Top 3 Price Prediction Bitcoin, Ethereum, Ripple: How will CPI affect the crypto markets?

- Bitcoin price continues to stagnate below the bear flag setup, delaying the inevitable.

- Ethereum price could drop 15% if the $1,280 support level gives in.

- Ripple price is at a crucial foothold, a breakdown of which could trigger a 10% correction.

Bitcoin price could see a minor run-up to retest the recent broken, bearish setup. This development is likely to influence Ethereum, Ripple and other altcoins to do the same. Regardless, investors need to stay focussed on the mid-term outlook, which is still pessimistic.

Investors need to be cautious as September's US Consumer Price Index (CPI) numbers will be announced on October 13 at 12:30 GMT. While the expectation is 8.2%, which is lower than the previous month’s 8.3%, an upside surprise would send the markets into a tailspin as it would confirm expectations for steeper Fed rate hikes.

Regardless of the direction, investors should prepare for a surge in volatility tomorrow.

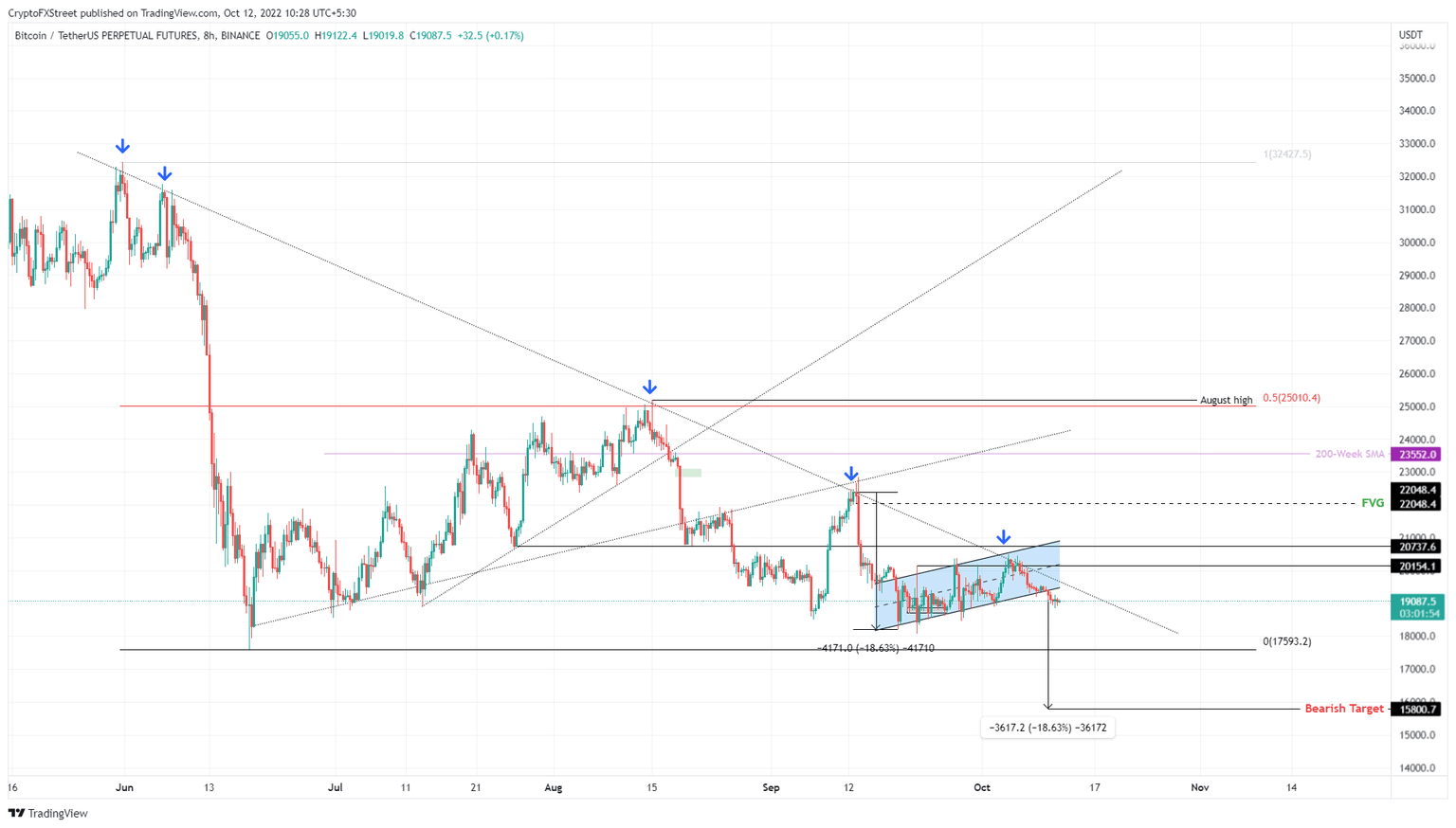

Bitcoin price waits for volatility

Bitcoin price has breached the bear flag setup, as discussed earlier. This technical formation is a bearish continuation pattern that forecasts an 18% downswing to $15,800. The recent breakdown of this bear flag has triggered this steep correction but lacks one key ingredient - volatility.

