Ripple Price Forecast: XRP future depends on two crucial technical levels

- Ripple stuck between 200 SMA support and 50 SMA resistance on the 4-hour chart.

- A slump in daily active addresses reveals low network activity, which is a bearish signal.

- A real break above $0.5 and the 50 SMA could trigger buy orders for gains beyond $0.6.

Ripple is attempting another recovery in the wake of the freefall to $0.45. The massive losses incurred since Wednesday have not been unique to the cross-border token. Bitcoin tumbled toward $50,000, while Ethereum tested the support at $1,500. At the time of writing, XRP is teetering at $0.49, while bulls battle for gains past $0.5.

Ripple pivotal between critical resistance and support

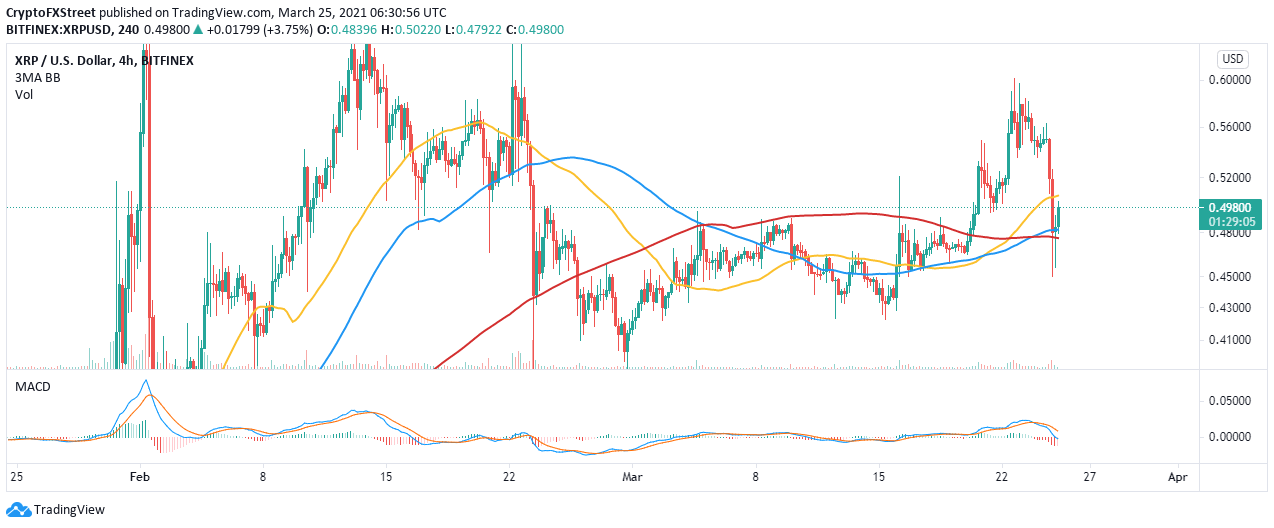

The international remittance token movement is limited between the 50 Simple Moving Average (SMA) resistance and the 200 SMA support on the 4-hour chart. Price action under the 200 SMA could lead to losses eyeing lower levels as far as $0.4 and $0.35, respectively.

Ripple's gravitational pull has been emphasized by the Moving Average Convergence Divergence (MACD) indicator on the 4-hour chart at the time of writing. If the indicator progresses into the negative region, we are bound to see XRP drop further.

XRP/USD 4-hour chart

Consequently, Santiment, a leading behavioral analytics platform, highlights a significant slump in the number of daily unique addresses in XRP transactions. In other words, the metric measures the level of interaction or speculation in the community.

The number of daily active addresses topped out at 17,400 on March 22 but dropped to roughly 14,500 at the time of writing, representing a 16.6% decline in less than three days. If the addresses fail to recover, Ripple may continue to deal with rising overhead pressure.

Ripple daily active addresses

Looking at the other side of the fence

Ripple could soon resume the uptrend if the price cracks the resistance at $0.5 and the 50 SMA on the 4-hour chart. A move such as this would call out to buyers to join the market as speculation mounts for gains eyeing $0.6. It is also essential that the 200 SMA support holds to ensure market stability and allow bulls to focus on higher price levels.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B10.16.37%2C%252025%2520Mar%2C%25202021%5D-637522551740741042.png&w=1536&q=95)