Mt.Gox pushes distribution deadline for creditors owed $2.29 billion, Bitcoin price outlook remains bullish

- Mt.Gox has pushed its registration and distribution deadline for creditors to March 10, 2023.

- The defunct crypto exchange owes $2.29 billion to creditors; experts argue that Kraken’s shutdown affected the repayment registration deadline.

- Experts have drawn parallels between Binance and Mt.Gox with the former increasing dominance in number of users and trade volume.

Mt.Gox, a defunct crypto exchange that owes its customers $2.29 billion, has pushed the deadline for registration and distribution of lost user funds. The exchange suffered an exploit in 2014, and experts believe that Kraken recently shutting down its Japan operations is hampering the distribution of the lost Bitcoins.

Also read: Justin Sun next in line as FTX contagion spreads from DCG to Huobi exchange amid insolvency rumors

Mt.Gox creditors have a long wait before $2.29 billion in Bitcoin is returned

Mt.Gox, a Japan-based defunct cryptocurrency exchange, has pushed the timeline for registration and distribution of lost Bitcoin tokens. Creditors now have more time to decide on the repayment method they want to be paid in and register their payee information.

The crypto exchange announced that the deadline has been pushed back to March 10, 2023 from January 10. Creditors now have longer to register themselves with Mt.Gox and select how they want to be repaid. The announcement has urged creditors to share their details and complete registration before the new deadline.

Mt.Gox announcement

The announcement reads:

The Rehabilitation Trustee will begin confirming the contents of your Selection and Registration, etc., after this point in time in order to make repayment as promptly as possible after March 10, 2023 (Japan time).

Kraken, a leading cryptocurrency exchange, recently closed its operations in Japan. Experts believe Mt.Gox is delaying its registration and repayment deadline because of the same.

Why Binance is being compared to Mt.Gox

Binance, one of the largest cryptocurrency exchanges in the world, has witnessed a spike in dominance. Changpeng Zhao’s exchange commands as high as 92% of Bitcoin spot volume according to an end-of-year study by crypto researchers at Arcane.

The firm said that there are no evident winners of 2022 other than Binance, both in crypto market structure and dominance. The only competitor for Binance's current dominance is Mt.Gox in 2013, when the exchange was still functional.

Mt.Gox handled as much as 70% of all Bitcoin trading in 2013, before it was robbed of 850,000 BTC, worth $500 million in 2014 and $14.3 billion in 2022. Binance recently launched zero-fee trading for BTC spot pairs in July 2022, a move attributed to solidifying its dominance in the crypto ecosystem.

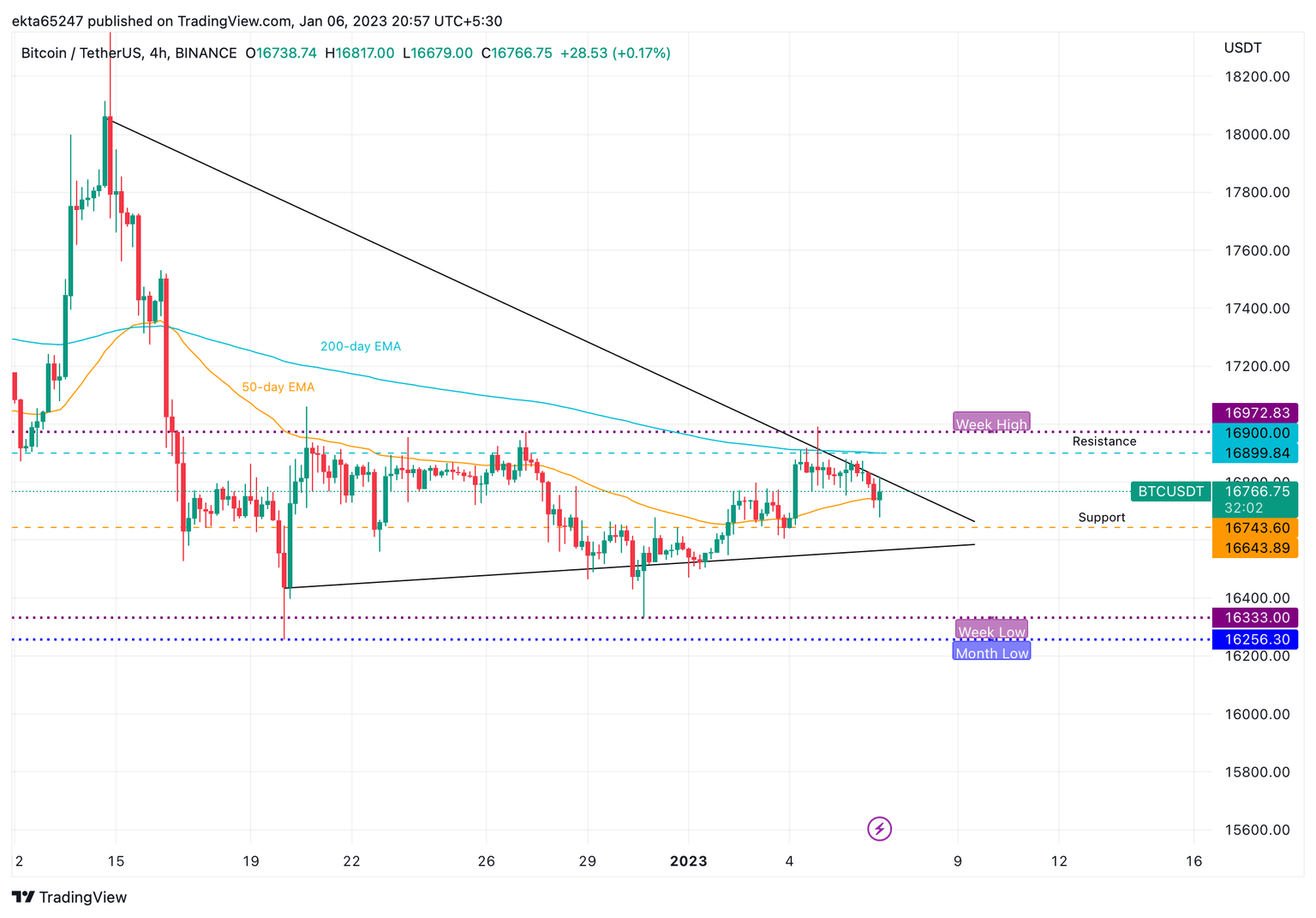

Bitcoin price outlook remains bullish

Bitcoin price outlook is bullish as BTC edges closer to the trendline. A close above the trendline will validate the bullish outlook among traders. The 200-day Exponential Moving Average (EMA) is acting as resistance for the asset and the 50-day EMA is support. Below this level, the 50-day EMA from the daily chart is support for the altcoin.

BTC/USDT price chart

Relative Strength Index (RSI), a momentum indicator, currently reads 50.71 and is in the neutral zone. Bitcoin could witness a breakout or a breakdown depending on whether the asset closes above the trendline on the 4-hour price chart.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.