XRP Price Prediction: A pullback in Ripple to entice sidelined bears

- XRP price is down 9% after a 23% rally in October.

- The bears have pushed the XRP price into oversold territory on the Relative Strength Index.

- Invalidation of the bearish thesis is a breach adobe the swing high at $0.56.

XRP price will likely rise a bit before a stronger decline occurs.

XRP price to experience turbulence

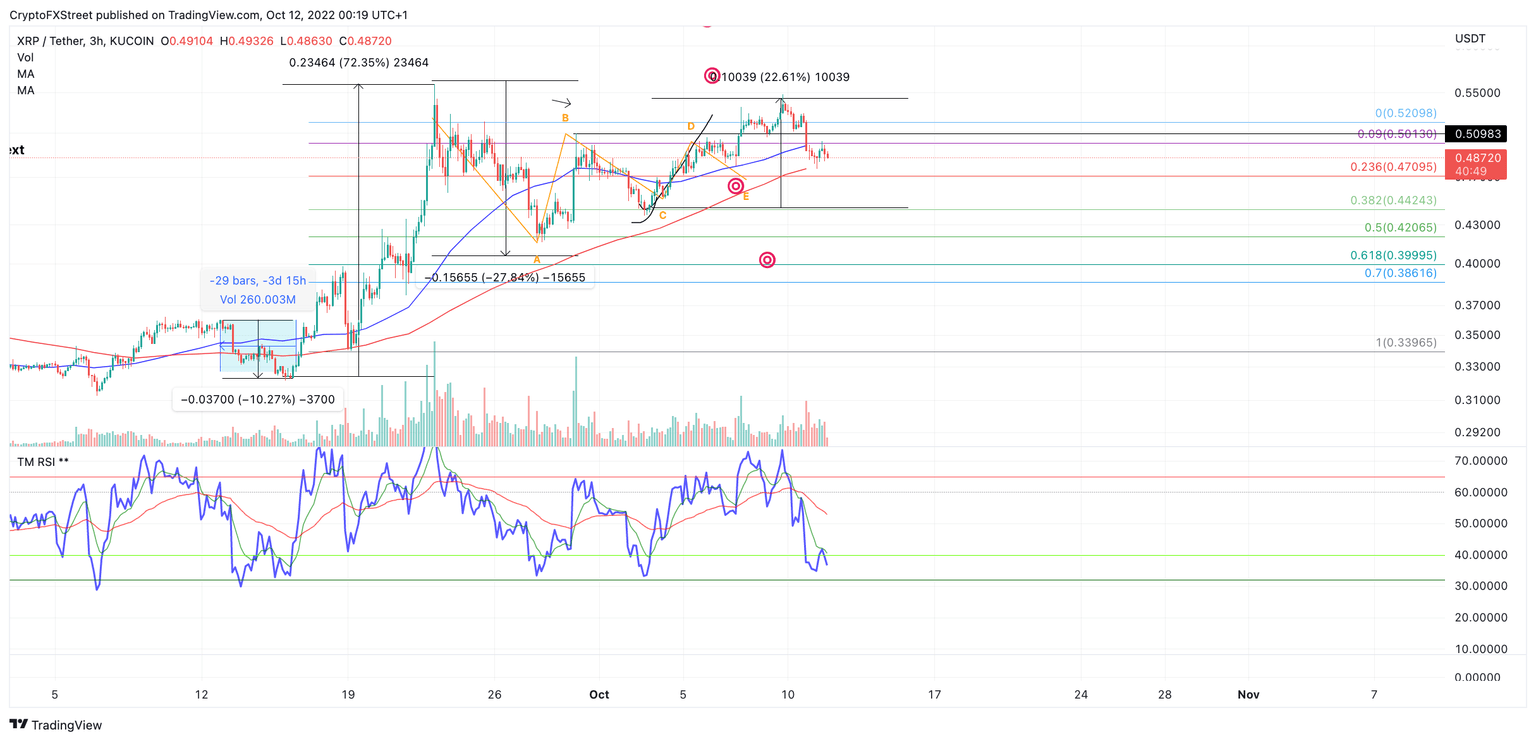

Ripple's XRP price has lost 9% of market value since pulling off a 23% rally in October. The 24% rally is now the smallest compared to the initial 70%, and 30% rises witnessed previously during August and September. This is a subtle cue that the impulsive wave-up may have recently been finalized.

XRP price is currently trading at $0.49. The digital remittance token is currency testing the 21-day Simple Moving Average as support after the bulls abandoned ship near the 8-day exponential.

The Relative Strength has fallen into the oversold territory—however A hidden bullish divergence between the $0.48 and the previous swing lows of $0.44.A countertrend pullback should be expected in the coming days and will likely entice sidelined bears to jump into the market.

XRP/USDT 3-Hour Chart

Traders should keep the XRP price on their watchlist as the price could pull back towards $0.51 liquidity levels. A short will be justified if the bulls fail to establish new highs.

Invalidation of the bearish outlook depends on the swing high at $0.56 remaining unbreached. If the bulls were to breach this barrier, an additional rally towards $0.58 and possibly $0.61 could occur Such a move would result in up to a 27% increase from the current XRP price

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.