Ripple partners drive adoption to the South Asia and MENA, here’s what to expect from XRP price

- Ripple’s managing director for South Asia, Middle East and North Africa (MENA) affirmed the company’s expansion plans for the region.

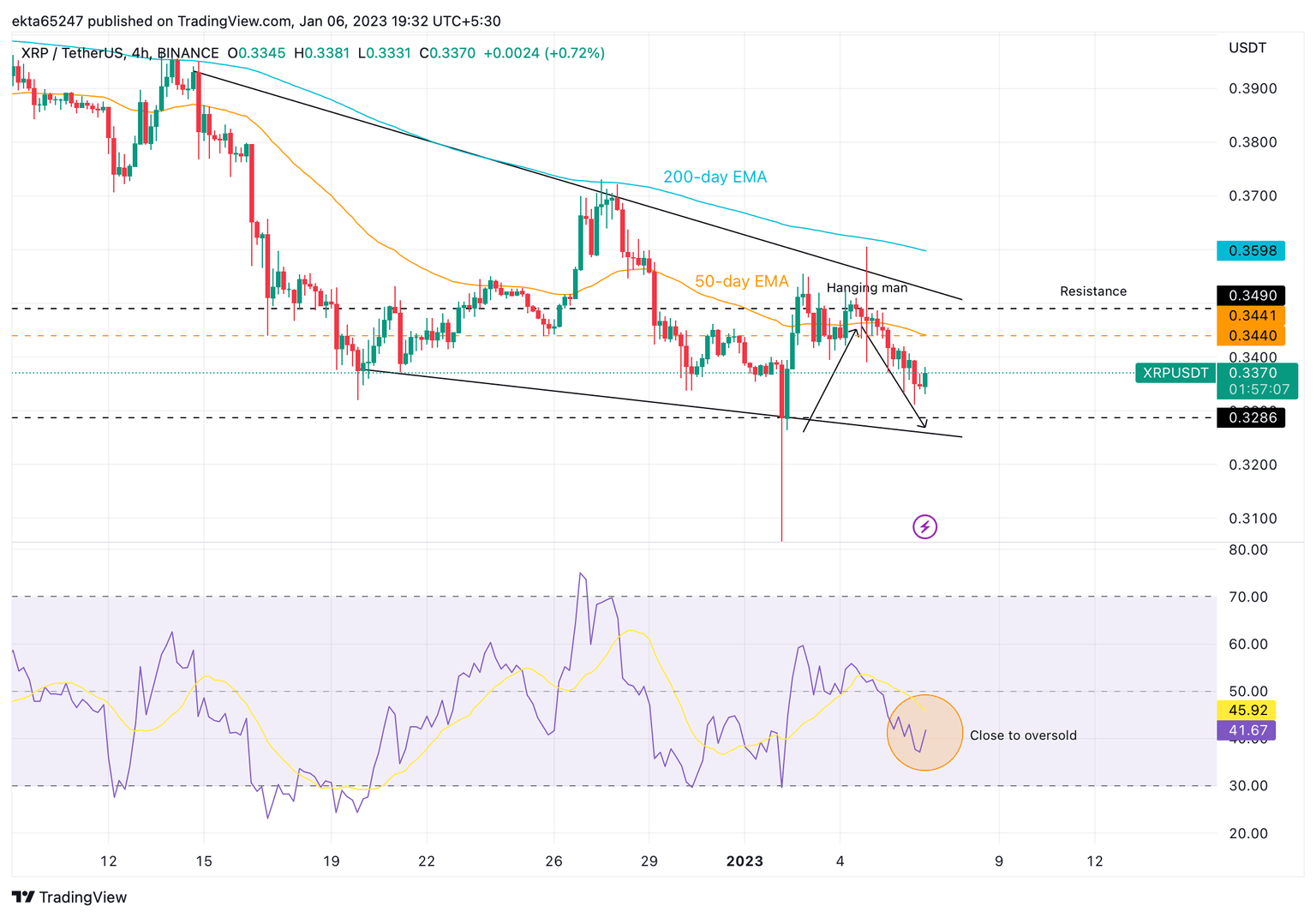

- XRP price outlook remains bearish as the altcoin drops below the 50-day Exponential Moving Average (EMA) at $0.3440.

- Large wallet investors moved 385 million XRP tokens over the past 24 hours, implying that the altcoin could witness mass sell-off soon.

Ripple, the cross-border payment settlement firm is focused on expansion to South Asia and Middle East and North Africa (MENA). XRP price outlook is bearish as the altcoin nosedived below its Exponential Moving Average.

Ripple is set to drive adoption in South Asia and MENA, expanding XRP utility

Ripple, the global remittance firm, is focused on its expansion to South Asia and MENA, according to Navin Gupta, Ripple’s Managing Director for the region. As Ripple partners expand to this region, it is set to increase XRP utility and adoption in South Asia, Middle East and North Africa.

Gupta shed light on Pyypl, a Ripple partner that started implementing on-demand liquidity in the MENA region. Major banks like Saudi British Bank and Qatar National Bank are the partners in the region. All of these businesses are using Ripple's crypto technologies to facilitate cross-border transactions, driving XRP adoption higher.

XRP whales move 385 million tokens within a 24-hour period

Large wallet investors on the XRP network increased their activity. Based on data from WhaleAlert, crypto whales moved 385 million tokens, approximately worth $131 million in multiple transactions in the past 24-hour period.

The single largest XRP transaction recorded was worth $95.4 million. A surge in whale activity has been associated with profit-taking by large wallet investors.

XRP price is at risk of decline to the $0.3286 level.

XRP/USDT price chart

As seen in the chart above, XRP price is edging closer to the lower trendline of the descending channel. The hanging man, a bearish reversal candlestick pattern that occurs after a price advance is composed of price bars moving higher overall.

The asset is ready for a bearish trend reversal. The Relative Strength Index (RSI), a momentum indicator reads 41.67 and XRP is close to being oversold. A climb above resistance at $0.3490 could invalidate the bearish thesis for the altcoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.