Bitcoin Price Forecast: BTC nears $90,000 as recovery hopes clash with institutional outflows

- Bitcoin price is approaching a key resistance level at $90,000, a firm daily close above suggests a potential recovery ahead.

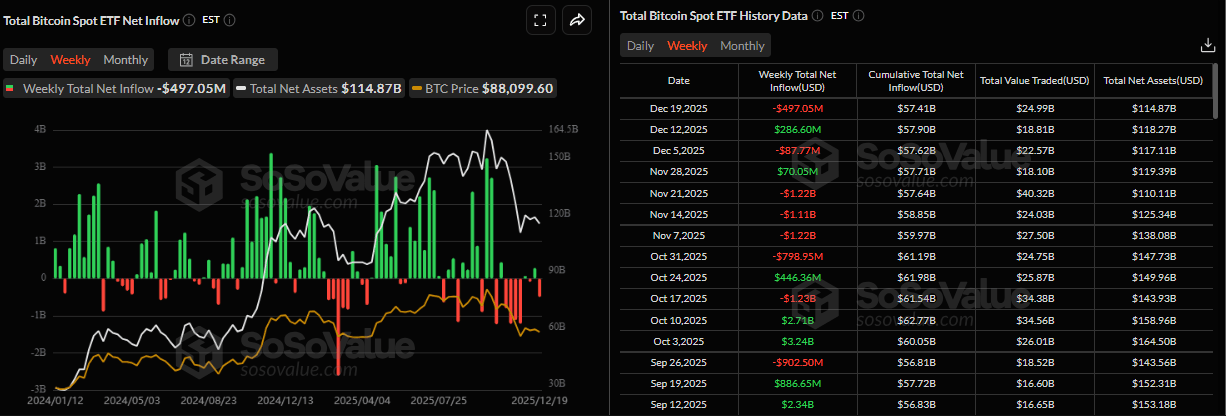

- US-listed spot ETFs recorded an outflow of $497.05 million last week, signaling weakening institutional demand.

- Report highlights that BTC’s cycle may be turning bearish, with demand exhaustion and early signs of a broader downtrend.

Bitcoin (BTC) is approaching the $90,000 resistance level at the time of writing on Monday, raising hopes of a short-term recovery. However, the bullish recovery is being challenged by weakening institutional demand, as evidenced by outflows from Spot Exchange-Traded Funds (ETFs).

Weakening institutional demand

Institutional demand for Bitcoin weakened last week. SoSoValue data show that Spot Bitcoin ETFs recorded a net total outflow of $497.05 million last week, marking the largest weekly outflow since November 21 and breaking the previous week’s streak of positive inflows. If these outflows continue and intensify, the Bitcoin price could see further correction.

Is BTC heading to a bear market?

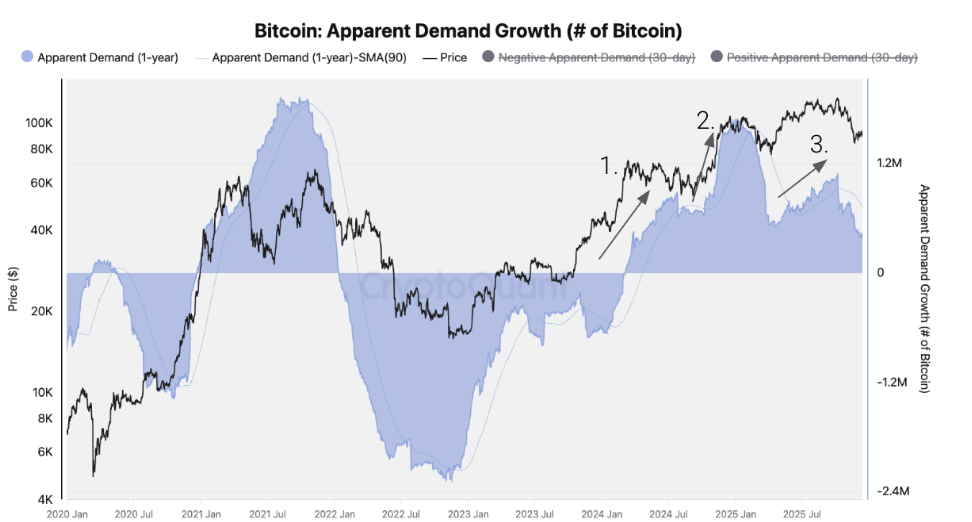

CryptoQuant's weekly report highlighted that BTC’s cycle may be turning bearish, with demand exhaustion and early signs of a broader downtrend.

The report explained that BTC demand growth has slowed sharply, signaling a transition into a bear market.

"After three major spot demand waves since 2023—driven by the US spot ETF launch, the US presidential election outcome, and the Bitcoin Treasury Companies bubble—demand growth has fallen below trend since early October 2025," noted CryptoQuant's analyst.

This indicates that the bulk of this cycle’s incremental demand has already been realized, removing a key pillar of price support.

