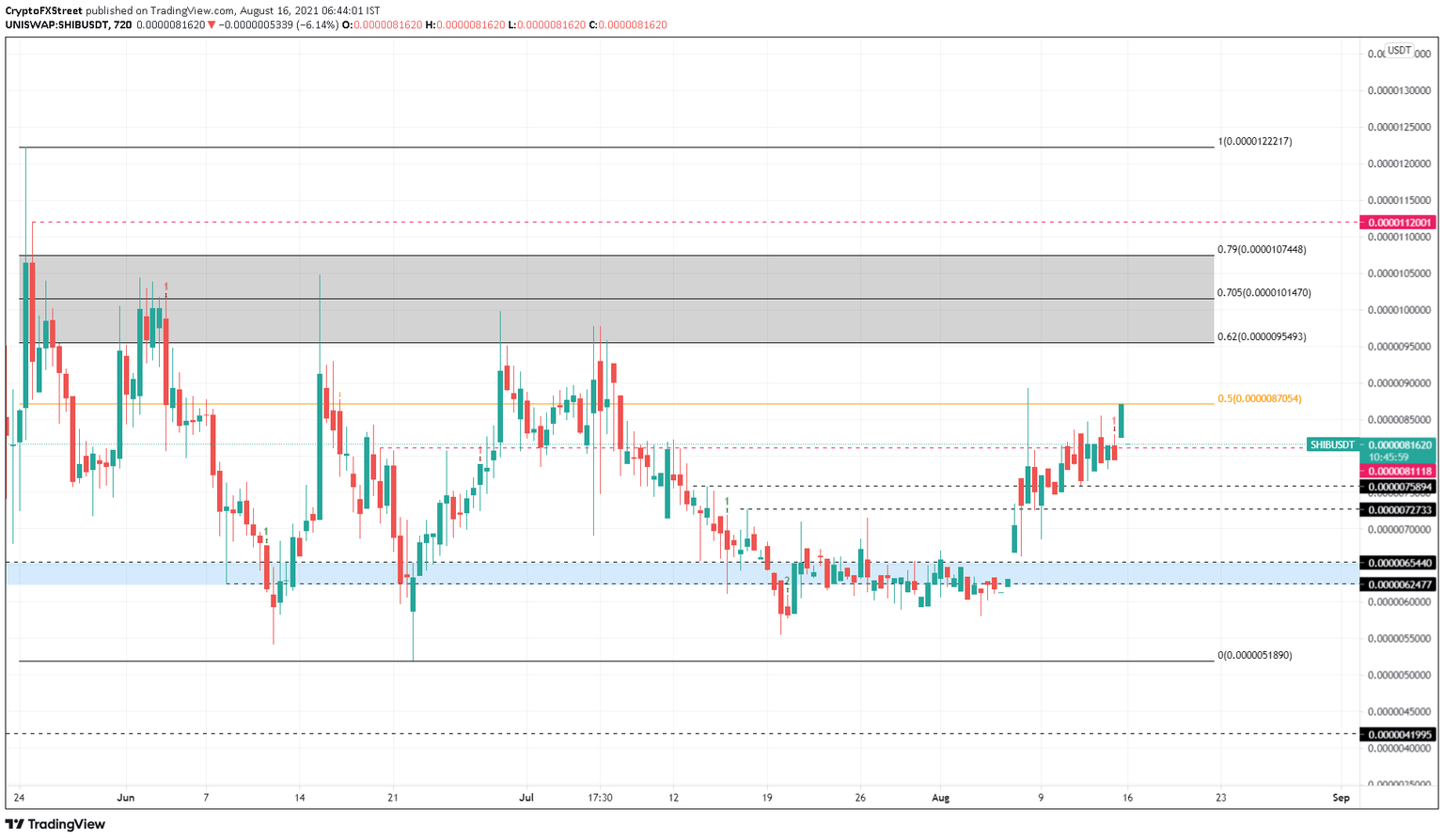

- If SHIB slices through the high probability reversal zone’s upper limit at $0.00001070, it will confirm a bull rally.

Shiba Inu price saw a period of extended stagnation while most of the cryptocurrency market rallied. However, this stagnation proved to be an accumulation and was followed by explosive price action. While this sudden uptick failed to sustain, SHIB is currently attempting to climb to its intended target for the second time.

Manual process delays rewards for ShibaSwap DEX users

Shiba Inu price is making a comeback as ShibaSwap Decentralized Exchange (DEX)’s weekend rewards are nowhere to be seen. The rewards are obtained by a part of the transaction fees being converted and sent to TreasureFinder.

This conversion method applies to any swap on the DEX, and the rewards are distributed at the end of every week.

Last week’s rewards, however, were delayed as the developers announced the reason for this delay in the official Discord server for Shiba Inu.

The developer mentioned that a lot of DEXs in the cryptocurrency community get hacked. To ensure this does not happen to ShibaSwap users, the reward distribution process for the “BURY section” is a multi-step process that runs manually and lasts roughly 14 to 16 hours.

Interestingly, the announcement also mentions,

This process has some pros and cons: the pros are that it’s 100% safe and it ensures no hacks or drains can happen. The cons, it requires time, and a manual process run by actually one person.

Since this ‘person’ is dealing with ‘an unforeseen family emergency,’ last weekend’s rewards distribution has been delayed. The announcement also added that the developers are working toward automating the process to avoid similar delays.

While some users are okay with this delay, others are not. Regardless of the mishap, technicals indicate that the Shiba Inu price is bullish as it looks to breach a crucial overhead barrier.

Shiba Inu price on a journey to shatter crucial barriers

Shiba Inu price rose roughly 43% between August 6 and August 8 but retraced almost 23% in the next 24 hours. While this run-up was ephemeral, SHIB gathered steam as the bulls pushed its market value higher.

Despite the Momentum Reversal Indicator (MRI) flashing a sell sign in the form of a red ‘one’ candlestick on the 12-hour chart, Shiba Inu price rose past it and is currently grappling with the 50% Fibonacci retracement level at $0.00000871.

If the meme coin produces a decisive 12-hour candlestick close above the said barrier, it will confirm a resurgence of buyers and an ability to move higher. In such a case, SHIB will target the high probability reversal zone, ranging from $0.00000955 to $0.00001070.

In the past, Shiba Inu price has tagged the 70.5% Fibonacci retracement level at $0.00001010, which is a primary target. However, if the big crypto and the altcoins continue to rally, SHIB might clear this zone and attempt to tag $0.00001120, roughly a 28% upswing from $0.00000871.

SHIB/USDT 12-hour chart

On the other hand, a breakdown of the $0.00000811 support barrier will indicate an inability of the buyers to prolong this upswing. If the resulting selling pressure pushes SHIB to shatter $0.00000727, it will invalidate the bullish thesis and potentially trigger a 10% crash to $0.00000654.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.