Elon Musk's favorite altcoins: Will Dogecoin price be the next to rally after MASK?

- Mask network garnered attention on crypto Twitter after yielding 42% gains for holders since January 30.

- Dogecoin and Mask Network holders are hopeful that these cryptocurrencies will break ground on Elon Musk’s Twitter as payment methods.

- Dogecoin and Mask Network have witnessed massive price rallies in 2023, experts believe DOGE is on the cusp of a price rally.

Elon Musk’s Twitter is working on adding payment features to the social media platform. Mask Network (MASK), which enables users of popular social media apps like Twitter to send crypto to dApps without leaving the platform, yielded 87.6% gains in the 30 day period from January 7, as MASK holders anticipated the token’s utility for crypto payments on Twitter.

With similarities between MASK and meme coin DOGE’s price rallies, it is likely that Dogecoin could witness a massive breakout in the short-term.

Also read: Can Visa's large value payments on Ethereum fuel an ETH price rally?

How Mask Network and Dogecoin are related

Mask Network (MASK) is proving popular in the crypto community and the token’s holders believe the asset could find utility on Twitter for crypto payments.

Elon Musk, the owner of Twitter Inc. and a Dogecoin proponent recently applied for a payments license for the social media giant. With self-proclaimed Dogefather Musk’s plans for Twitter, and his objective to turn the social media platform into a “Super App” or everything app, payments, including crypto are inevitable.

Both MASK and DOGE rallied together, in response to Musk’s $44 billion takeover of Twitter. Since Mask Network allows users to send encrypted messages and even cryptocurrencies over Twitter, the narrative is that the asset is better suited to payments on the social messaging platform.

As seen in the chart below, DOGE’s price rally mirrors MASK, with peaks and troughs coinciding.

DOGE and MASK price chart

On-chain metrics supporting bullish narrative for Dogecoin

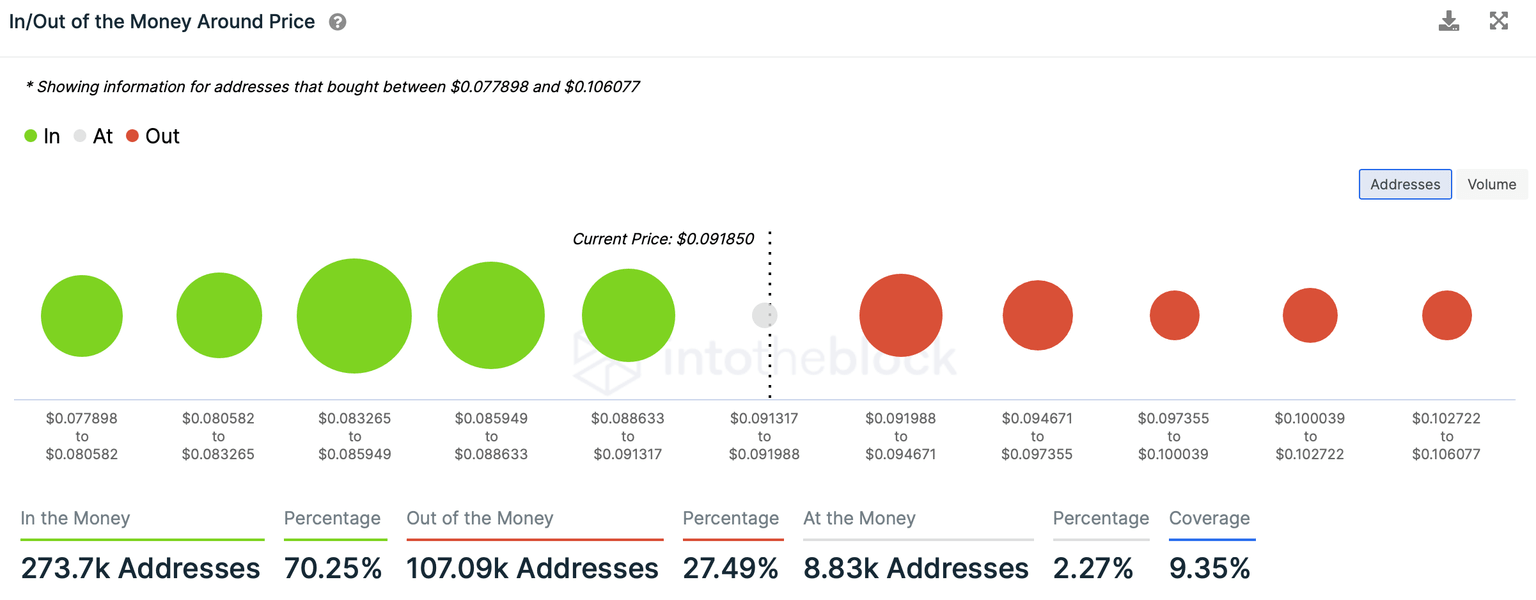

The Global In/Out of the Money (GIOM), an on-chain indicator by crypto intelligence platform IntoTheBlock addresses whether investors are profiting (in the money), breaking even (at the money) or losing money (out of the money) on their positions at the current price of the asset.

The chart below revealed the In/Out of the money addresses for Dogecoin.

In/ Out of the Money Around Price for Dogecoin

In the chart above, the large in-the-money clusters indicate a key price range on-chain where a high amount of addresses previously bought DOGE. 70.25% of the addresses are “In the Money” and this is positive for the network as there is less selling pressure from holders trying to break-even on their positions.

Social dominance of Dogecoin has been rising consistently since January 2023, which is bullish for price. Historically, a peak in the meme coin’s dominance on social media platforms coincides with a peak in DOGE price as seen in the chart below.

%2520%5B18.22.47%2C%252006%2520Feb%2C%25202023%5D-638112868933334240.png&w=1536&q=95)

Social dominance of DOGE v. Dogecoin price

On-chain metrics signal a likely rise in Dogecoin price, supporting the bullish narrative for the meme coin. Since Dogecoin price has historically mirrored Mask Network’s MASK token, on-chain metrics signal a rally in the meme coin too.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.