Shiba Inu bulls watch for reaction in SHIB price as total value locked in ShibaSwap doubles

- Shiba Inu bulls pushed the meme coin’s price higher as the total value locked on ShibaSwap doubled since November.

- SHIB and BONE prices increased nearly 30% over the past week as Shiba Inu holders and community members await the launch of layer-2 scaling solution Shibarium.

- Multiple developments in the Shiba Inu ecosystem and spike in burn rate have fueled a bullish narrative among SHIB holders.

Shiba Inu ecosystem witnessed a slew of positive developments with the launch of layer-2 scaling solution Shibarium’s beta, rising total value locked in ShibaSwap and skyrocketing SHIB burn rate.

Also read: Will Bitcoin bulls remain in control of BTC price after another volatility-filled week?

Shiba Inu ecosystem’s DeFi platform ShibaSwap’s TVL has doubled

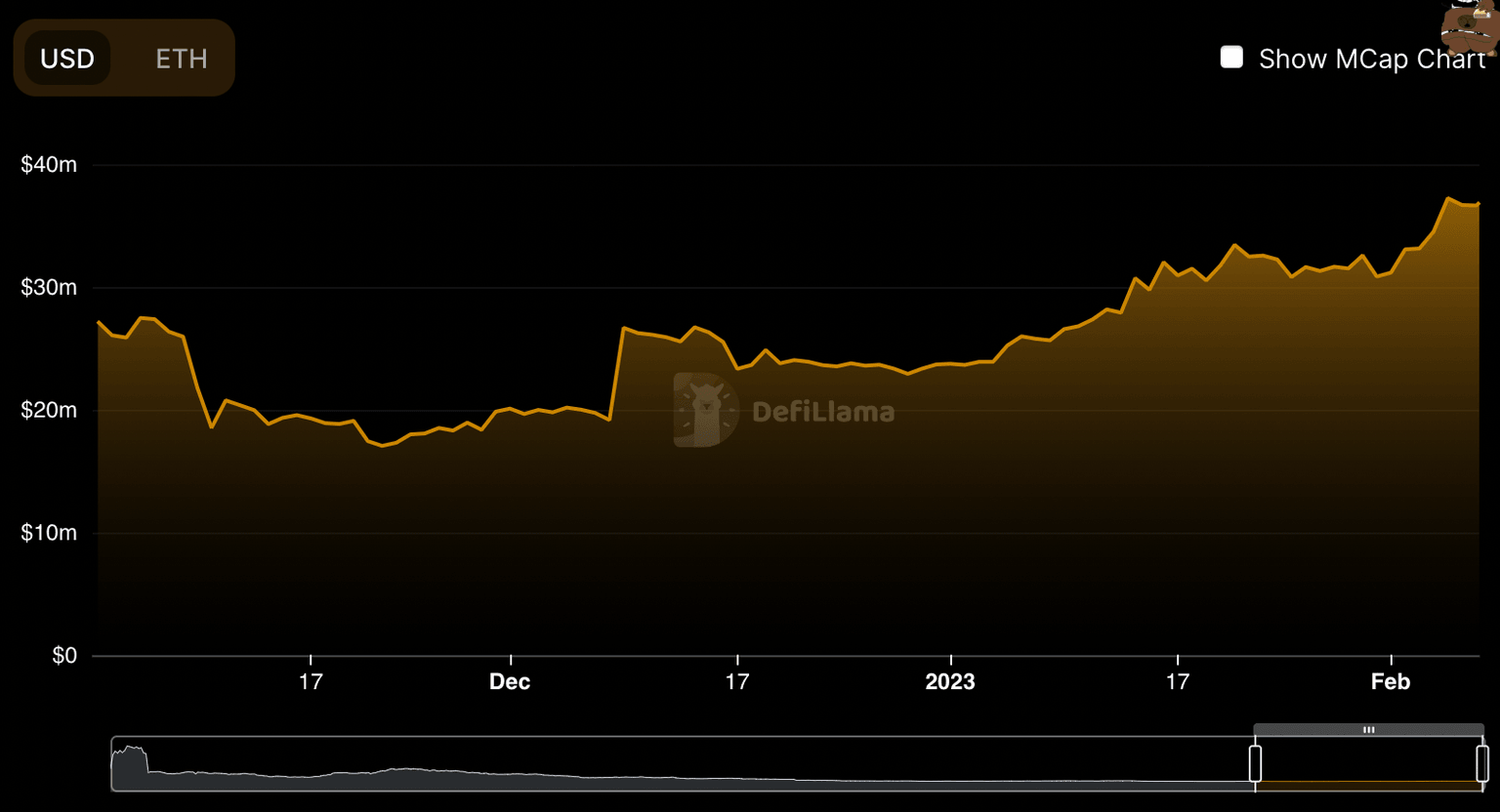

ShibaSwap, a DeFi platform featuring a decentralized exchange (DEX) and passive income-generating services like staking, liquidity pools and yield farming in its ecosystem. The total value locked on ShibaSwap has nearly doubled since November.

ShibaSwap TVL

The TVL of ShibaSwap has more than doubled, as seen in the chart above increasing from $17 million to $36.5 million. There have been multiple developments in the ecosystem. The DeFi platform has witnessed a massive boost in its TVL since November 2022.

