Dogecoin price eyes double digit gains as DOGE bulls make a comeback

- Dogecoin price trades between the $0.0749 to $0.0943 range for roughly a month.

- The recent breach of the declining trend line forecasts more upside for the dog-based crypto.

- DOGE could see a 10% rally that overcomes $0.0895 and tags $0.0911.

- Invalidation of the bullish outlook will occur if DOGE flips the $0.0749 support barrier into a resistance level.

Dogecoin price has been consolidating for a few weeks now with no directional bias in sight. But the recent move to the upside is likely going to attract traders to DOGE as the altcoin looks primed for a rally.

Also read: Dogecoin's recent network activity spike might not trigger DOGE price do the same, here's why

Dogecoin price overcomes critical hurdles

Dogecoin (DOGE) price consolidation after the January 3 crash seems to have come to an end after the recent 6.54% move. This development accomplished two goals – breach the declining trend line and overcome the $0.0821 resistance level. Both of the mentioned points were key barriers that prevented DOGE from moving higher.

Going forward, investors can expect the meme coin to run higher.

The road ahead for Dogecoin price is not going to be a walk in the park. DOGE needs to flip the $0.0846 barrier into a support floor. Doing so will allow the altcoin to retest $0.0911, which is the midpoint of the 30% crash witnessed between December 11, 2023, and January 3, 2024.

This move, in total, would account for a 10% gain from the current level of $0.0824.

Read more: Dogecoin price struggles to recover despite fast-paced wallet growth

DOGE/USDT 1-day chart

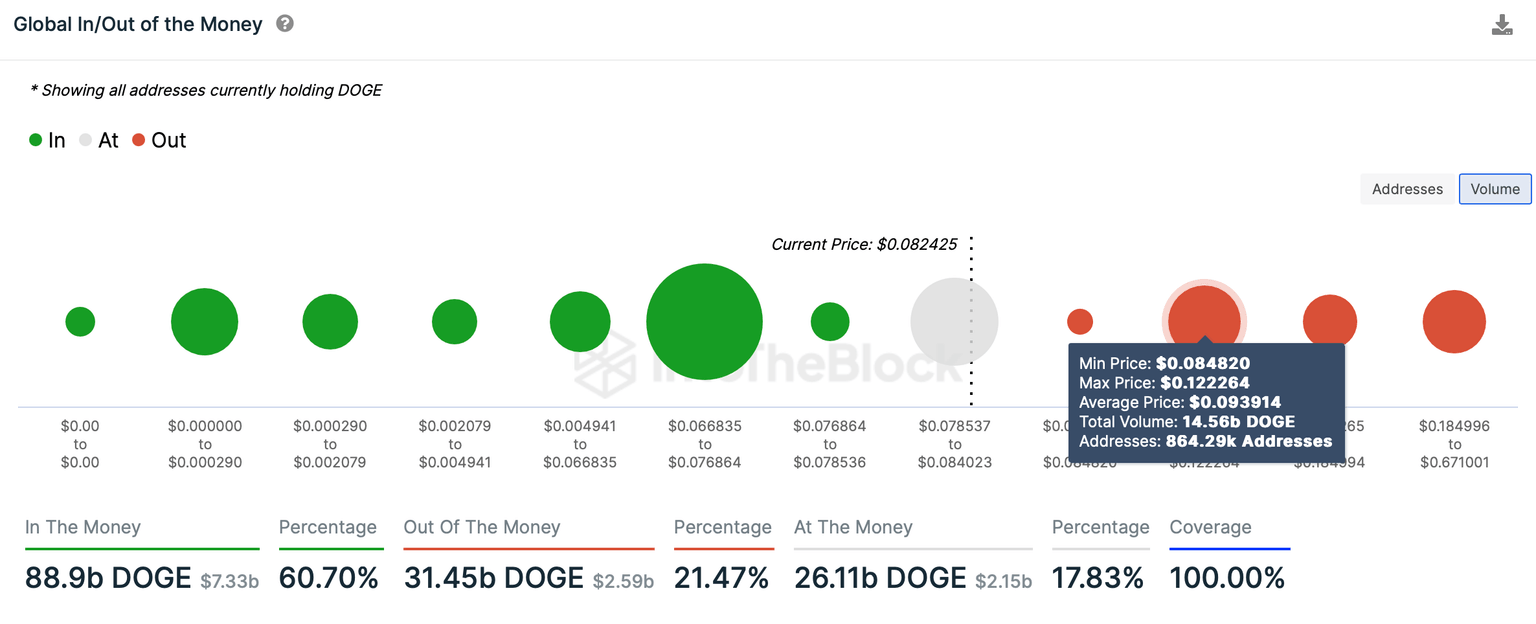

Additionally, IntoTheBlock’s In/Out of the Money indicator shows that the next key resistance cluster for DOGE, extends from $0.0844 to $0.1222. Here, roughly 864k addresses bought 14.56 billion tokens at an average price of $0.0931. Interestingly, this level coincides well with the forecasted target from a technical perspective, which adds credence to the bullish outlook of the dog-based meme coin.

These investors, who are Out of the Money, are likely to sell at breakeven if the Dogecoin price moves higher. Hence, $0.0911 to $0.0931 are key take-profit levels.

DOGE GIOM

On the other hand, if Dogecoin price breaches the $0.0749 support level, it will invalidate the bullish thesis by producing a lower low. Under these conditions, DOGE could slide 5% lower and revisit the next key support level at $0.0713.

Read more: Dogecoin price sees minor gains despite uptick in network demand

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.