Sandbox whale moves $260m of SAND to new address on Day 2 of Metaverse Fashion Week

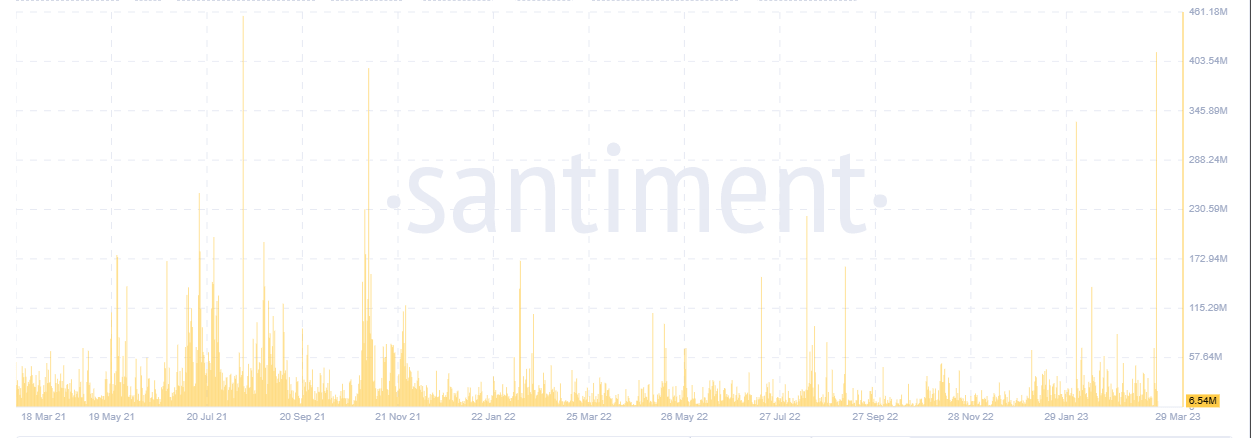

- A crypto whale moved $260 million worth of SAND tokens to a new address on the second day of the Metaverse Fashion Week.

- This is the highest number of tokens moved since August 13, 2020, Santiment data shows.

- Users fear the whale could be preparing for a sell-off.

The Sandbox stands among the leading metaverse platforms, boasting commendable price performance in 2023, having risen almost 70% year-to-date. The metaverse project has also scored notable high-profile partnerships. However, investor sentiment appears to be turning sour as one whale has emptied its entire SAND wallet, valued at hundreds of millions of dollars, to a new address.

A known #TheSandbox whale emptied out its entire 409M $SAND ($250M in total) and moved to a new address today. This was the most coins moved since the asset's first week of existence in August, 2020. Today's $261M moved is the most moved in 7 months. https://t.co/VnAiYbN06Z pic.twitter.com/SOHbUk2OvO

— Santiment (@santimentfeed) March 28, 2023

Orchestrating something?

A renowned Sandbox whale moved 409 million SAND tokens on Wednesday, March 29, the second day of the Metaverse Fashion Week (MVFW23). Being a metaverse token, the Sandbox (SAND) token is expected to react to the event that will focus on the newly constructed Neo Plaza, a welcome area established to showcase the next generation of fashion designers, Neo Designers.

Plan your #MVFW23 itinerary

— Decentraland #MVFW23 (@decentraland) March 25, 2023

March 28-31 brings four fabulous days of fashion shows, parties, shopping, panel talks, and amazing experiences to the metaverse.

Get ready to make your way through the big event like a model on the catwalk. https://t.co/ZNWLY1EtJF

At current rates, the 409 million SAND tokens transferred to a new address are valued at around $262.62 million, with each token auctioning for $0.64 at the time of writing. Based on Santiment data, this is the highest number of tokens moved since August 13, 2021, representing approximately 13.7% of the token's total supply.

