Shiba Inu Price Prediction: Key levels to watch as SHIB bulls plan to revisit $0.0000179

- Shiba Inu price seems to be lacking momentum after tagging the $0.0000083 to $0.0000092 inefficiency on October 13.

- This development could see SHIB slide lower and retest the $0.0000081 support level before triggering a 119% upswing.

- A daily candlestick close below $0.0000081 will invalidate the bullish thesis for the meme coin.

Shiba Inu price shows a lack of bullish momentum that has caused its recent run-up to reverse. As a result, SHIB is likely to undo the recent gains and slide lower before retesting a critical support level.

Shiba Inu price needs more oomph

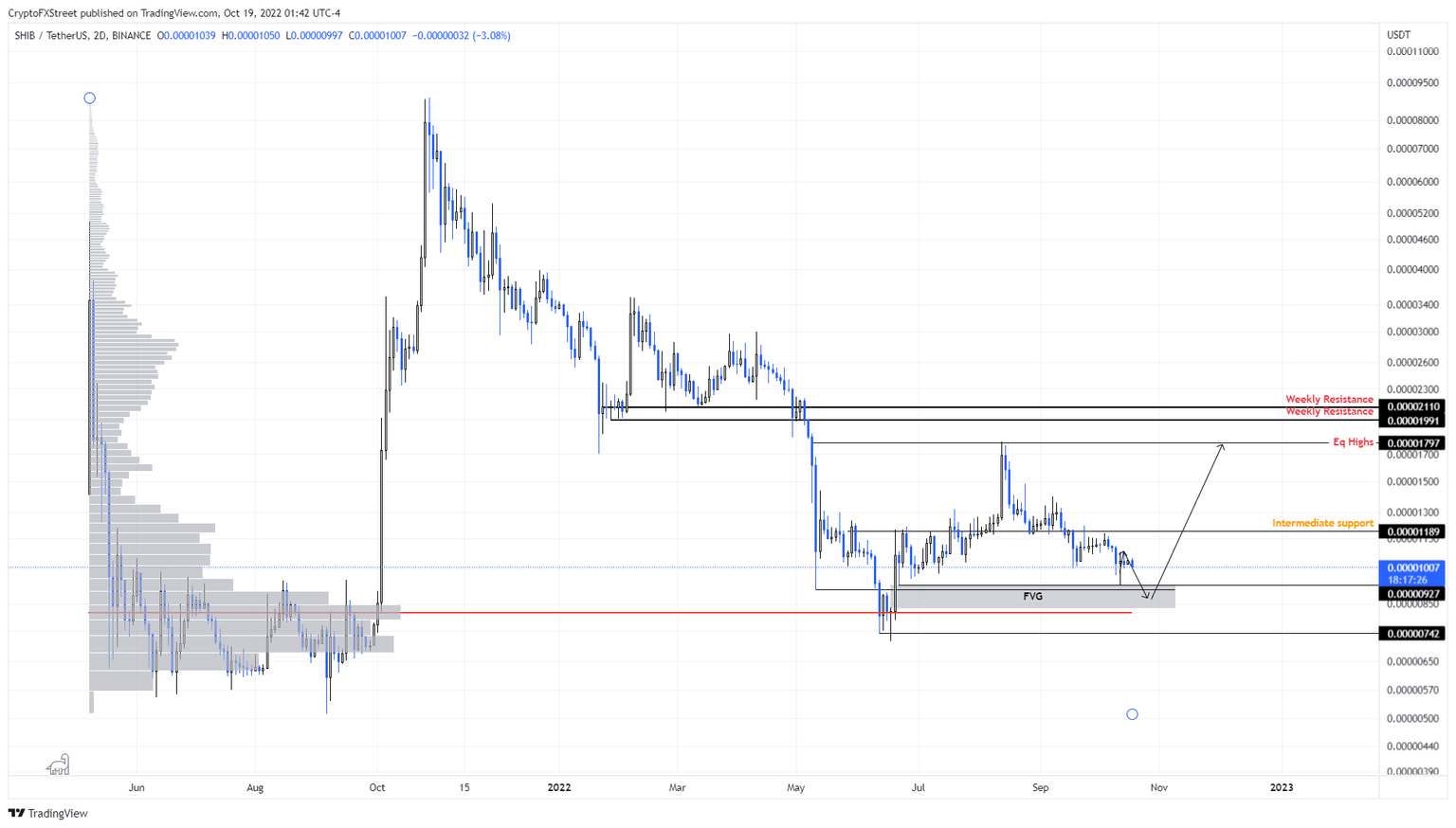

Shiba Inu price slid 11% on October 13 to tag the Fair Value Gap (FVG), extending from $0.0000083 to $0.0000092. Due to the highly volatile event on the day, SHIB recovered the losses and closed higher than its opening price.

This development, while bullish, lacked follow-up. As a result, Shiba Inu price has been moving sideways. If Bitcoin price fails to stabilize and trigger a recovery, SHIB is likely going to continue shedding weight.

The key levels to watch include the FVG’s lower limit at $0.0000083, which is close to the Point of Control (POC) at $0.0000081, the highest volume traded level since May 2021. A retest of one of these levels would be a good place to accumulate.

If the market conditions have improved, investors can expect Shiba Inu price to trigger a reversal. From a market makers’ perspective, the equal highs at $0.0000179 would be a good place to start offloading.

This move would constitute roughly 119% in gains and is likely where the upside is capped for the meme coin.

SHIB/USDT 4-hour chart

On the other hand, if Shiba Inu price produces a daily candlestick close below the POC at $0.0000081, it will invalidate the bullish thesis.

In such a case, Shiba Inu price could slide lower and retest the $0.0000074 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.