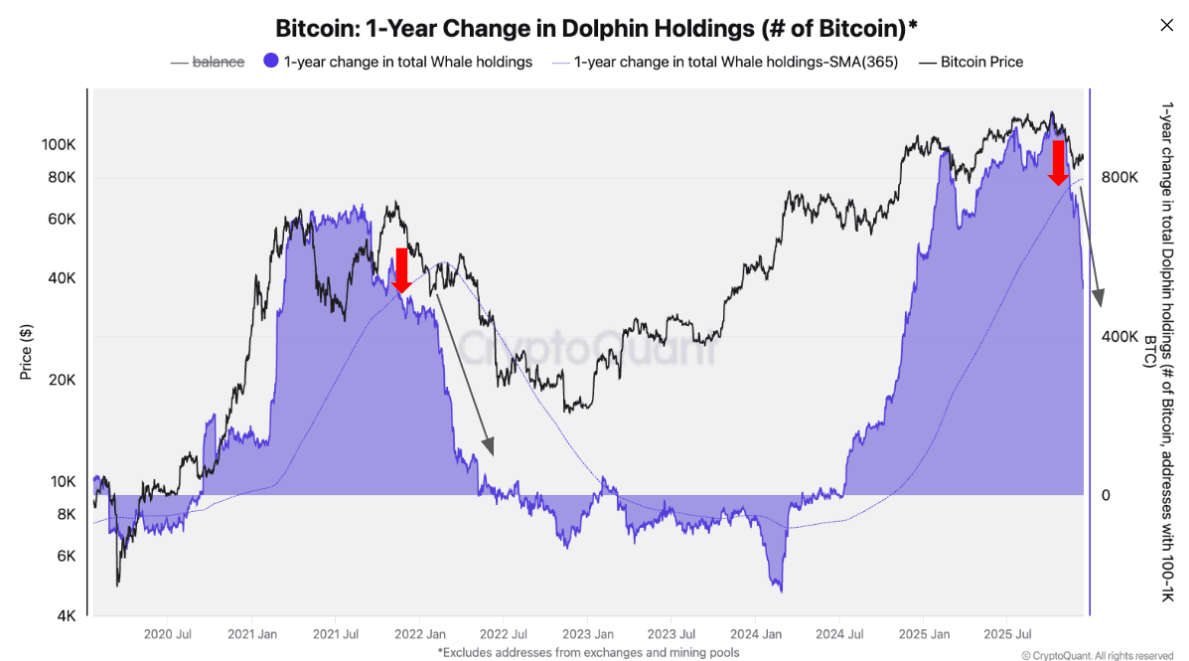

In addition, large investors are decreasing their BTC balances. The total Bitcoin balance of addresses holding 100-1,000 BTC is growing below trend, signaling weaker demand from large holders. This weakening mirrors a shift in demand at the end of 2021, which preceded the 2022 Bitcoin bear market (red arrows).

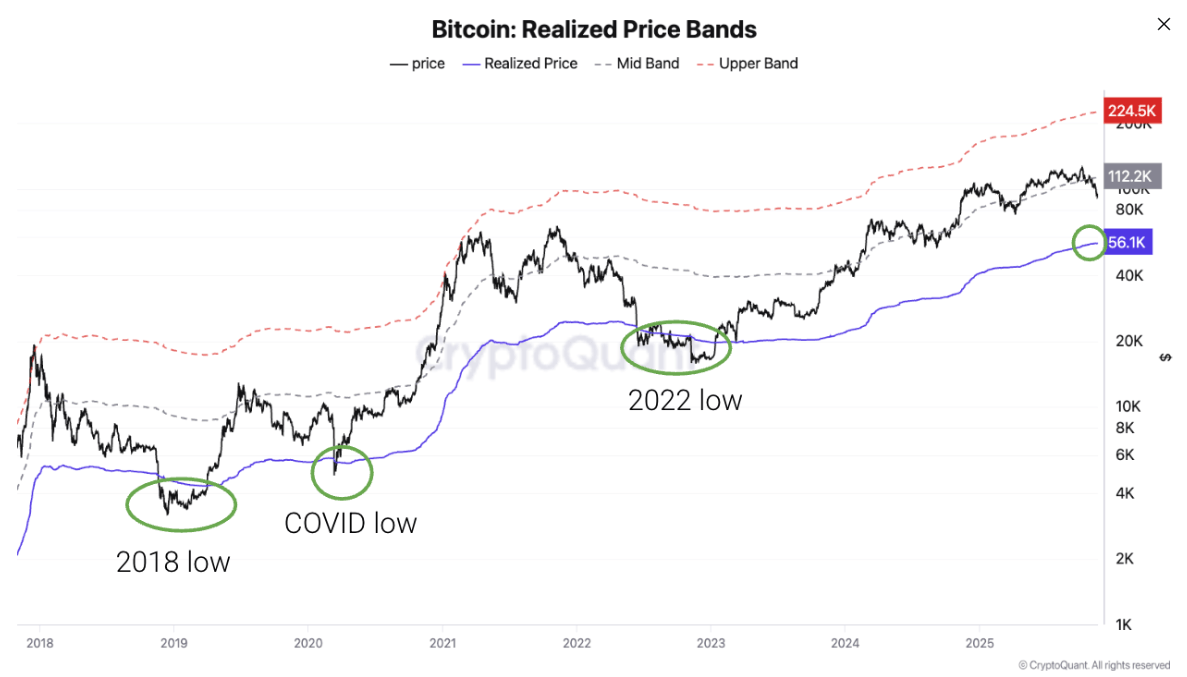

The analyst concluded that the BTC bear market would be around $56,000, the realized price that has signaled the bottom in all previous BEAR markets.