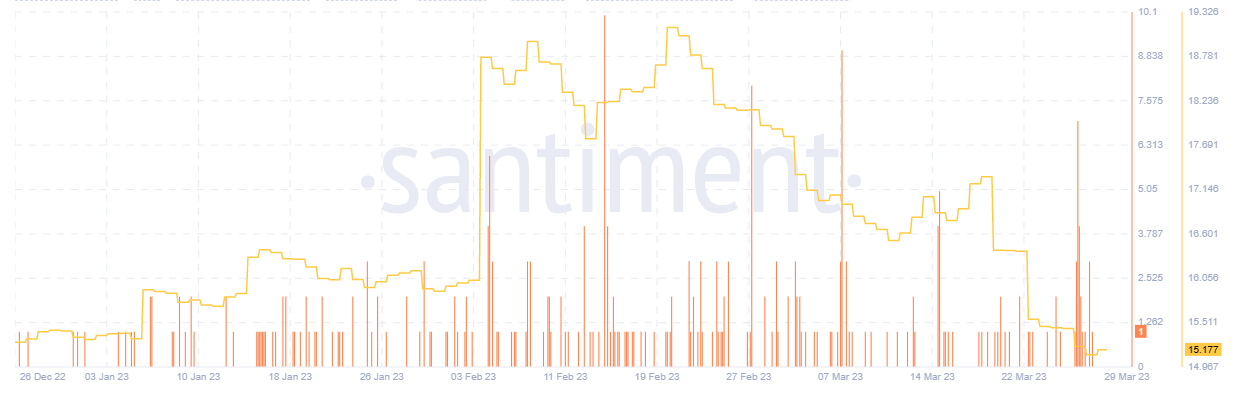

Etherscan data shows that the wallet holder ranks second after The Sandbox Genesis wallet in tokens held. Accordingly, users fear the whale may be preparing for a major sell-off, considering the decrease of major players since the onset of 2023.

On January 1, top addresses accounted for 77% of the total supply of the SAND token, but at the time of writing, the number has reduced to 74%, the lowest since the project's 2020 debut.

Effect of whale activity on SAND price

Notably, if whales decide to sell off their tokens, SAND price could suffer severely, worsening the network's underperformance in February.

SAND/USDT 1-day chart

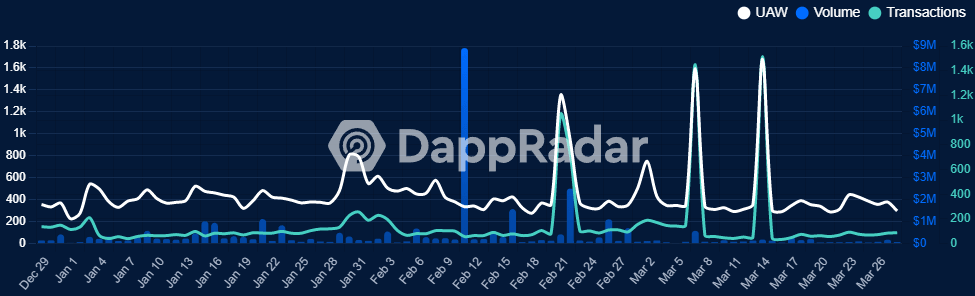

A comparison of SAND price against DappRadar data shows that retail investors' interest in the SAND token has plummeted despite the metaverse token's discounted rates. Similarly, network activity has dropped over the past few weeks, with DappRadar showing a 9.55% drop in Unique Active Wallets (UAW) on The Sandbox.

With one cohort of whales fleeing the scene, it should not be surprising if others follow.

A deal from the Metaverse Fashion Week?

However, it is possible that big players have identified deals amid the ongoing Metaverse Fashion Week. Moreover, such large amounts have often been linked to maintenance procedures, which means the 409 million SAND transaction could be related to a newly found partnership. For instance, the recent collaboration between The Sandbox and Ledger required the former to recommend its security solutions to its partners. Presumably, the whale is upgrading the security features of the wallet.

It is worth mentioning that The Sandbox is actively looking to forge new partnerships and restore interest with exciting events. As most people speculate, with 2023 being the year metaverse projects and Web3 gaming ecosystems will make their breakthrough, SAND price could impress token holders soon.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.