Ripple Price Prediction: XRP at the threshold, ready for takeoff

- Ripple looks forward to a breakout eyeing $0.65 as long as buyers reclaim ascending channel's crucial support.

- Consistent network growth is usually a bullish signal.

- The MVRV begins to retrace, implying that XRP could be approaching a sell zone.

Ripple is trending upwards after rebounding from last week's support of around $0.4. The bullish leg recently hit highs slightly above $0.6, but the momentum has fizzled out. The correction that ensued embraced support marginally above $0.53. In the meantime, XRP has made a quick recovery above $0.55 and is dealing with a crucial hurdle, likely to give way to massive gains toward $0.65.

Ripple nurtures uptrend within an ascending parallel channel

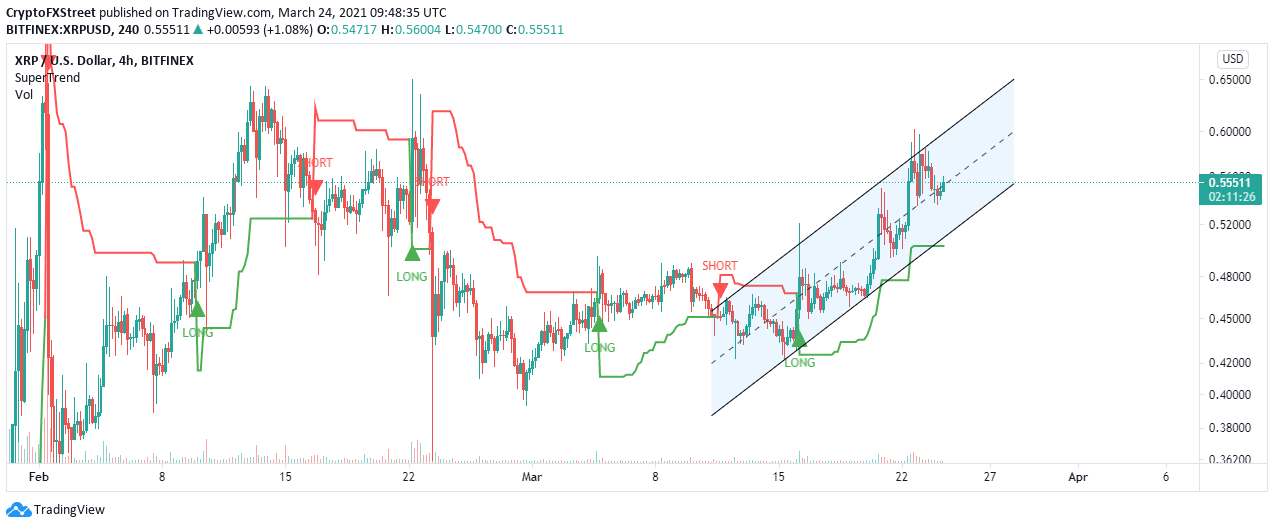

The cross-border token is pivoting at the ascending parallel channel middle boundary—the retreat from $0.6 held onto the support at $0.53, hence the ongoing recovery. Meanwhile, Ripple must settle above the middle level of the channel to confirm the impending upswing.

For now, the least resistance path is upward based on the bullish impulse coming from the SuperTrend indicator. A signal to long Ripple was presented on March 16, in the wake of the support at $0.4. This indicator helps investors to identify the trend of an asset. As long as the SuperTrend line stays under the price, XRP's uptrend will be intact.

XRP/USD 4-hour chart

According to Santiment, Ripple's network growth has been on an upward roll since March 19. The spike in the number of unique addresses joining the network daily is a clear indicator of a lasting uptrend.

For now, the on-chain metric shows the number of new addresses standing at nearly 3,020 from a monthly low of 2,150. If the addresses joining the ledger continue to grow, we are likely to see an upswing in the price of XRP.

XRP/USD network growth chart

Looking at the other side of the picture

Santiment's MVRV on-chain metric seems to disagree with the above analysis. This indicator follows the average profit or loss of XRP holders from tokens moved within the last 30 days and then compares it to the tokens' previous price.

Ripple MVRV model

A higher MVRV ratio shows that XRP holders are in profit and are likely to cash out. At the time of writing, the MVRV holds at 13.2% (the highest in 30 days). A retreat is underway to reinforce the bearish outlook as investors sell to take profit. If the ratio fails to recover, the ratio may have to drop to ze

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B12.54.43%2C%252024%2520Mar%2C%25202021%5D-637521790866396903.png&w=1536&q=95)

%2520%5B13.02.53%2C%252024%2520Mar%2C%25202021%5D-637521790946137922.png&w=1536&q=95)