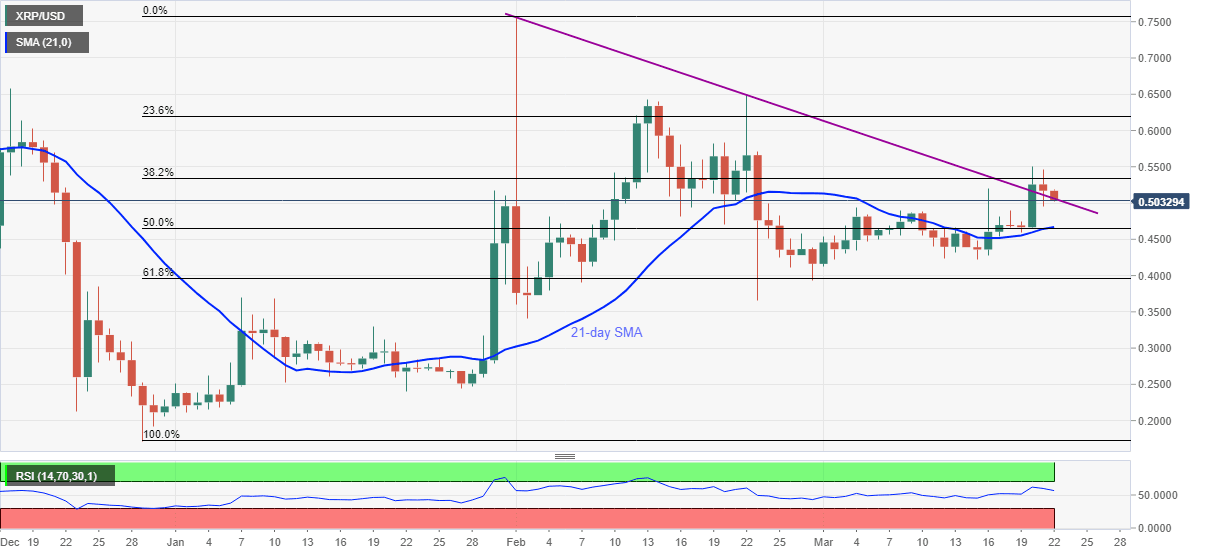

Ripple Price Analysis: XRP extends losses following failure to cross $0.5500 hurdle

- XRP/USD extends weekend pullback as bears battle short-term key support line.

- Downbeat RSI, U-turn from 38.2% Fibonacci retracement of late December to early February favors sellers.

- Bulls need to cross $0.5830 to retake controls.

Ripple bears return to the table after a miss in crossing the $0.5500 hurdle, currently down 2.94% to $0.5030, during early Monday. In doing so, the altcoin sellers attack the previous key resistance line from February 01 amid downbeat RSI.

Given the XRP/USD sellers’ recent dominance, a clear break of the stated support line, previous resistance, near $0.5050 seems imminent, which in turn could recall the $0.5000 threshold on the chart.

However, a confluence of 21-day SMA and 50% Fibonacci retracement level, currently around $0.4650, could challenge the XRP/USD bears afterward.

Alternatively, a bounce off the nearby support line, at $0.5050, will have to cross the $0.5500 resistance before eyeing the late February tops near $0.5800.

In a case where the XRP/USD gains past-$0.5800, the $0.6000 round-figure and February 22 top surrounding $0.6500 will lure the bulls.

XRP/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.