Shiba Inu price has investors sidelined in the wake of a catalyst

- Shiba Inu price action sees volume wearing thinner due to investors remaining sidelined as peace talks in Ukraine stall.

- SHIB bulls are a bit puzzled about what to do next as global worries on inflation and Ukraine are dampening any upward potential in SHIB price action.

- Expect to see the price go sideways to lower today, heading into the weekend.

Shiba Inu (SHIB) price action has not been in a sweet spot for investors this week. With whipsawing price action and bears still sitting on lucrative gains, investors got burned several times on false breakouts and mixed signals coming from both the markets and price action in SHIB. Expect a large number of funds to stay sidelined as more peace talks get underway, but Russia’s stance of not wanting to meet Ukraine halfway, suggest those talks are likely to end in failure rather than success.

Shiba Inu price reveals that bulls are not taking chances as new peace talks have no chance of succeeding

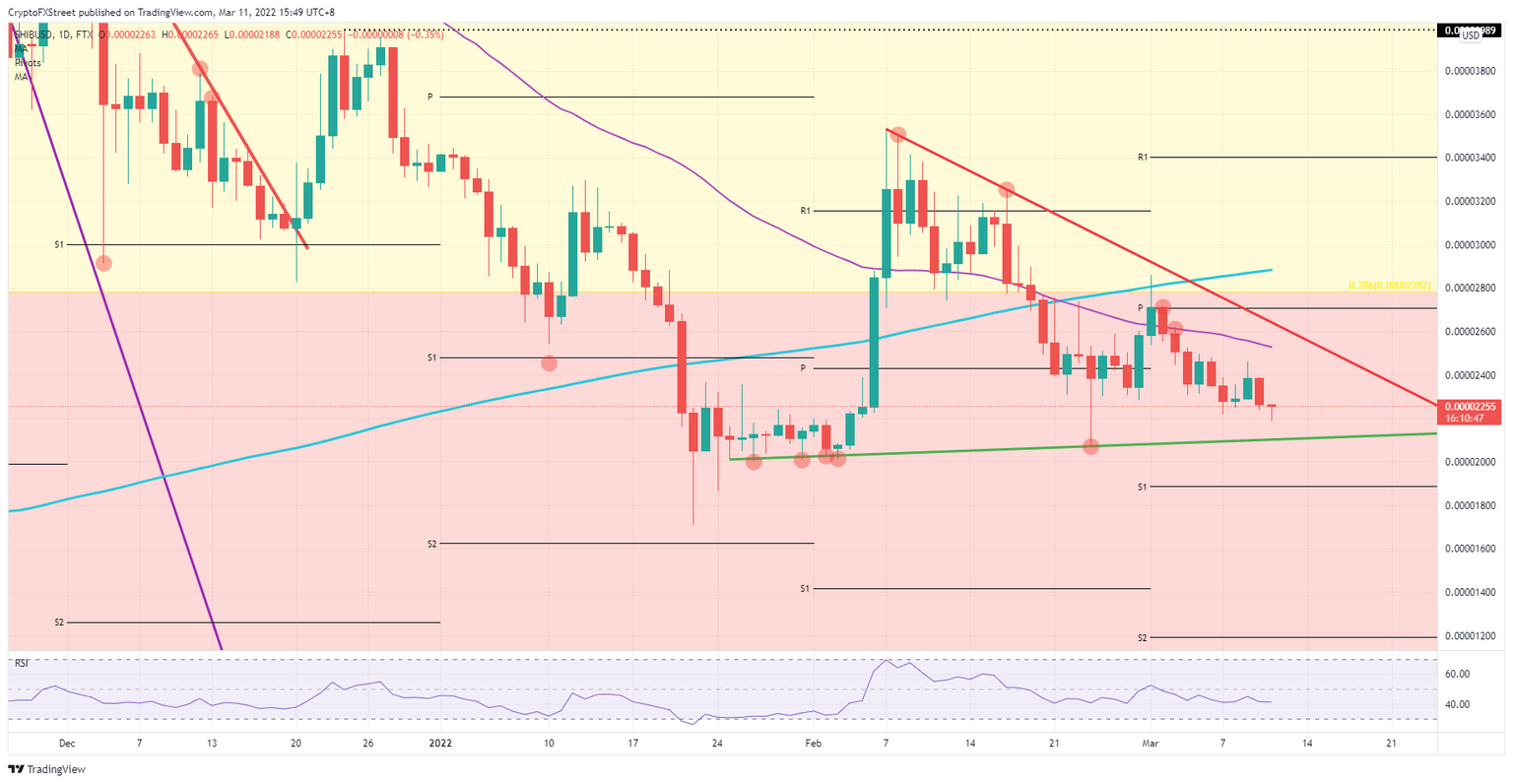

Shiba Inu price action is on a slow downward burn after bulls got tempted in to what looked like a relief rally but instead turned out to be a full-fledged bull trap, squeezing bulls out of their positions, paring back all the gains accrued, and even making a new low for the week this morning. With the Relative Strength Index flatlining, it looks as if SHIB’s balance between bears and bulls is in gridlock as bulls do not want to engage without a clear positive catalyst, and bears are sitting on a pile of profits that they do not want to offload at the current levels. It will take either a breakthrough in peace talks or another catalyst to form some counterweight against the forecast of stagflation and further deterioration in Ukraine that is at the moment directing price action in Shiba Inu.

SHIB price will test the new lows for this week and looks set to drop to the green ascending trend line near $0.00002108, which falls roughly in line with the low of February 24. Depending on how the US dollar behaves, expect to see some movement to the upside, but nowhere near the high of yesterday, so relatively muted below $0.00002400. Expect SHIB price action to go into the weekend within that price range, awaiting any headlines that could set the tone for next week.

SHIB/USD daily chart

If a breakthrough is made on some front, or some economic data opens a window of relief, expect to see a pop above $0.00002400, breaking the high of yesterday and opening up more upside towards $0.00002533, which is the 55-day Simple Moving Average (SMA). SHIB price action would print a new high for the week with this. As the red descending trend line is in the near vicinity, expect possible bulls to try and reach out to that level, near $0.00002636, for a test and possible break to the upside if the positive sentiment only gains traction going into the weekend.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.