Investors can expect the sell-off to occur on October 13, when the Consumer Price Index (CPI) and the inflation numbers will be released. This is high-impact news for the traditional as well as the crypto markets.

Therefore, market participants should prepare for this event to knock Bitcoin price to sweep the June 18 swing low at $17,593 and try to extend this downswing to retest the bear flag target at $15,800.

BTC/USD 8-hour chart

While things are looking gloomy for Bitcoin price, a decisive flip of the $20,737 hurdle into a support level will invalidate the bearish thesis. This move could further extend the run-up to $22,048.

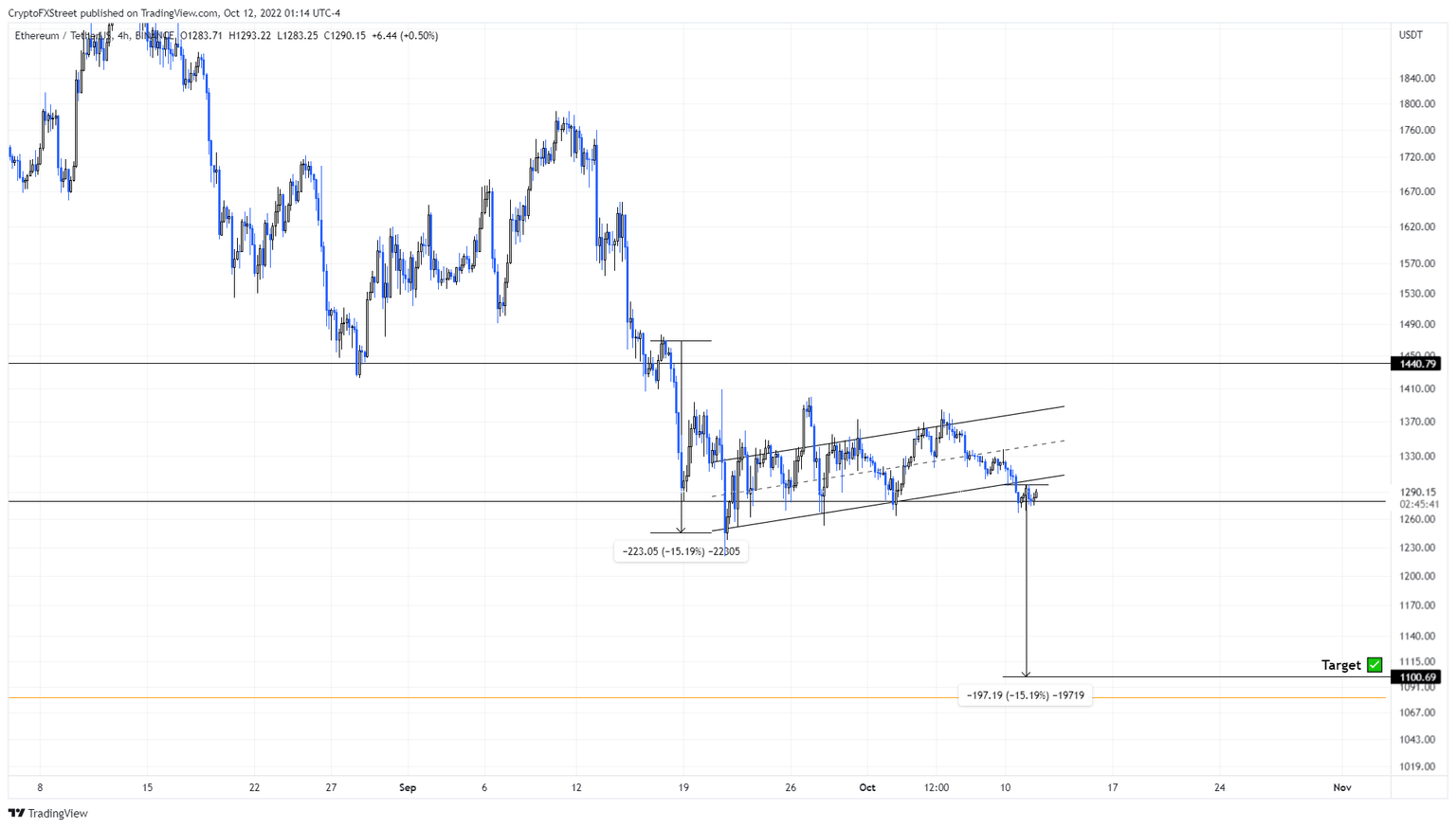

Ethereum price at wits’ end

Ethereum price has also created a bear flag pattern, following Bitcoin’s lead. As discussed in a previous article, this technical formation forecasts a 15% downswing to $1,100. However, ETH bears need to slice through the $1,280 support level.

A breakdown of the aforementioned barrier will signal the start of a downtrend and knock Ethereum price to $1,100. If the bearish momentum is strong, ETH could extend this bearish move to retest the $1,000 psychological level and even dip into the triple-digit territory.

