SHIB Price Prediction: Shiba Inu may rally 20% despite indecisiveness

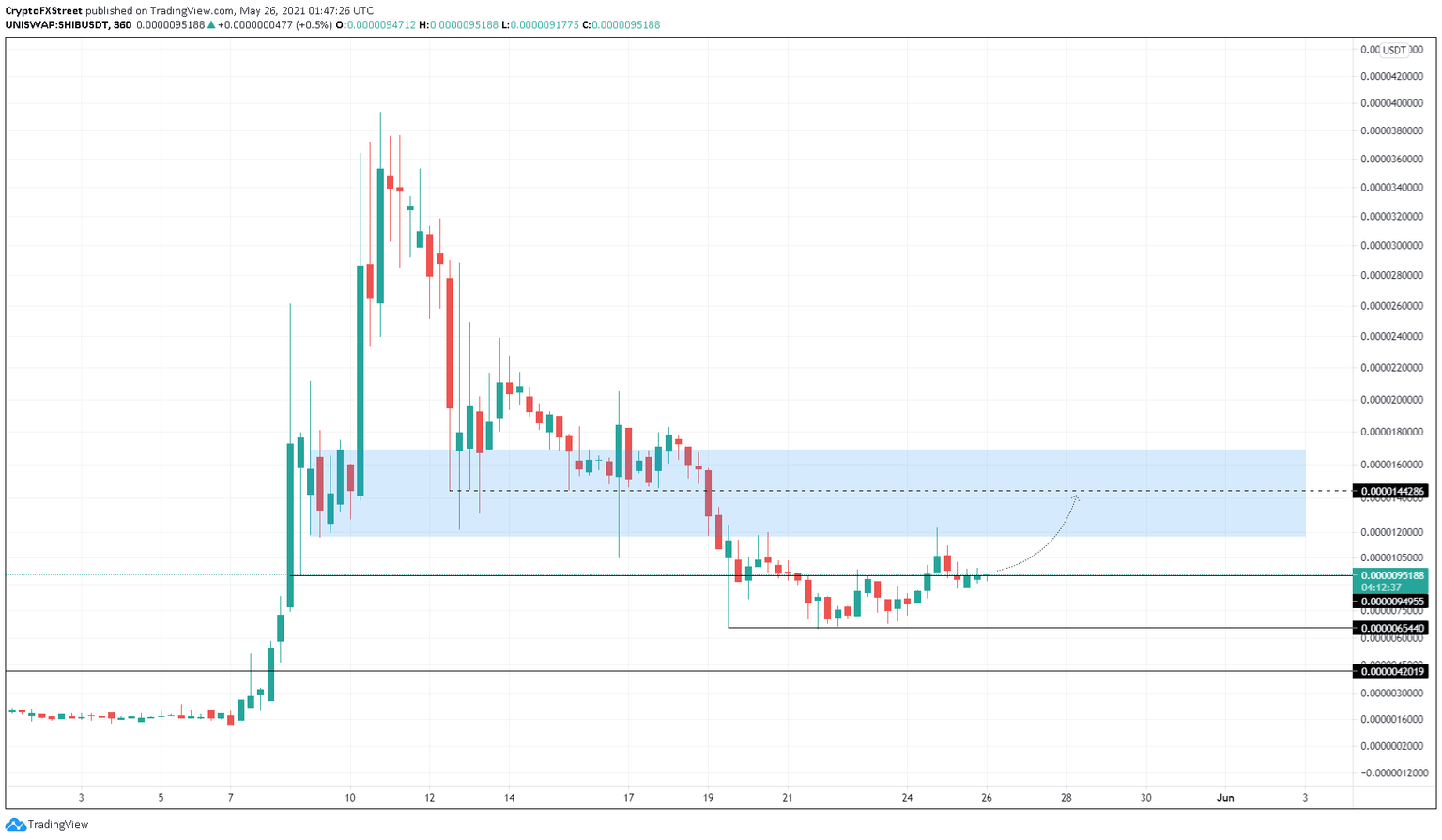

- SHIB price remains indifferent as it is stuck under a supply zone ranging from $0.0000117 to $0.0000168.

- Shiba Inu could rally 23% to retest the lower boundary of the resistance barrier at $0.0000117.

- A decisive 4-hour candlestick close below $0.00000654 will signal a massive shift in trend to the downside.

SHIB price does not show a clear directional bias as it trades in a narrow range. However, a minor upswing to retest the critical area for the third time seems likely.

SHIB price eyes equal highs

SHIB price is currently stuck in a tight range without a clear trend. It is moving back and forth between the supply zone’s lower range at $0.0000117 and swing low of May 19 at $0.00000654.

At the time of writing, the meme coin is currently grappling with the resistance barrier at $0.00000949. A decisive 4-hour candlestick close above this might propel SHIB price by 23% to $0.0000117.

If the buying pressure continues to mount, there is a high chance that Shiba Inu will rise an additional 22% to retest $0.0000144.

Investors should note that any uptick in SHIB price or an attempt to head higher will be an arduous task due to the presence of a massive supply zone that extends from $0.0000117 to $0.0000168. This means Shiba Inu is likely to experience more consolidation in the near future.

SHIB/USDT 4-hour chart

While the upswing narrative seems logical, it is dependent on a successful breach of the resistance level at $0.00000949. A failure to flip this barrier will invalidate the bullish thesis detailed above and question the bulls’ authority, leading to a 30% decline to retest the May 19 swing low at $0.00000654.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.