Ripple Price Prediction: XRP at a critical juncture, could trigger a 10% crash

- XRP price is hovering above an inclined trend line serving as a support level.

- A breakdown of this trend line could result in a 10% sell-off that could extend to $0.360.

- A daily candlestick close above the $0.538 hurdle will invalidate the bearish thesis.

XRP price has shown tremendous strength over the last few weeks, which has resulted in amazing rallies. However, things are at an inflection point that could trigger a correction if bulls fail to step up at this important level.

Ripple price at crossroads

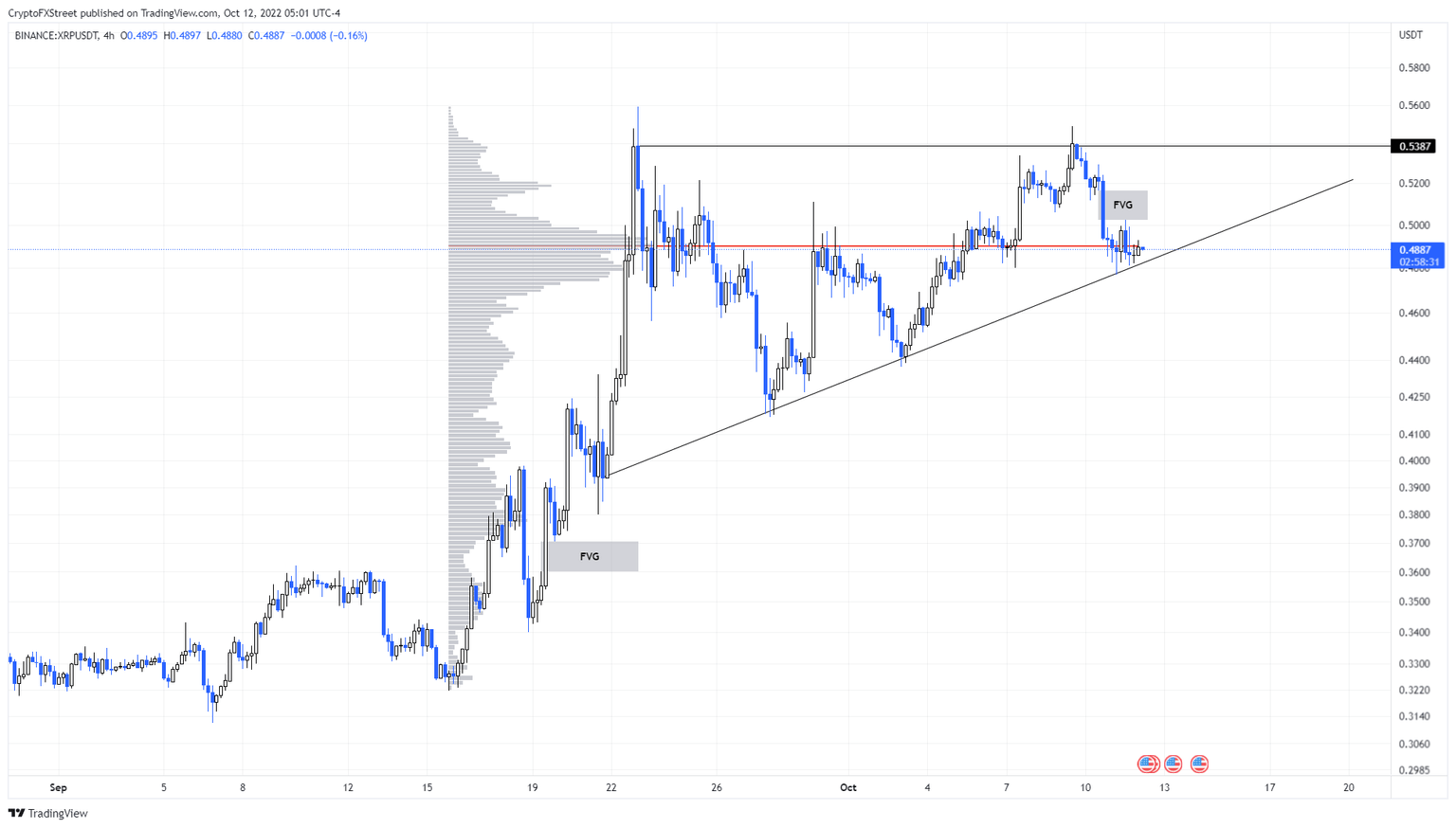

Ripple price rallied roughly 75% between September 15 and 23 and set up a local top at $0.559. This move was followed by a minor retracement that set up a higher low at $0.437 and attempted to break through the local top. Failure to push through led to a 12% retracement, forming another higher low at $0.476.

Connecting a trend line to the higher lows formed since September 21 shows that XRP price is in an uptrend but is facing selling pressure at roughly $0.540. If this trend continues, the remittance token could form an ascending triangle.

However, considering the US Consumer Price Index (CPI) is set to be announced tomorrow, investors should expect a breakdown of this level followed by a 10% retracement to $0.440. If this downswing continues, knocking XRP price to produce a lower low below the October 3 swing low at $0.437, it will indicate the start of a downtrend and probably crash the altcoin to fill the Fair Value Gap (FVG), extending from $0.370 to $0.360.

XRP/USD 4-hour chart

Regardless of the palpable bearish outlook, the CPI numbers announcement is a make-or-break event. If this number is lower than the previous month, the Fed is less likely to aggressively increase the interest rate. Such a development could see traditional finance and crypto markets rally, which is a good sign for XRP holders.

Investors can expect a recovery bounce to fill the FVG to the upside, extending from $0.502 to $0.516. If this run-up extends beyond and flips the $0.538 hurdle into a support floor, the bearish thesis would face invalidation.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.