Shiba Inu Price Prediction: SHIB primed for 10% rally

- Shiba Inu price has breached a declining trendline, suggesting strong signs of bullish momentum on the daily time frame.

- A pullback to the $0.00920 support level seems likely before SHIB triggers a quick 10% bounce.

- In some cases, SHIB could slide as low as $0.00872 before rallying, bringing the total gain to 15%.

- Invalidation of the bullish thesis will occur if the dog-themed crypto flips $0.00872.

Shiba Inu (SHIB) price has been on a downtrend for the last two months. However, the recent slowdown and sideways movement have led to a positive development that forecasts SHIB is likely to move higher.

Also read: Dogecoin price eyes double digit gains as DOGE bulls make a comeback

Shiba Inu price coils up for a bounce

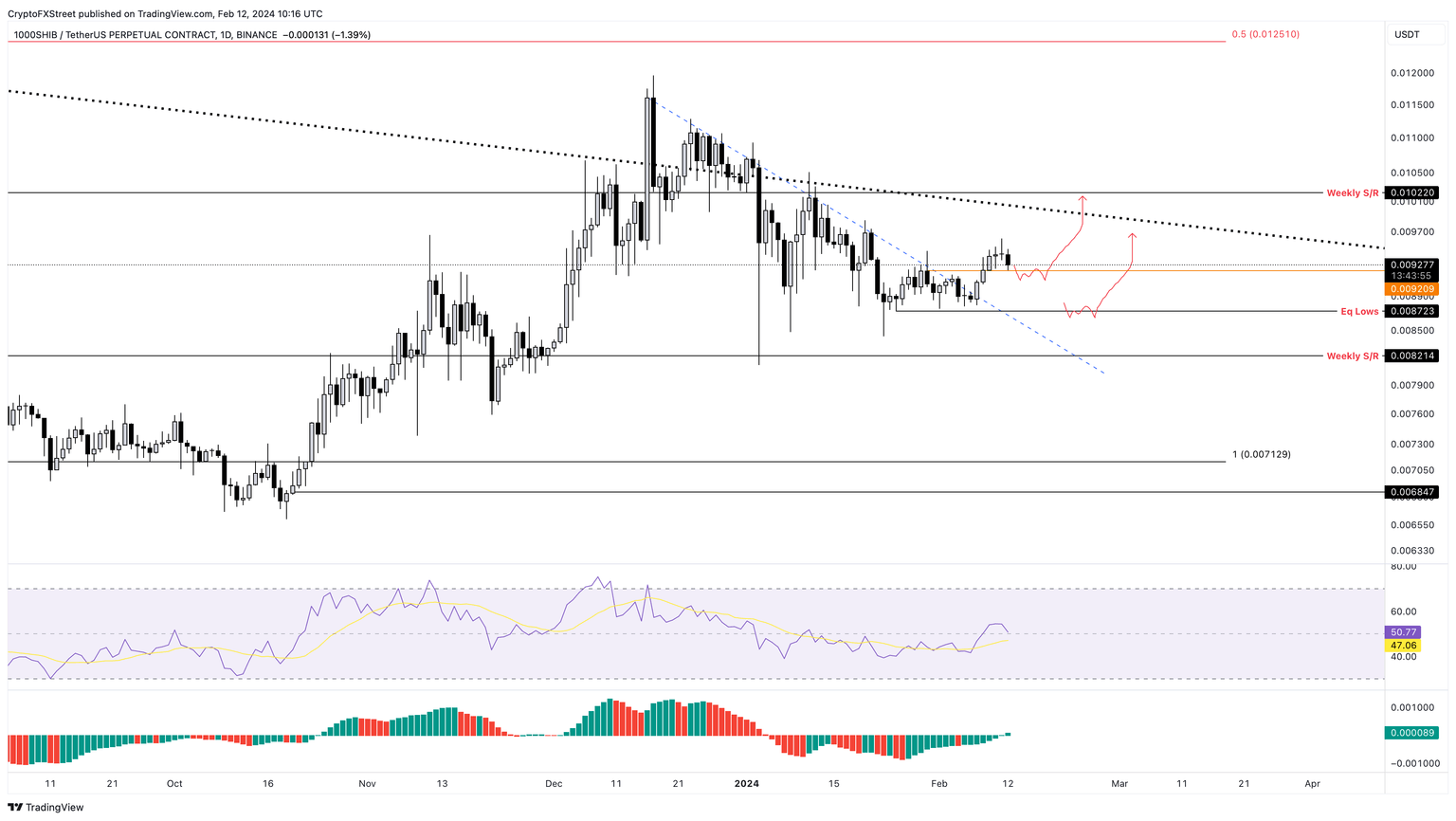

Shiba Inu price shed 32% between December 17, 2023, and January 3, 2024. Connecting the lower highs formed during that down move traces a declining trend line, which serves as a dynamic resistance level.

Shiba Inu breached this trend line on February 8 and then saw its price rally 8.50%. It is currently retracing, probably in preparation for the next up leg. The $0.00920 level is the first key support level that could serve as a launchpad for a bounce.

If there is a spike in selling pressure across the board, however, then SHIB could retrace even lower before bouncing, collecting the sell-side liquidity below $0.00872. A quick liquidity run below this level, followed by a recovery, will be the first sign of an uptrend.

The eventual upside target for Shiba Inu price is the weekly resistance level at $0.0102, roughly 10% away from $0.00920 and 15% from $0.00872.

The Relative Strength Index and Awesome Oscillator are both showcasing a surge in bullish momentum, supporting the optimistic outlook noted above.

Also read: Dogecoin price struggles to recover despite fast-paced wallet growth

SHIB/USDT 1-day chart

While a sweep of $0.0872 will allow sidelined buyers a buying opportunity, a failure to recover above $0.00872 will signal a weak bullish camp. If SHIB flips the aforementioned level into a resistance level, it will invalidate the bullish thesis by producing a lower low.

In such a case, Shiba Inu price could slide 6% to retest the $0.00821 support level.

Read more: Shiba Inu renews focus on digital identity in Shibarium for 2024

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.