Bitcoin Price Forecast: BTC could recover if it closes above key resistance

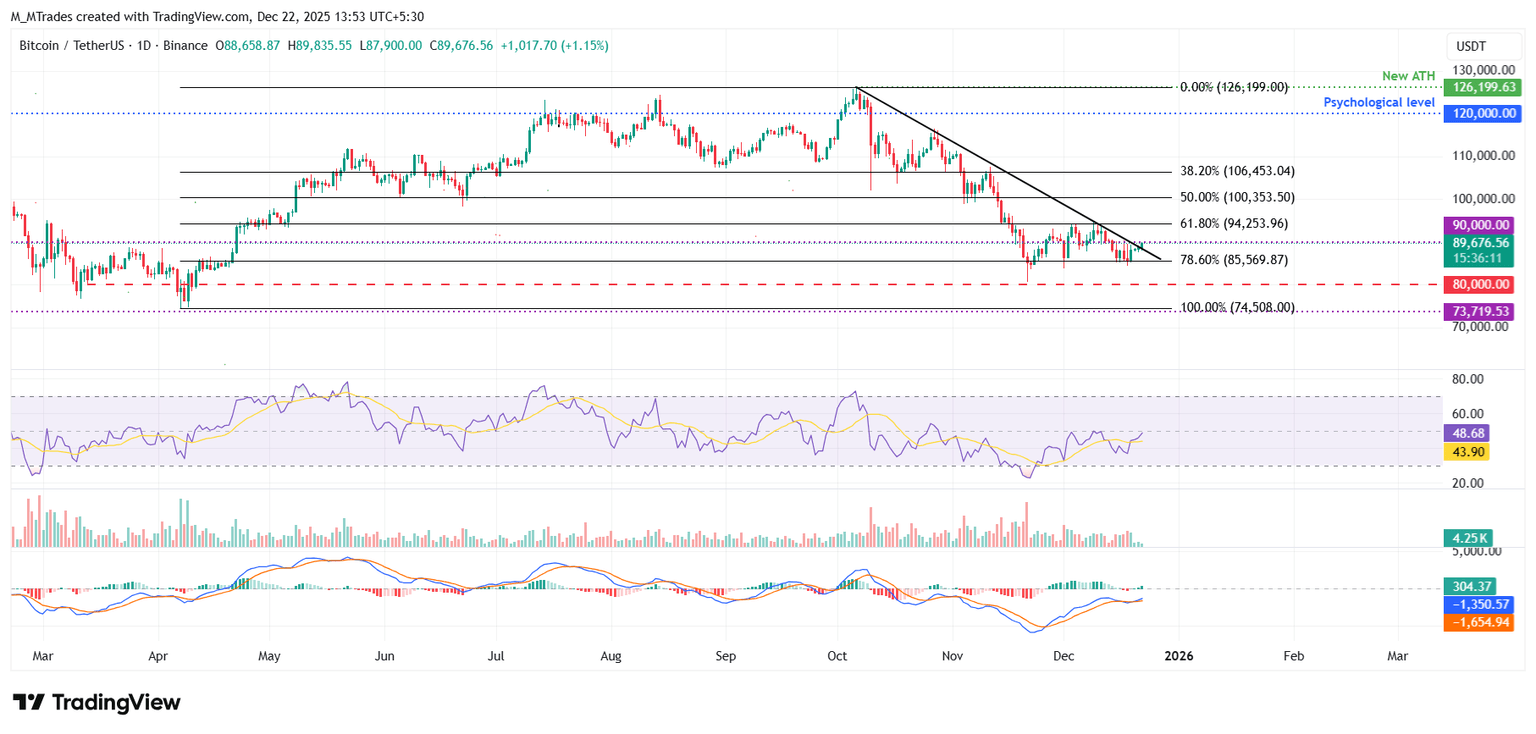

Bitcoin price was retested and found support at the 78.60% Fibonacci retracement level at $85,869 on Thursday, and it recovered 3.67% over the next three days. As of Monday, BTC is approaching the key resistance level at $90,000.

If BTC closes above the $90,000, it could extend the recovery toward the next resistance at $94,253.

The Relative Strength Index (RSI) reads 48, pointing upward toward the neutral level of 50, indicating early signs of fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on Saturday, further supporting the recovery thesis.

On the other hand, if BTC faces a correction, it could extend the decline toward the key support at $85,569.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.