SHIB Price Prediction: Shiba Inu to rally by 50%

- SHIB price suffered a significant crash along with the top altcoins.

- Now, Shiba Inu is approaching a turning point as it prepares to rally following a period of underperformance.

- Vitalik Buterin has drastically reduced the token supply, and speculators believe this could be an eventful beginning to a breakout.

SHIB price witnessed a massive drop of nearly 60% in just one day. Shiba Inu fell in tandem with Bitcoin and other major cryptocurrencies to hit a low of $0.00000629. However, the meme-token could rebound due to a decrease in its supply.

SHIB price to rebound strongly

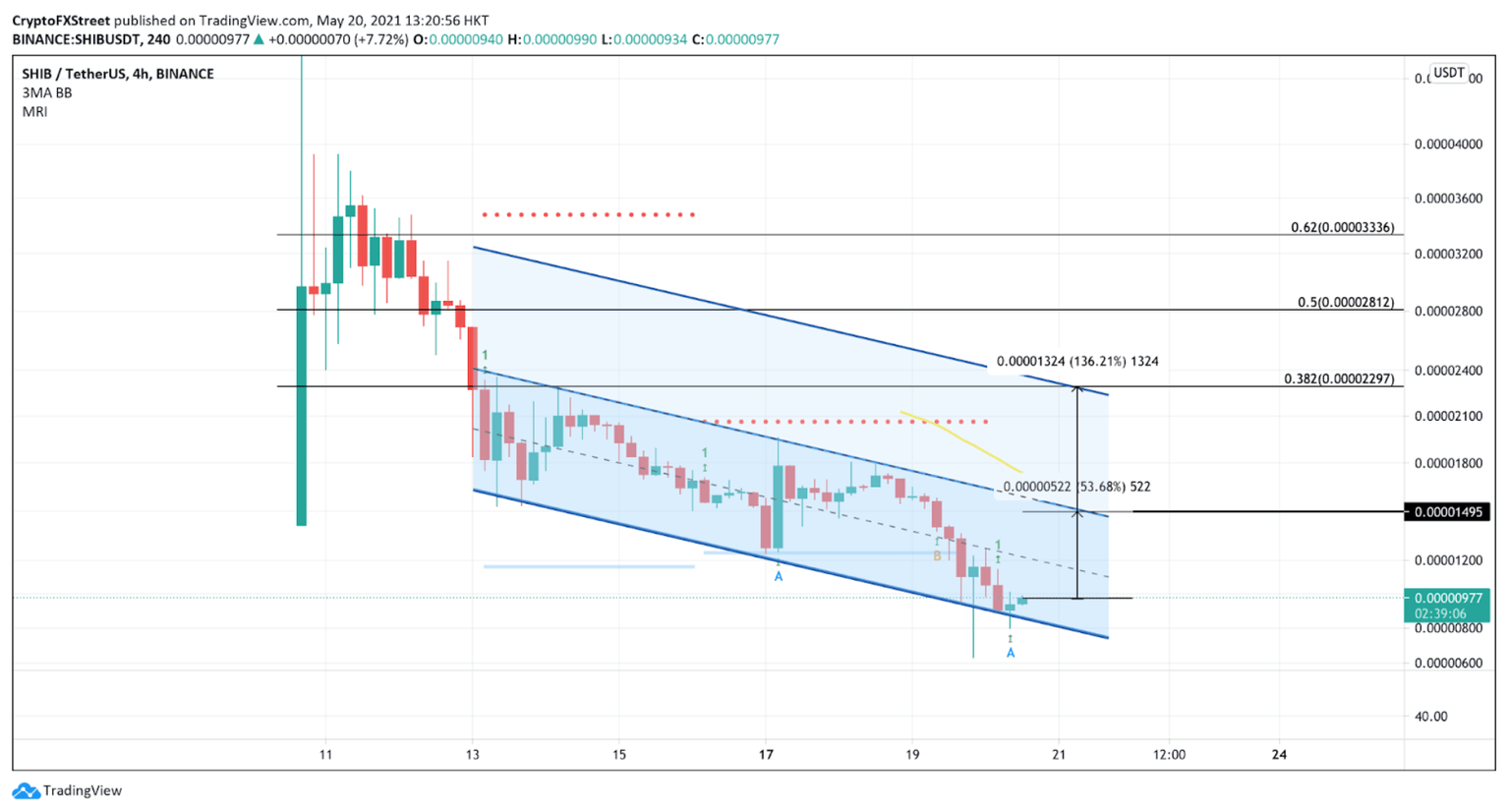

SHIB price appears to be trading within a descending parallel channel on the 4-hour chart. Shiba Inu has formed lower highs and lower lows, forming a downward trend.

Despite the weakness, the recent retest of the channel’s lower boundary could see Shiba Inu price rebound towards the pattern’s upper edge. Such an upswing would represent a 50% price increase for SHIB to tag the topside trend line at $0.00001474.

If SHIB bulls work further in favor of a rally, SHIB price could unravel a new uptrend, pushing the coin to the 38.2% Fibonacci extension level at $0.00002297, coinciding with the target projected by the parallel channel.

SHIB/USDt 4-hour chart

It is worth noting that Vitalik Buterin burned 410 trillion Shiba Inu tokens earlier this week, which allowed the coin to climb by over 40%. The Ethereum founder’s move made the supply of SHIB considerably scarcer.

Apart from Buterin, the SHIB team did not burn any tokens, but speculators may have followed the footsteps of the Ethereum figurehead.

According to the SHIB Informer Twitter account, the user noted that some market participants seemed to have burned their tokens, assuming that this could propel Shiba Inu price higher.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.