Ripple price action has a hall pass to rally higher as the dollar retreats

- Ripple price action has room to move to the upside as the dollar weakens substantially.

- XRP price action could be set to test $0.56 again at the top of September.

- Traders must remember that the economic and geopolitical environment has stayed the same, it is merely readjusting a bit.

Ripple (XRP) price action has opened up a very large room to rally into as its main bearish factor, the stronger dollar, is taking a big step back for a second day in a row. Although XRP price seems unmoved initially, expect a catchup sometime soon. The rally could bear a 21% gain on projections and forecasts, which means it could jump as far as $0.56, which is the high of September.

XRP price sees room for opportunity

Ripple price action is set to jump broadly as its biggest opponent, the stronger dollar, has taken a firm step back for a second day. The reshuffle in the dollar came after a respected journalist at the Wallstreet Journal said he thought the Fed might start to slow down its rate hiking by the end of the year. This triggered a rebalancing of the dollar which has faded roughly 200 pips thus far.

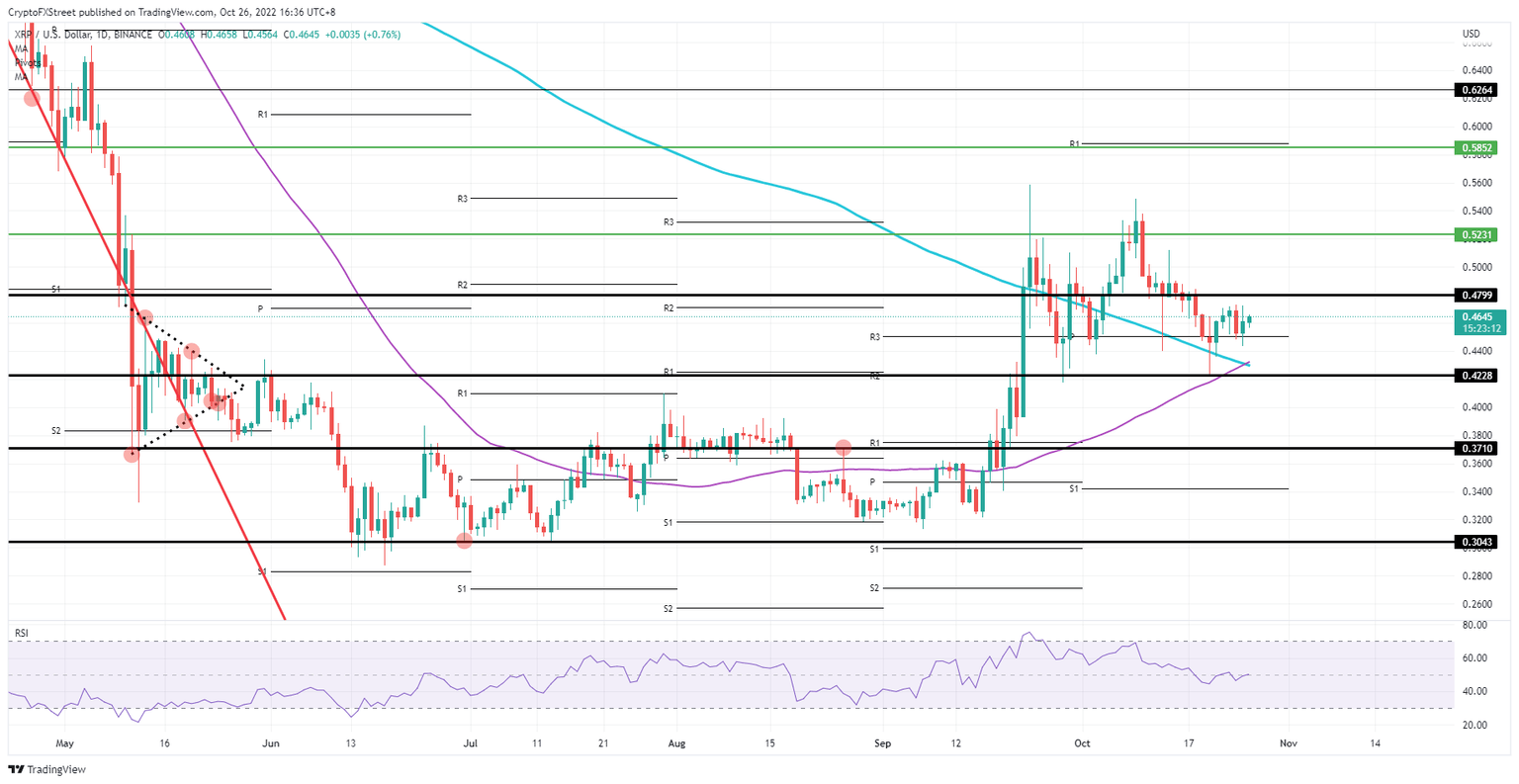

XRP price action, for now, has not been affected by the weakening dollar as much as Bitcoin and other peers. It is fair to think that it will have a delayed effect. That means that XRP price needs to do one thing: break the $0.48 level, which should not be too difficult, and from there, it should be plain sailing towards $0.56, with 21% gains to be booked on the way.

XRP/USD Daily chart

It is clear that the current fade in the dollar is backed by hope, aspirations and assumptions that the Fed has reached its tipping point and will announce soon or even next week that it will start to slow down its rate hikes. Should the Fed remain committed to a continued aggressive policy stance, however, it would suggest that the market swerved too soon, and lead to the dollar being bid again. In such a scenario, XRP price action would drop back to $0.4228 and could even fall towards $0.3710 in the coming weeks, with the midterms also set to be a risky event.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.