SafeMoon Price Prediction: SAFEMOON shatters critical support area, eyes correction

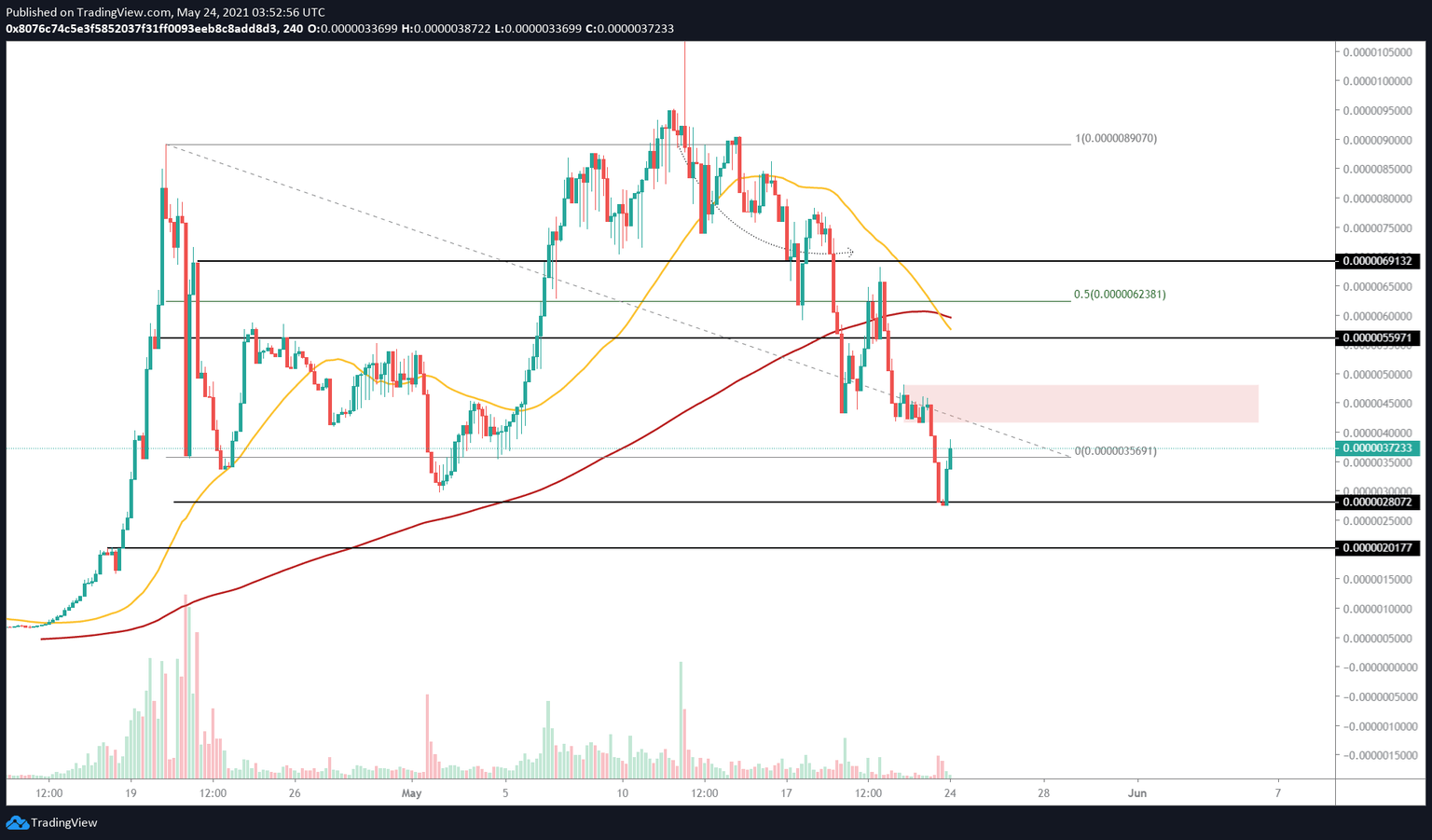

- SafeMoon price is currently bouncing from a key demand floor at $0.00000280.

- Rejection at a support ceiling, ranging from $0.00000416 to $0.00000481, could trigger a 51% downswing to $0.00000201.

- A bullish scenario will evolve if SAFEMOON generates a decisive 4-hour candlestick close above $0.00000481.

SafeMoon price has seen a quick bounce after tagging the immediate support level. However, a failure to slice through a crucial resistance level will lead to a steep correction.

SafeMoon price rises with faux bounce

SafeMoon price began consolidation briefly after crashing 35% between May 21 and May 22. This move was followed by a steep 35% decline that led to a retest of the support level at $0.00000280. The short-lived consolidation formed a demand zone ranging from $0.00000416 to $0.00000481 but was flipped to a supply area as SAFEMOON sliced through it as it continued its downtrend.

While the recent 40% upswing might seem bullish, it is likely to get rejected around the mentioned supply zone.

Adding credence to this downtrend is the bearish crossover, a move of the 50 four-hour Simple Moving Average (SMA) below the 100 four-hour SMA. Such a development indicates that the short-term momentum is declining faster than the long-term, indicating a sell-side pressure.

Therefore, investors can expect SafeMoon price to reverse around $0.0.00000416, leading to a 51% sell-off to $0.00000201.

Market participants should keep an eye on the support floor at $0.00000280, as this level might try to deter the downswing.

SAFEMOON/USDT 4-hour chart

While the 40% rally seen so far seems bullish, a confirmation of this will arrive after SafeMoon price produces a decisive 4-hour candlestick close above $0.00000481. Such a move would indicate that the buyers have overcome the sellers and that a further appreciation of SAFEMOON’s market value seems plausible.

In that case, the altcoin could surge 16% to tag the resistance level at $0.00000559.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.