ETH/USD 4-hour chart

On the other hand, if the Ethereum price produces a daily candlestick close above $1,338 will create a higher high and invalidate the bearish thesis. Such a development could see ETH retest the $1,450 hurdle.

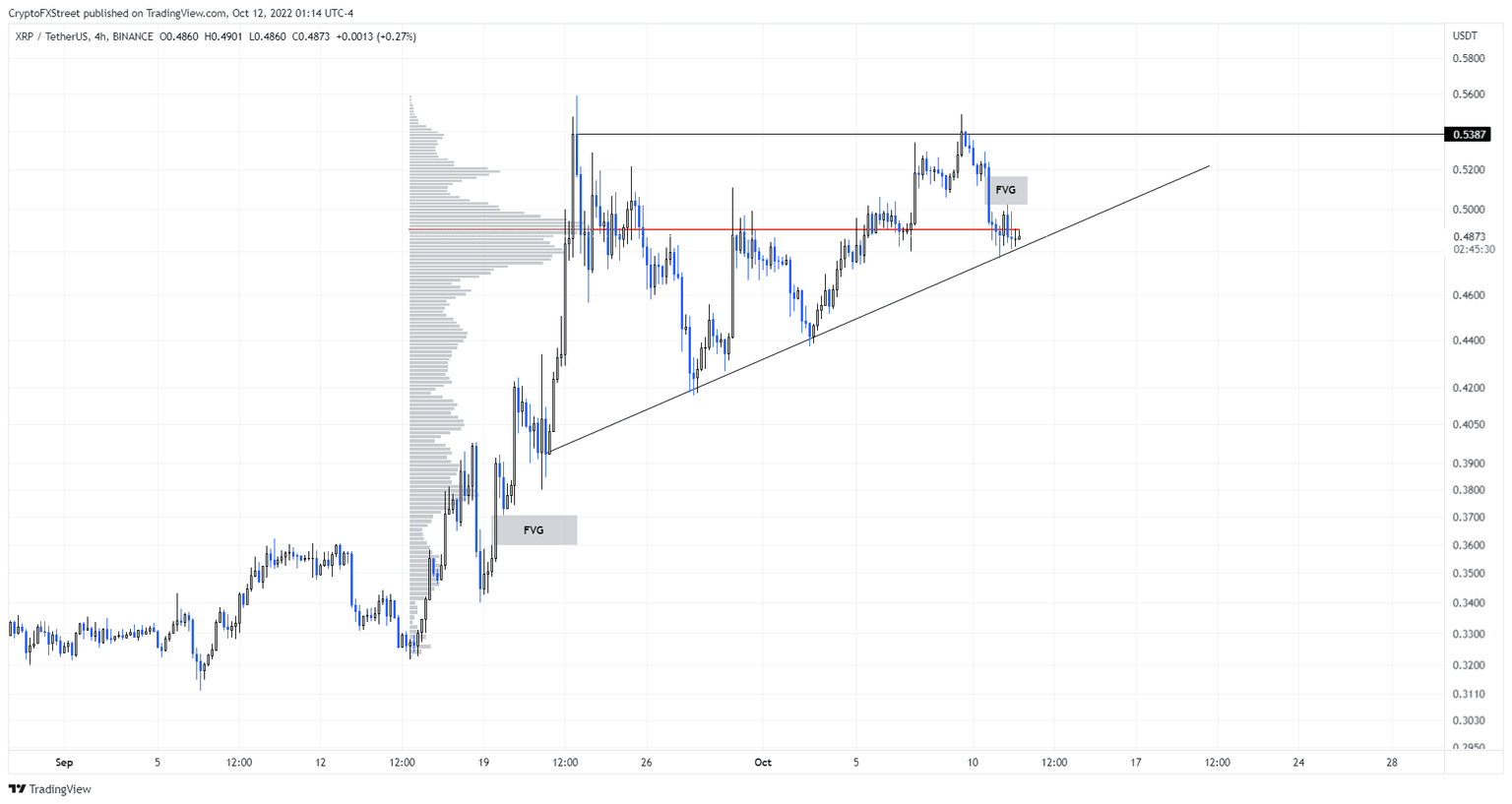

Ripple price at critical levels

Ripple price has slipped lower after last week’s rally and is currently hovering above an inclined trend line connecting the higher lows formed since September 21. Moreover, it has also slipped below the Point of Control at $0.490, which is the highest volume traded level since September 15.

Unless Ripple price flips $0.490 into a support floor, bears are in control and are likely to break below the declining trend line mentioned above. This development is a bearish outlook and could trigger another sell-off that would plummet XRP price by 10% to $0.440

XRP/USD 4-hour chart

While the general outlook for Ripple price is bearish, investors can expect a minor bounce to capture the Fair Value Gap (FVG) to the upside at $0.516. If this run-up extends beyond and flips the $0.538 hurdle into a support floor, the bearish thesis would face invalidation.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.