Ripple Price Prediction: XRP is on the cusp of a massive price movement

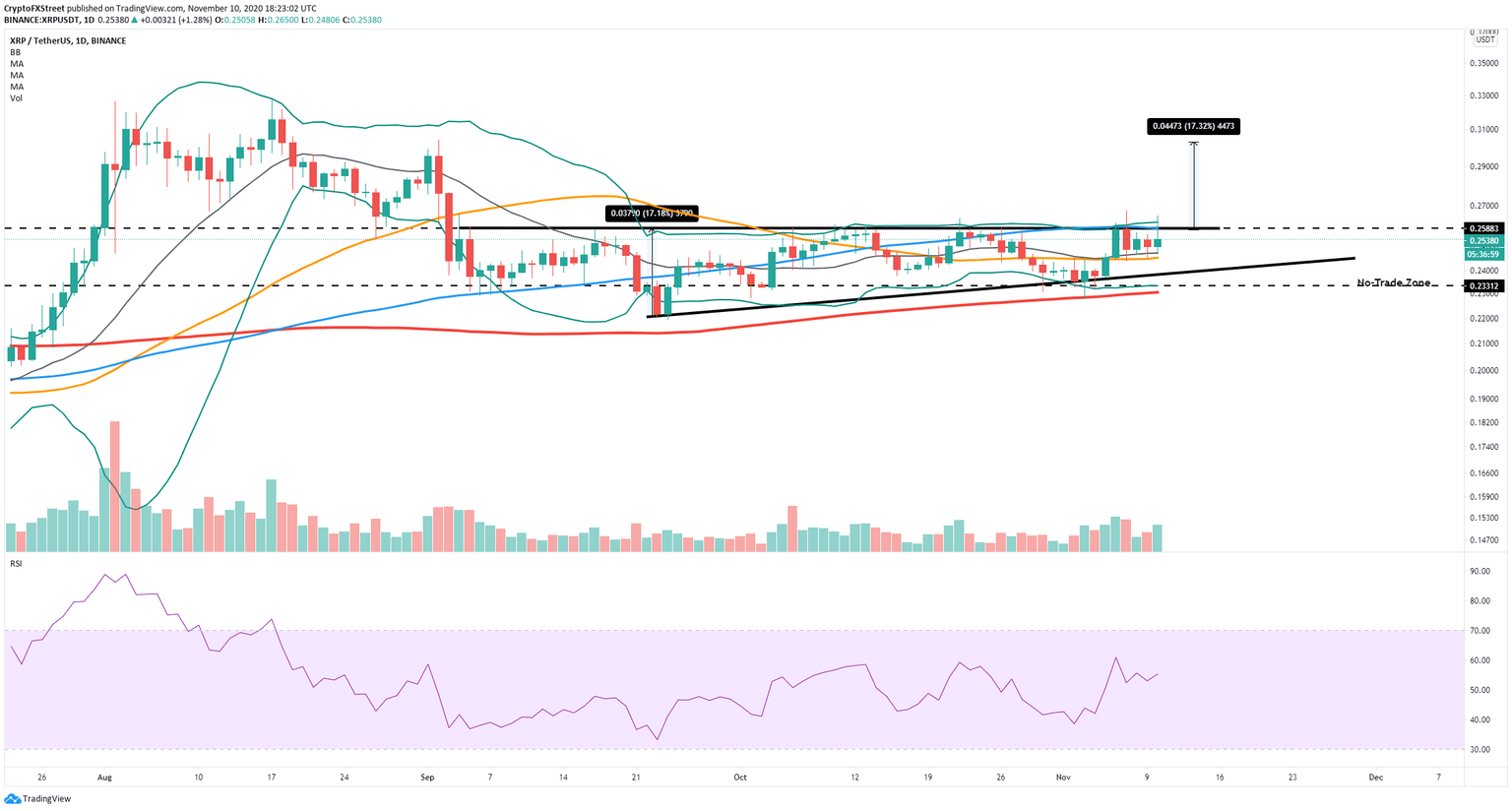

- Ripple price is bounded inside an ascending triangle pattern formed on the daily chart.

- Several indicators show the price is ready for a breakout in the short-term.

XRP price is currently at $0.253, right below a critical barrier at $0.26, which has been tested several times throughout the past two months. A breakout above this point can easily drive XRP price towards $0.30.

XRP bulls need to crack $0.26 for good

XRP price has pierced through the critical resistance level at $0.26 several times in the past but never managed to close above it. The 100-SMA on the daily chart is also established at $0.26, adding even more strength to the level.

XRP/USD daily chart

Additionally, the Bollinger Bands are squeezing significantly after a period of stagnation. The upper Band coincides with the 100-SMA and the upper boundary of the ascending triangle pattern on the daily chart. A breakout above this critical point can quickly drive XRP price towards $0.30.

