SHIB Price Prediction: Shiba Inu hints at 30% rally

- SHIB price is setting up a potential Adam and Eve pattern, suggesting a reversal.

- A decisive close above $0.0000109 will confirm a breakout and project a 30% upswing to $0.0000146.

- A breakdown of 0.00000784 will invalidate the bullish thesis and trigger a downtrend.

SHIB price shows the formation of a bottom reversal technical pattern that projects a huge potential bullish breakout. However, Shiba Inu needs to produce a decisive close above a critical resistance level to kick-start this upswing.

SHIB price needs to maintain its bullishness

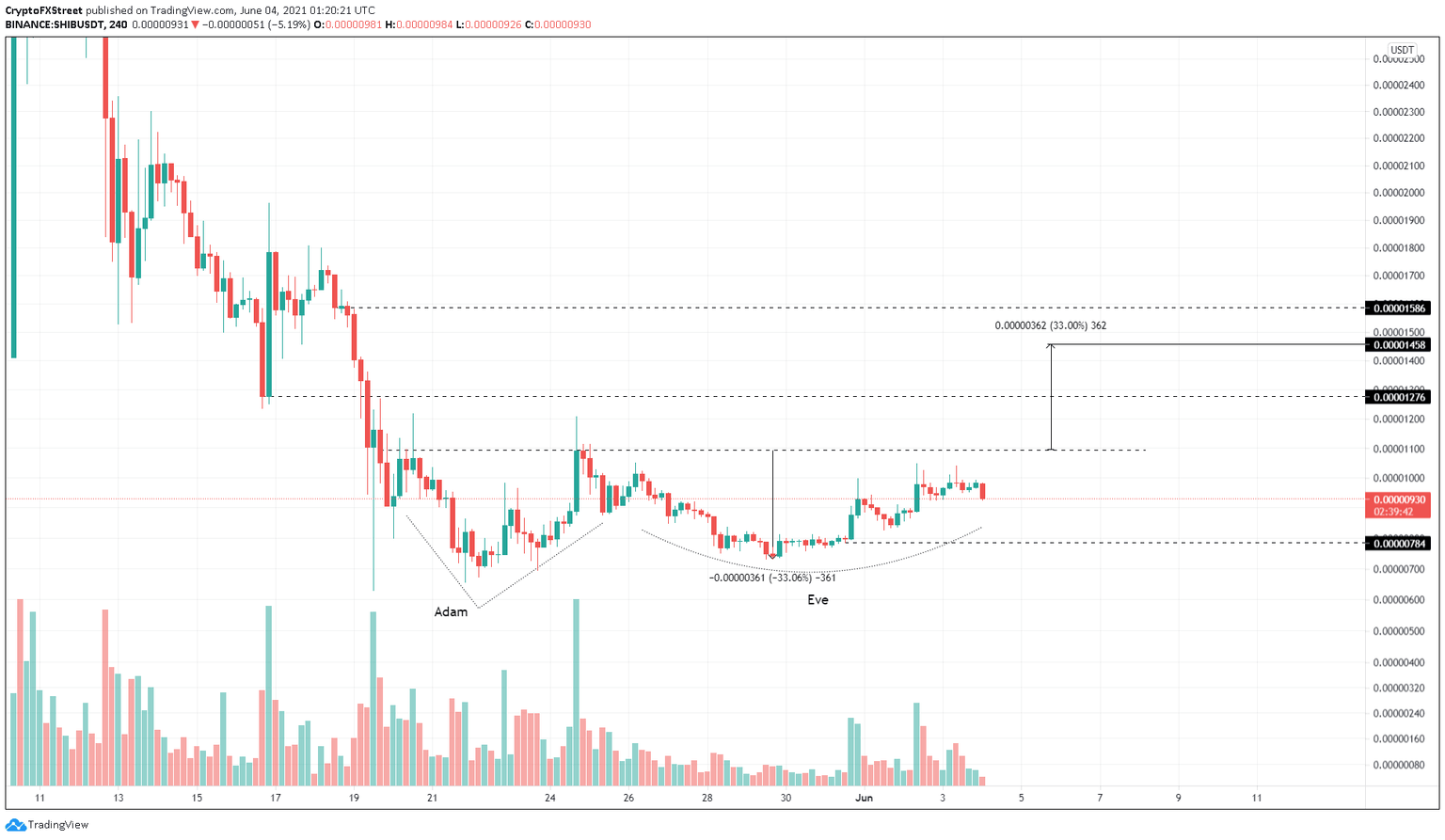

SHIB price action since May 20 has formed two distinct valleys known as Adam and Eve. The first swing low is narrow and v-shaped, known as Adam, while the one that follows has a rounded bottom and is referred to as Eve.

This technical formation is a bottom reversal pattern that projects a 30% upswing to $0.0000146. The target is determined by measuring the distance between the valley’s swing low to the peak and adding it to the horizontal resistance level connecting the swing highs.

Investors need to note that this is a potential pattern, and confirmation of the breakout will arrive when Shiba Inu price produces a decisive 4-hour candlestick close above $0.0000109.

If the bullish momentum persists after hitting the intended target, SHIB price could rise another 9% to tag the immediate resistance level at $0.0000159.

SHIB/USDT 4-hour chart

On the other hand, if Shiba Inu price continues to bleed, the bullish outlook will be in jeopardy. If the sellers manage to produce a convincing close below $0.00000784, it will invalidate the bullish outlook.

Confirmation of a downtrend will arrive after SHIB price closes below the swing low at $0.00000731, formed on May 29.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.