Shiba Inu bulls can't hold SHIB from dropping to $0.000006

- Shiba Inu price has fallen -28% over the past four trading sessions.

- Bears remain in control as bulls fail to complete a breakout above $0.000008.

- Bulls must hold $0.000007 to prevent a drop towards $0.000006.

Shiba Inu price continues to follow the path of the aggregate crypto market. However, significant selling pressure over the past four days has weakened bulls' resolve and put significant pressure on any longs who entered the market about $0.00008.

Shiba Inu price to test $0.000006, bulls anxious as prices move lower

Shiba Inu price action has been a source of frustration for both investors and speculators alike. There exists a significant and persistent trading range that neither bulls nor bears have been able to break. There was some early evidence that a breakout may occur and break months of stagnation over the past weekend, but that did not occur.

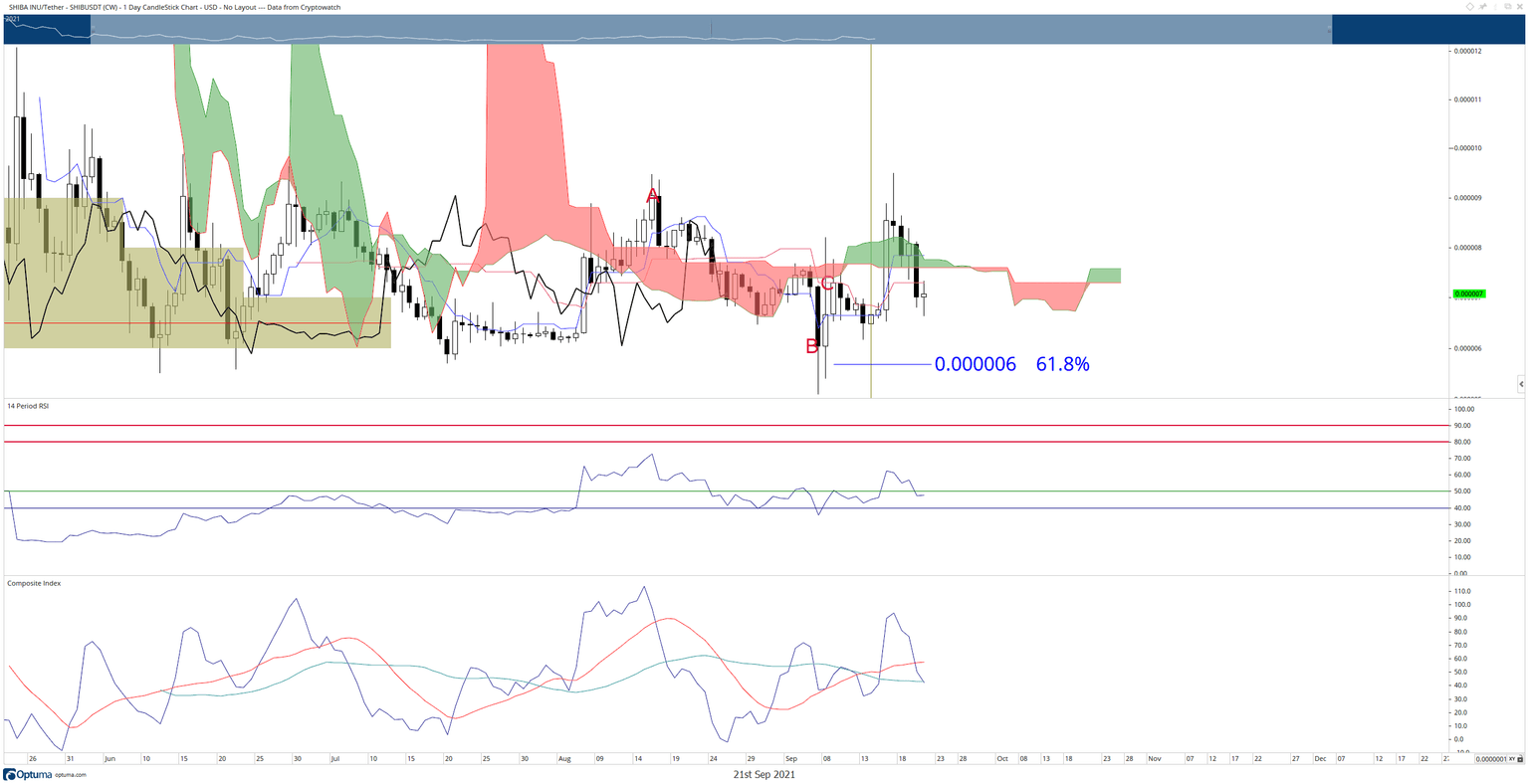

Instead, Shiba Inu price fell by a staggering -28% to return to the present $0.000007 trading range. The critical level that will dictate a breakdown towards $0.000006 is the Chikou Span moving below the candlesticks and the bottom of the Cloud (Senkou Span A). If that occurs, then the current sentiment on the Ichimoku chart will be overwhelmingly bearish.

SHIB/USD Daily Ichimoku Chart

However, given the constricted trading range, Shibu Inu bulls have an equal chance to pull the rug out from under the bears. For example, if bulls were to push Shibu Inu price to a close at $0.000008, the Chikou Span would be above the candlesticks and the Cloud. This would likely create a condition that begins the process of breaking out higher from the consolidation zone.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.