Ripple Price Prediction: XRP to retest $0.44 before the uptrend resumes

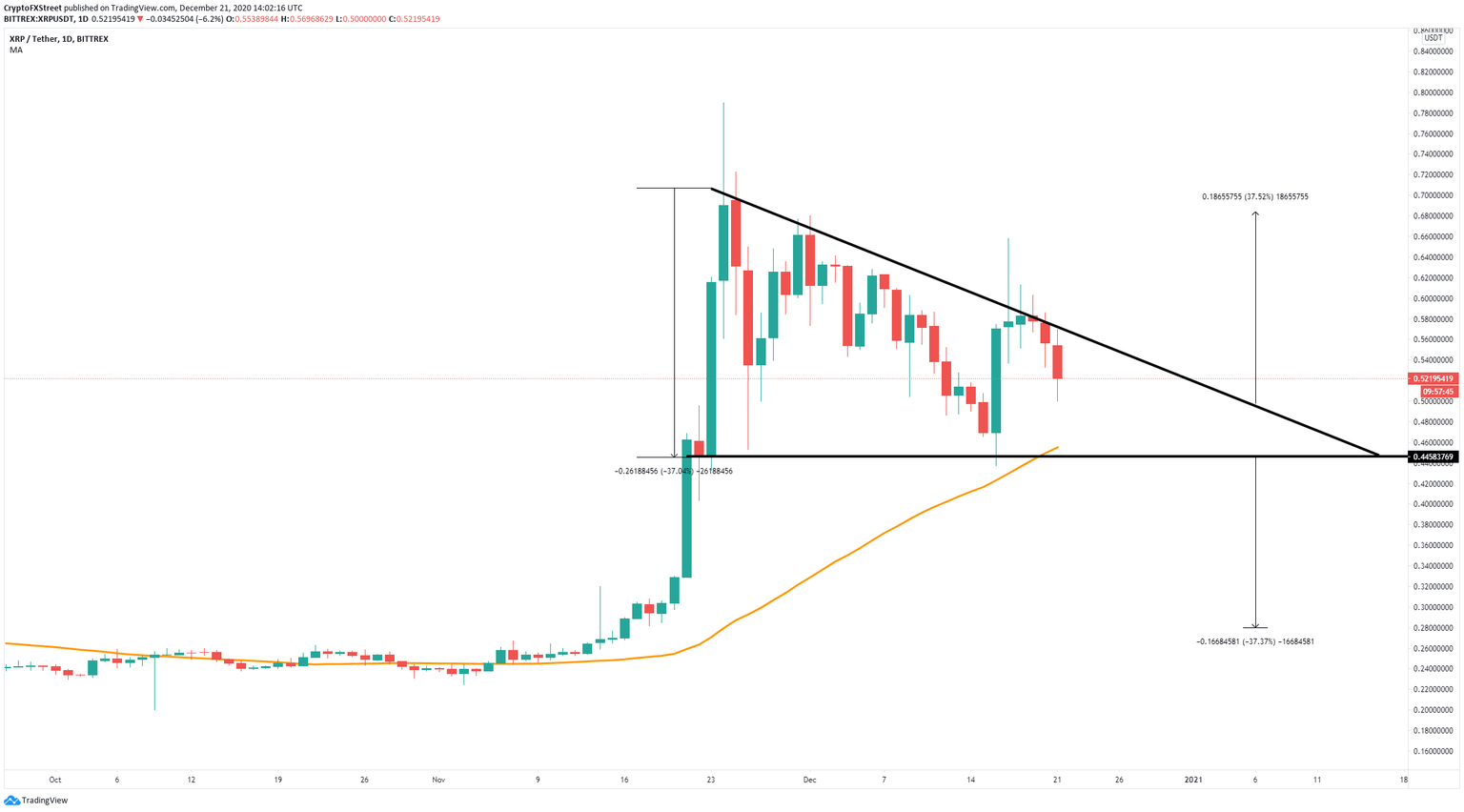

- Ripple price is contained inside a descending triangle pattern on the daily chart.

- The digital asset is on its way towards the triangle's x-axis at $0.44.

Ripple had a significant pullback after the SPARK airdrop ended on December 12, but managed to recover promptly. Now that the rest of the cryptocurrency market seems to be in consolidation mode, XRP bears are targeting $0.44.

Ripple price faces short-term correction

XRP price action has formed a descending triangle pattern on the daily chart. The third-largest cryptocurrency by market capitalization was recently rejected from the triangle's hypotenuse, indicating that is bound for a correction towards the underlying support at $0.44.

The 50-day SMA coincides with the triangle's x-axis, which further strengthens this support barrier.

If the bulls can indeed defend the $0.44 level, Ripple price will likely rebound towards the descending trendline at $0.55. A breakout above this hurdle can push XRP to a high of $0.70.

XRP/USD daily chart

It is important to note that even though large XRP holders sold off their tokens following the SPARK airdrop to take advantage of the upward price action, some of them appear to be reentering the market. Most importantly, the number of whales holding 10,000,000 XRP or more, worth roughly $5,200,000, continues making a series of higher highs.

Such a rising demand for this cryptocurrency among institutional investors adds credence to the bullish outlook.

XRP Holders Distribution chart

Regardless, investors must pay close attention to the $0.44 support level. A breakdown below this demand wall can quickly drive Ripple price towards $0.30.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.03.25%2C%252021%2520Dec%2C%25202020%5D-637441563779790163.png&w=1536&q=95)