The prices of Shiba Inu ecosystem’s tokens BONE and SHIB have increased more than 30% in the past week. While SHIB Army members await the launch of layer-2 scaling solution Shibarium, the meme coin’s price has skyrocketed 23.6% within a seven-day period from January 31, 2023.

Shiba Inu bulls gear up to push SHIB higher, anticipating Shibarium launch

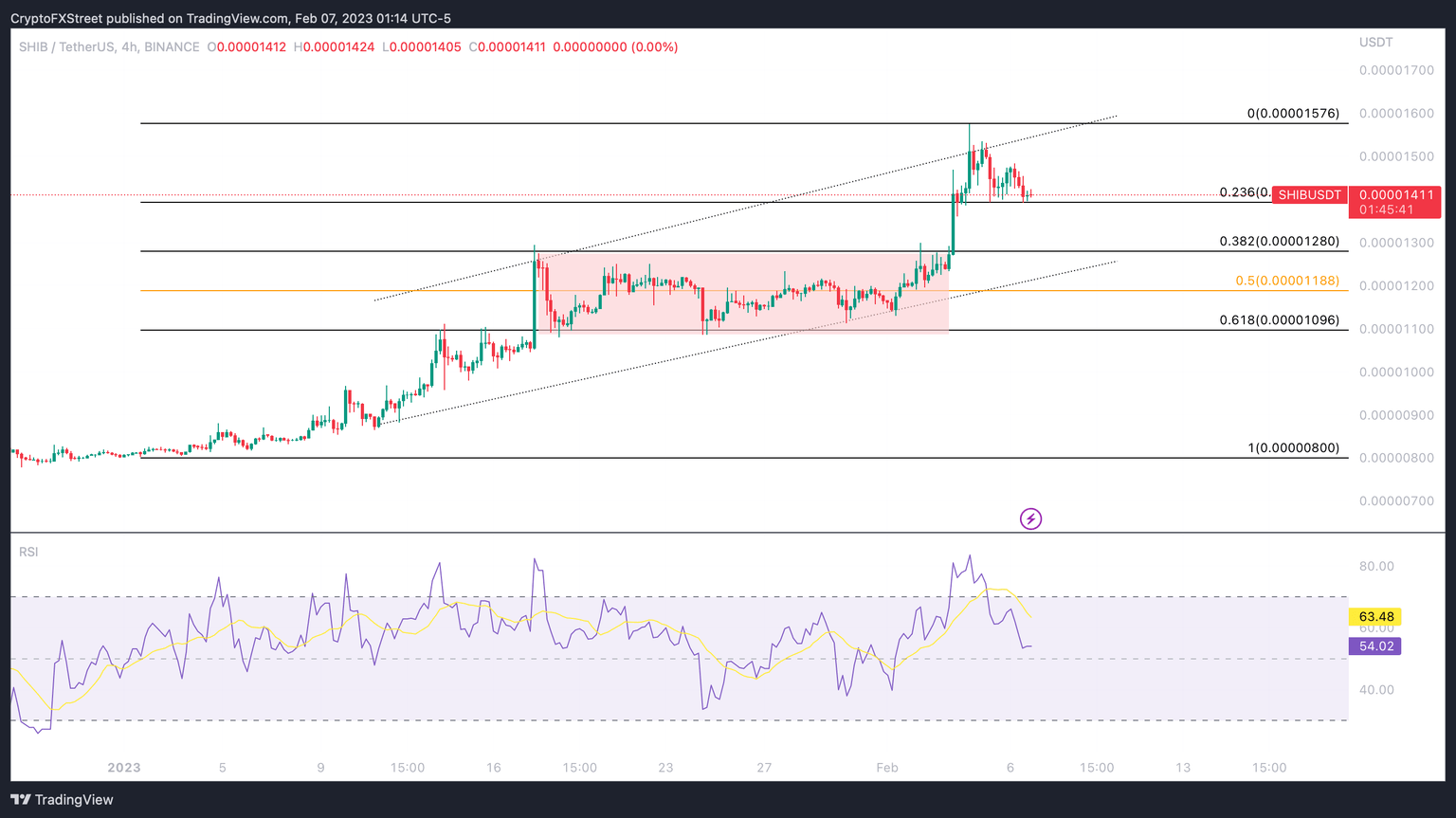

Shiba Inu price is in an uptrend since the beginning of 2023. The meme coin’s price climbed consistently, after temporarily trading sideways in the last two weeks of January. As seen in the chart below, the support zone for SHIB begins at $0.00001274 and $0.00001087.

The meme coin’s price is in an ascending parallel channel and the price attempted to breakout of the upper trend line recently, hitting the bullish target of $0.00001576. The 38.2% Fibonacci retracement level at $0.00001280 is a key support for the Dogecoin-killer token.

SHIB/USDT price chart

Relative Strength Index (RSI), a momentum indicator reveals a bearish divergence and dropped close to the neutral level at 54.02. Shiba Inu’s recent uptrend lacks underlying strength, however bulls could push the meme coin higher if SHIB sustains above $0.00001393.

A drop below the 38.2% Fibonacci retracement level, or a close below the lower trendline could invalidate the bullish thesis for Shiba Inu.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.