Sandbox retraces to key levels as SAND price prepares to skyrocket 30%

- Sandbox has corrected 38% from its all-time high and is retesting crucial support floors, anticipating a move higher.

- A decisive close above $5.5 will confirm an uptrend’s start and trigger a 22% ascent to $6.77.

- If SAND produces a lower low below $3.77, it will invalidate the bullish thesis.

Sandbox has seen a considerable retracement over the past weeks from its record high. The recent pullback after the December 4 flash crash, tagged critical support floors and has triggered a quick recovery. Going forward, investors can expect SAND price to propel higher.

Sandbox bulls face a decisive moment

Sandbox price has dropped roughly 38% from its all-time high at $8.48 to where it currently trades - $5.27. During this descent, SAND price tagged the 70.5% retracement level at $4.28 but quickly moved away from it.

After getting rejected at the trading range’s midpoint and the declining trend line, SAND shows signs of heading higher. Assuming Sandbox produces a higher high above $5.50, it will confirm the start of an uptrend.

In this condition, investors can expect SAND price to retest the $6.77 hurdle. The run-up from $5.27 to $6.77 would constitute a 30% ascent.

SAND/USDT 4-hour chart

Supporting this bullish outlook is Santiment’s 30-day Market Value to Realized Value (MVRV) model, which hovers around -1.7% or in the opportunity zone. This on-chain metric is used to determine the average profit/loss of investors that purchased SAND over the past month.

A negative value indicates that most of the holders are facing losses, and hence a risk of a sell-off is close to zero. Moreover, reversals usually occur after the MVRV resets or is present in the opportunity zone. This development makes the comeback of the bulls more likely.

SAND 30-day MVRV chart

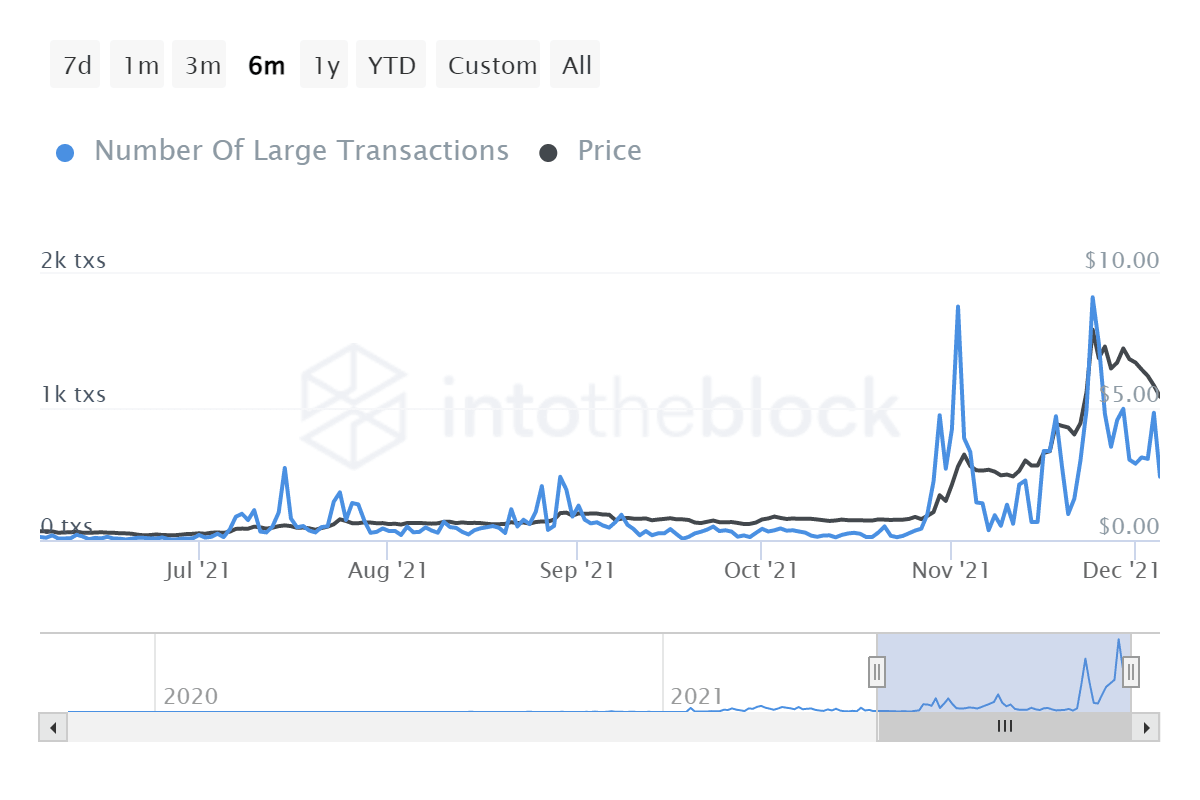

While things are looking good for SAND from a technical and on-chain perspective, investors should exercise caution and beware that large transactions worth $100,000 or more have declined by 79% from 1,830 to 476 since November 24. This downfall suggests that large institutions or whales are not interested in SAND at the current price levels.

SAND large transactions

Therefore, a potential spike in selling pressure that pushes Sandbox price to produce a lower low below $3.77 will invalidate the bullish thesis. In this situation, SAND could retrace to the range low at $2.52, where it will give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B09.03.50%2C%2008%20Dec%2C%202021%5D-637745365274774208.png&w=1536&q=95)