SafeMoon price prepares to escape from prevailing downtrend with 60% ascent

- SafeMoon price has found it challenging to break out of the governing downtrend in the past five months.

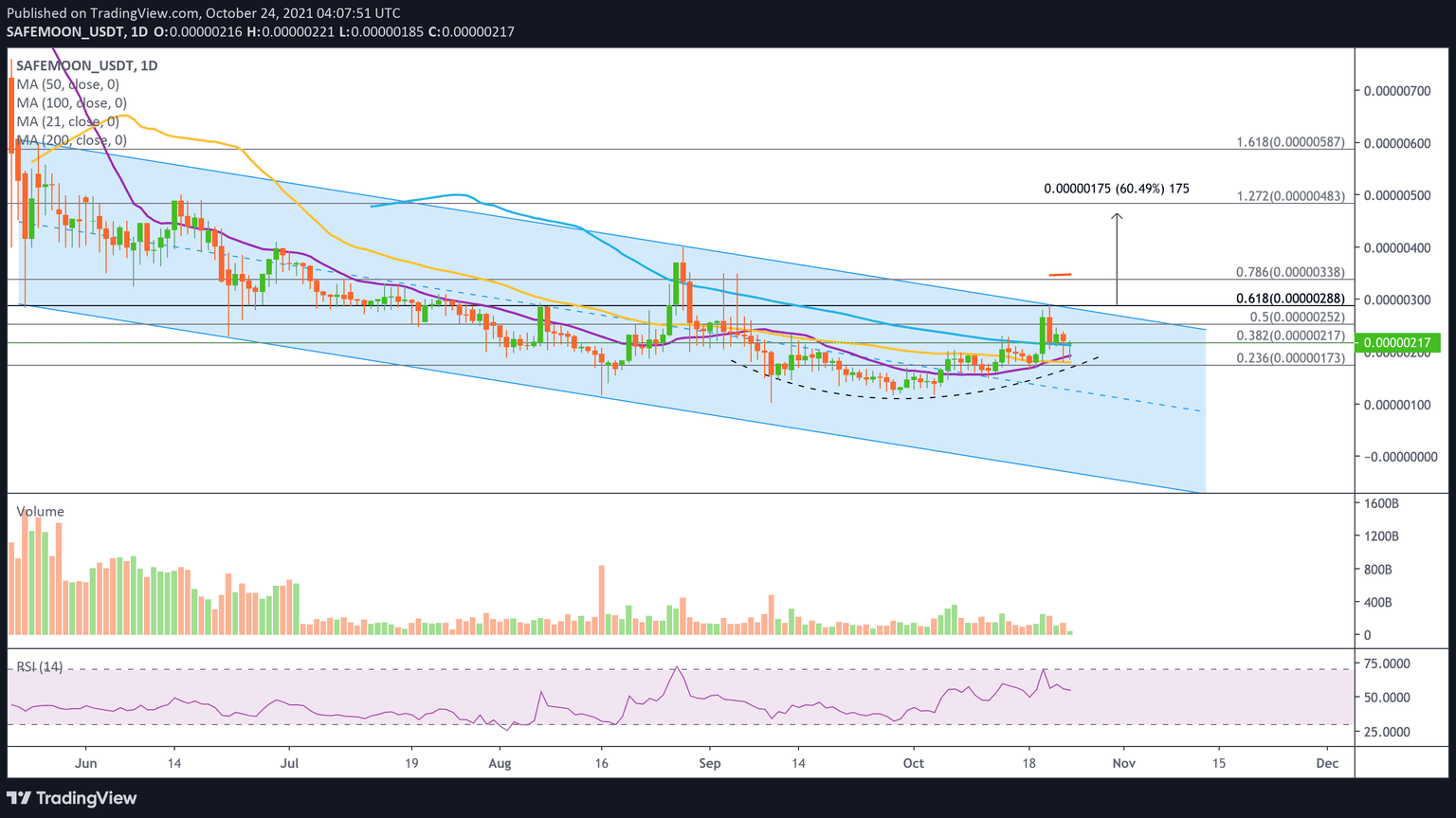

- SAFEMOON needs to climb toward $0.00000288 to achieve a 60% rally.

- However, dropping below $0.00000173 could spell trouble for the bulls.

SafeMoon price has been locked in a downtrend since May 23, with little ambition to reverse the period of sluggish performance. While the altcoin is trapped in the prevailing consolidation chart pattern, an escape above $0.00000288 could spell trouble for the bears.

SafeMoon price prepares to battle resistance

SafeMoon price has been trapped within a descending parallel channel on the daily chart since May 23, with little luck of breaking free prevailing chart pattern. However, the altcoin may be anticipating a move to the upside as a rounding bottom pattern has emerged.

SafeMoon price has formed a saucer pattern on the daily chart, suggesting that SAFEMOON may soon see its downtrend retreat. The rounding bottom pattern indicates a 60% ascent from the neckline, as the bulls eye $0.00000465.

However, SAFEMOON has a few hurdles to tackle before the optimistic forecast is in the offing. The first obstacle for SafeMoon price is at the 50% Fibonacci retracement level at $0.00000252, then at the upper boundary of the parallel channel at $0.00000279.

The neckline of the saucer at the 61.8% Fibonacci retracement level at $0.00000288 would act as the following hurdle for SafeMoon price. Investors should note that only a slice above this level accompanied by a spike in buying pressure could put the bullish target on the radar.

SAFEMOON/USDT daily chart

Further resistances may appear at the 78.6% Fibonacci retracement level at $0.00000338, then at the 200-day Simple Moving Average (SMA) at $0.00000348, then at the August 28 high at $0.00000400.

If selling pressure increases, SafeMoon price would be able to discover support at the 21-day SMA at $0.00000193, before falling toward the 50-day SMA which coincides with the 23.6% Fibonacci retracement level at $0.00000173.

Should the bears take control and see SAFEMOON drop lower, the bullish outlook would be voided and the altcoin could plunge toward the middle boundary of the chart pattern at $0.00000124.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.