SafeMoon Price Prediction: SAFEMOON nears key support as sellers retain control

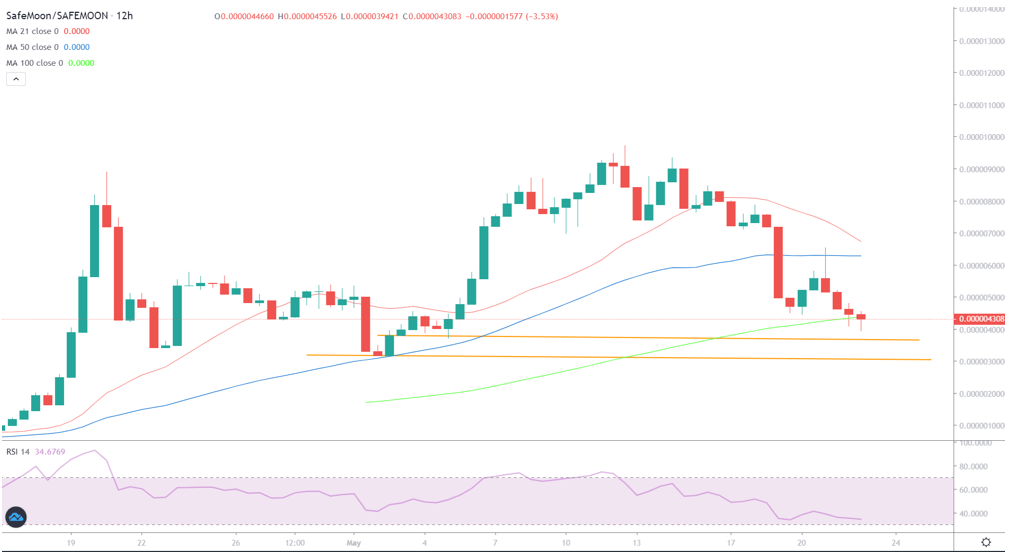

- SAFEMOON price eyes key support, as 12H technical setup favors bears.

- Bears need 12H candlestick closing below 100-SMA.

- RSI remains bearish, looks to test the oversold region.

SAFEMOON price is wallowing near two-week lows of $0.000003983, down nearly 10% over the past 12 hours, as the sellers remain in complete control after this week’s market turbulence.

Despite several encouraging tweets by the auto-generating liquidity protocol since the mid-week crash, investors continue to lack conviction amid a persistent downbeat mood across the crypto markets, courtesy of the recent Chinese regulatory announcements.

SafeMoon hit lifetime highs of $0.000008419 on May 12, in response to a broader market advance and celebrity endorsements. The most recent celebrity to promote SafeMoon is Barstool Sports founder Dave Portnoy.

Additionally, the meme-based coin also drew support earlier this month after the company tweeted out, a video boasting it was "CertiK Approved."

SAFEMOON/USD: Technical indicators scream sell, more losses in the offing

The downside appears more compelling for SAFEMOON, especially after the price failed to resist above the 100-simple moving average (SMA) at $0.000004362 on the 12-hour chart.

The sellers now await a 12-hourly candlestick close below the abovementioned key support, in order to challenge the immediate line of defense at $0.000003670.

If the selling pressure intensifies, the next downside target is aligned at $0.000003062.

The Relative Strength Index (RSI) is on the track to test the oversold territory, currently around 35.50, suggesting there is a scope for additional downside.

SAFEMOON/USD: 12-hour chart

However, should the bulls recapture the 100-SMA support-turned-resistance on a sustained basis, a recovery towards the $0.0000050 psychological barrier cannot be ruled out.

The horizontal 50-SMA resistance at $0.000006282 is the level to beat for the SAFEMOON bulls.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.