SafeMoon finds support, positions for return to $0.000007

- SafeMoon price has been the definition of what whipsaws in trading cryptocurrencies look like.

- Profit-taking and mean reversion traders smash SafeMoon lower as the market battles for equilibrium.

- The road to $0.000007 may be difficult but not insurmountable.

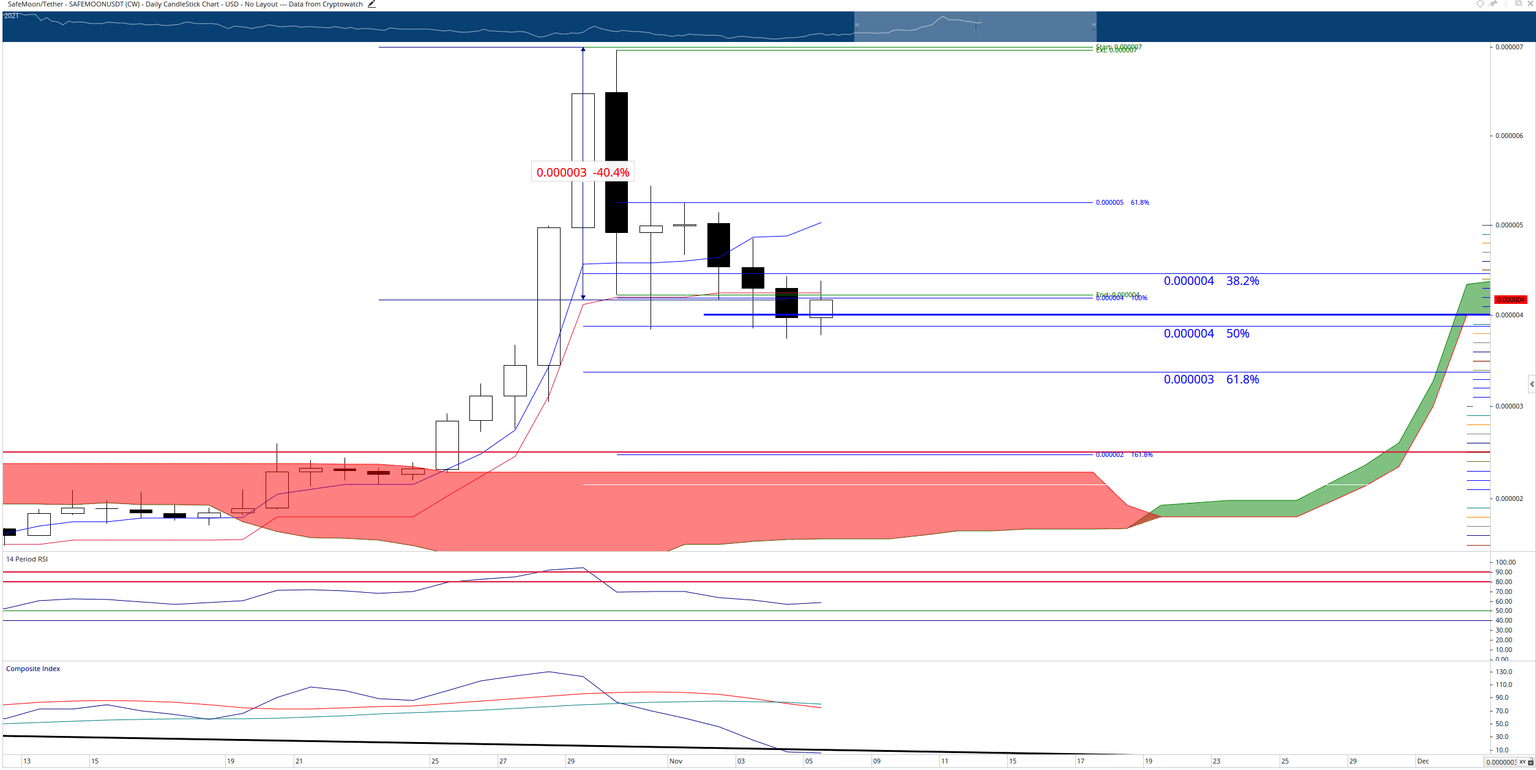

SafeMoon price has retraced more than 46% from the new all-time highs established on October 29th. SafeMoon remains 40% below its all-time highs. A strong confluence zone of support may limit and further selling pressure.

SafeMoon price dives nearly 50% and finds support

SafeMoon price is at an inflection point. A massive gap between the top of the Cloud (Senkou Span B) and the Kijun-Sen indicates that any move below the Kijun-Sen could trigger intense selling pressure to test Senkou Span B as support. However, support does exist between those two Ichimoku levels.

The 50% Fibonacci retracement drawn from the all-time high to the low of the weekly strong bar is at $0.0000039. Sharing that value area is the weekly Tenkan-Sen (blue, horizontal ray) at $0.0000040. SafeMoon price has bounced off the 50% Fibonacci retracement four times in the past six days. How likely is this confluence zone to hold as support? The oscillators can give us a clue.

The Relative Strength Index remains in bull market conditions. It has yet to test the first oversold level in a bull market (50) since moving to 100, but it has bounced off 55. This indicates that momentum may continue to the upside. Additionally, the Composite Index has created a lower low and tagged extreme lows, increasing the likelihood that SafeMoon price will at least find some equilibrium at its present value area.

SafeMoon/USDT Daily Ichimoku Chart

Any close below the 50% Fibonacci ratio could trigger increased selling pressure for Safemoon price. The 161.8% Fibonacci expansion sits right on top of the 2021 Volume Point Of Control at $0.0000026 and above Senkou Span B at $0.0000024. If SafeMoon price can maintain support near the 50% Fibonacci retracement, the most likely scenario is a consolidative market.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.