What to expect from Ethereum price after whale transactions hit the highest level

- Ethereum rebounded above $1,260 for the first time in three weeks, as whale transactions in the altcoin climbed.

- Large wallet investors are interested in scooping up Ethereum as altcoins begin their recovery in 2023.

- Users are likely to prefer liquid staking once they complete their withdrawal from Ethereum’s staking contract post the Shanghai hard fork.

Ethereum price wiped out its recent losses and rebounded above the $1,260 level. Large wallet investors on the altcoin’s network started scooping up ETH tokens through the December 16 local bottom in the Ethereum price chart.

Also read: Celsius ‘Earn’ customers do not own their assets, are deposits to crypto lenders unsafe?

Ethereum whales scooped up the altcoin through the recent dip

Ethereum network’s large wallet investors bought the recent dip in the altcoin’s price. On December 16, Ethereum hit a local price bottom at $1,168. While Bitcoin price remained largely unchanged in the first week of January, second-largest crypto by market capitalization bounced back above the $1,260.

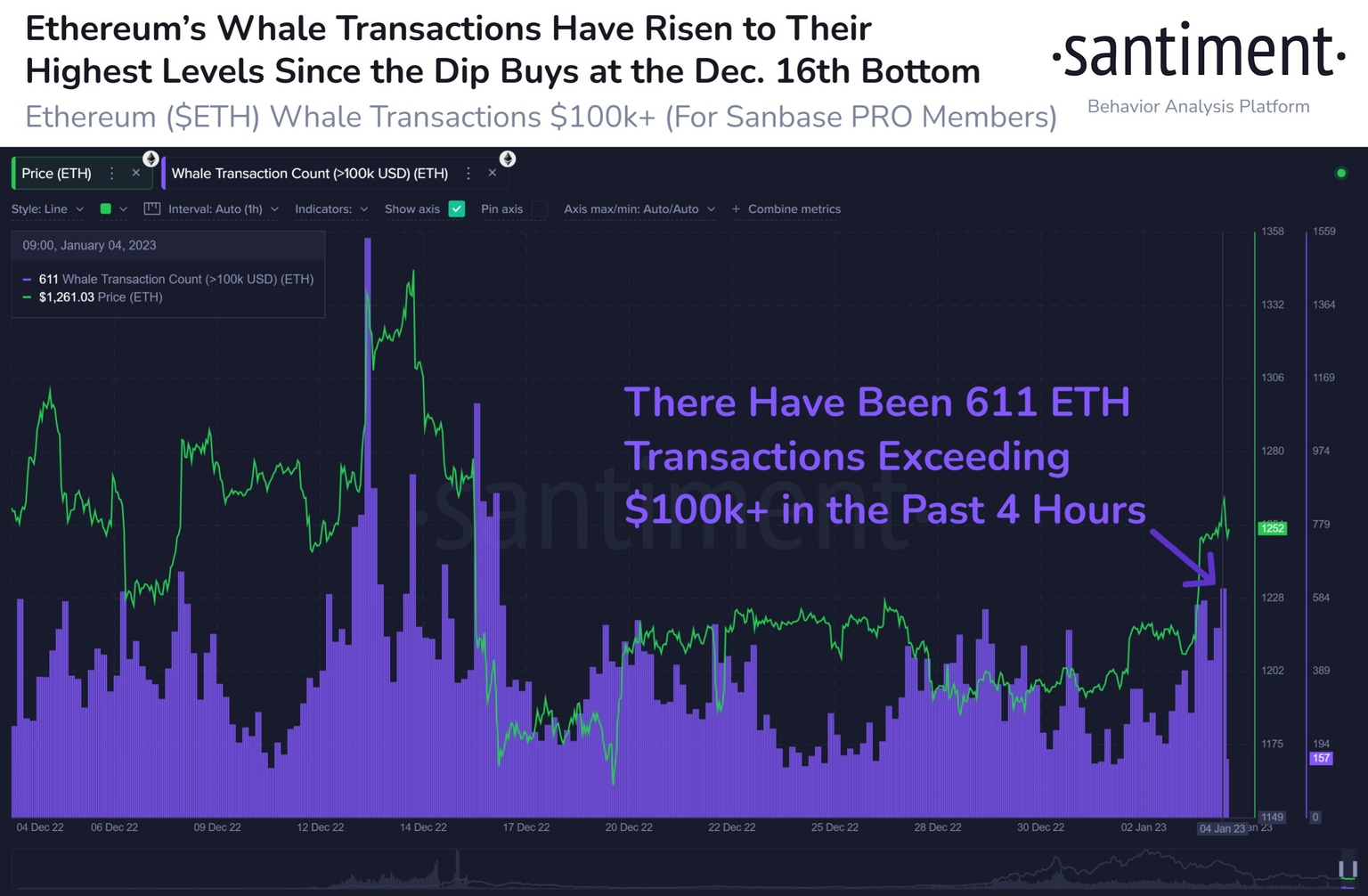

Ethereum whale transactions

Based on the chart above, there have been 611 ETH transactions exceeding $100,000. Higher whale activity, in terms of accumulation, is synonymous with a rally in the altcoin.

