Ripple Price Prediction: XRP poised to correct to $0.25 before next leg up

- XRP struggles to preserve its bullish momentum on Saturday.

- A correction toward $0.25 is in the books.

- A daily close above $0.27 could open the door for additional gains.

After gaining more than 4% on Friday, XRP extended its rally and touched its highest level in more than two months at $0.2774. However, bulls seem to be reluctant to commit to additional gains as price fails to hold above the key resistance area. As of writing, XRP was posting small daily losses at $0.2640.

A correction toward $0.25 is in the books

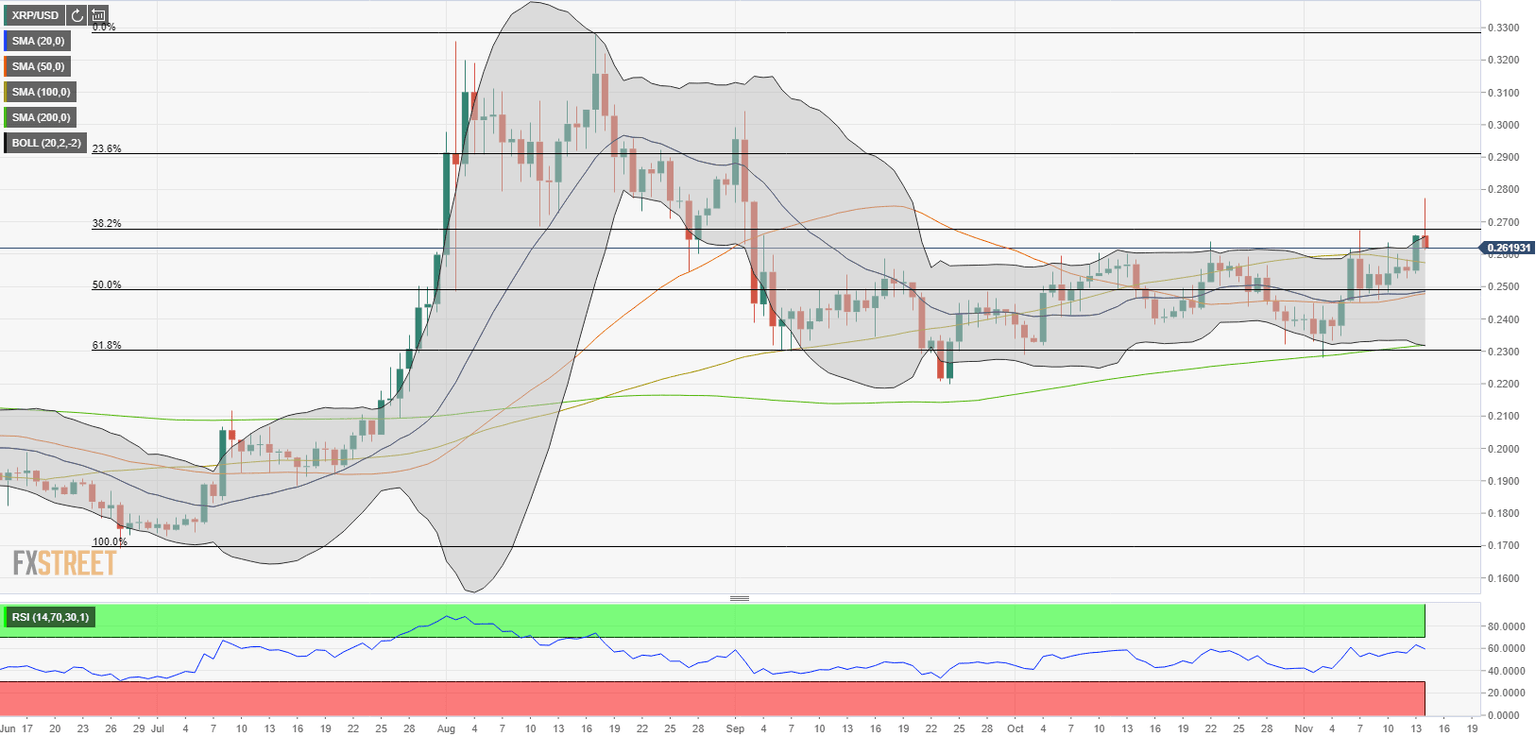

On the daily chart, the Fibonacci 38.2% retracement of the latest uptrend is located around $0.27 and this resistance is area is reinforced by the upper limit of the Bollinger Band. The initial break above that hurdle was unsuccessful and XRP is likely to stage a correction before attempting to push higher.

On the downside, the 100-day SMA forms the first technical support at $0.26. Below that level, the middle line of the Bollinger Band, the Fibo 50% retracement, the 20-day SMA and the 50-day SMA are all located around $0.25, making this level as the most likely correction target.

On the other hand, with a daily close above $0.27, the near-term outlook could turn bullish and XRP could turn its attention to $0.2775 (daily high) ahead of $0.2900 (Fibonacci 23.6% retracement).

XRP/USD daily chart

XRP started the weekend on a strong footing and rose to its highest level since early September but failed to preserve its bullish momentum. Although Ripple remains on track to close the second straight week in the positive territory, a retreat to $0.25 looks likely before the end of the week.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.