XRP Holders Distribution chart

The Holders Distribution chart shows a notable increase in the number of holders with at least 10,000,000 XRP coins from a low of 304 on November 2 to 310 currently. This growth of whales signifies a developing interest in the digital asset despite the current flat price action.

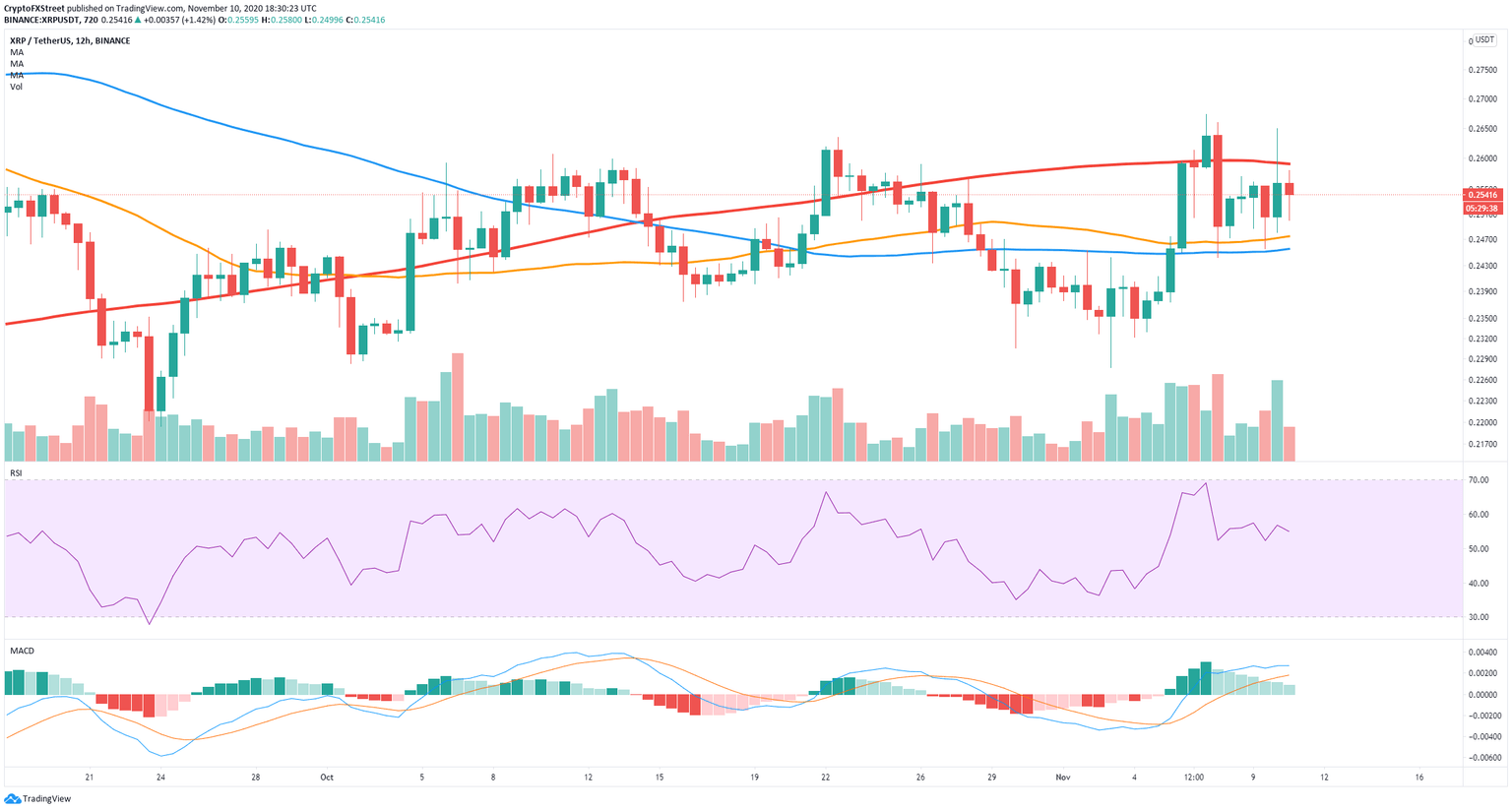

XRP/USD 12-hour chart

Despite the bullish metrics, XRP price got rejected from $0.26 again. On the 12-hour chart, the 200-SMA also coincides with the same level adding even more strength to it. The closest bearish price target following this rejection is $0.247, which is the 50-SMA on the 12-hour chart and also on the daily chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B19.23.52%2C%2010%20Nov%2C%202020%5D-637406298116543676.png&w=1536&q=95)