ETH holders are looking forward to unstaking their staked ETH tokens after the Shanghai hard fork.

Staked ETH withdrawal is imminent

Ethereum developers are tackling the most pressing issue in the ETH holder community, unstaking tokens staked in the December 2020 contract. Developers recently prioritized token unlock over other updates in the ecosystem and lined it up post the Shanghai hard fork.

The unstaking of Ethereum is the next major milestone for ETH holders after the successful transition from the proof-of-work to proof-of-stake consensus mechanism.

ETH Open Interest

Open interest in Ethereum has grown consistently for two weeks now, suggesting that the demand in the derivatives market is recovering. On-chain indicators reveal that the market is favoring the bulls.

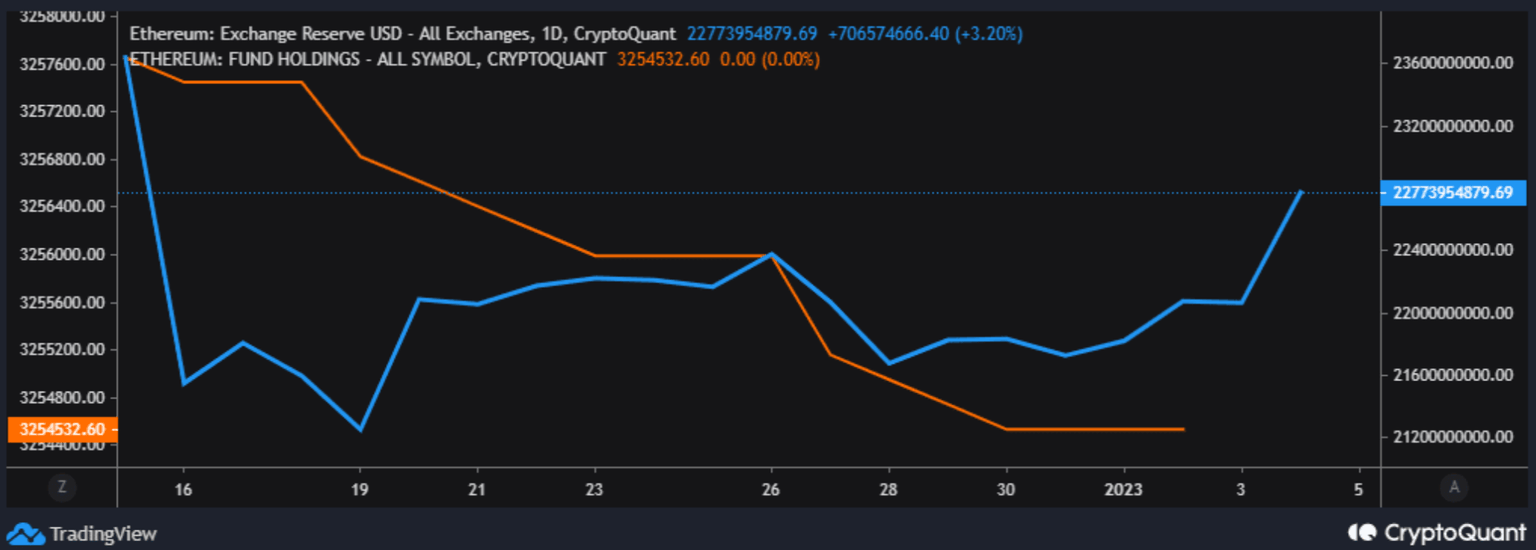

Ethereum’s exchange reserves have increased steadily over the last two weeks. This could imply a rise in selling pressure on the altcoin. A surge in exchange reserves is typically associated with a drop in the altcoin’s price. Interestingly, on-chain data revealed that institutional investors are trimming their Ethereum balances.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.