Although Robinhood may be on a mission to democratize finance, the company has been forced to endure a torrid time on the stock market since its July Nasdaq listing. Issues surrounding regulatory concerns, weakening Q3 results, and a downturn in the cryptocurrency markets have hit the popular investing platform hard. When are we likely to see a recovery for the stock?

It’s worth noting that upon listing in the summer of 2021, Robinhood looked to have timed its IPO rather well. The initial public offering market was still hot from the Covid-driven flurry of tech listings that began in 2020 and the cryptocurrency landscape looked to have begun its recovery from a sharp decline in Q2.

Upon its debut, Robinhood was priced at $38 at the lower end of its market expectations, which pegged the company’s valuation to around $32 billion.

Within a matter of days, the price of HOOD soared to a peak of $85 as meme investors clambered onto the stock, but the surge was to be short-lived. In the months that have followed, Robinhood has entered a sustained period of decline that the company has been unable to shake off.

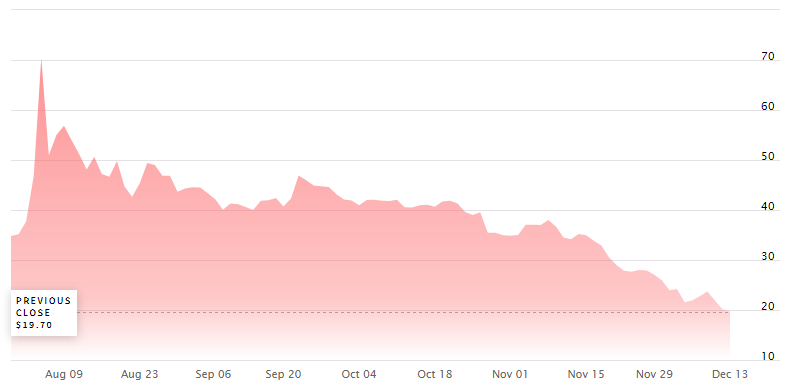

(Image: Nasdaq)

As we can see from the chart above, HOOD has recently dipped below $20, leaving the stock with a market cap of around $17 billion - some 43.4% lower than its first day of trading.

(Image: Reddit)

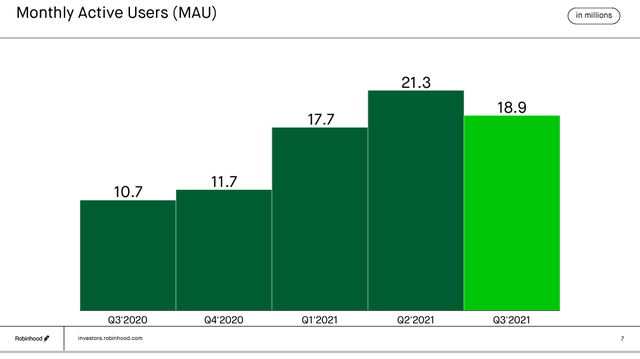

We can see that Q3 of 2021 paved the way for the first decline in Robinhood’s monthly active users since the Covid-driven influx of new retail investors onto the landscape. However, it’s also worth noting that 18.9 million users are still a significant increase on the same figures for the year prior. So, with this in mind, how can Robinhood navigate its market recovery? And when could we see an upturn for its embattled stock?

What’s causing the downturn?

Firstly, let’s dig into the root cause of HOOD’s downturn. According to Maxim Manturov, head of investment research at Freedom Finance Europe, Robinhood’s falling prices are largely a reaction to the company’s weak Q3 report:

“Robinhood's strong decline is linked to the Q3 report, where the company's revenue was below expectations and the company also expects a continued slowdown in revenue in Q4,” Manturov explained. “In Q4, the company's management has given a revenue forecast that will not exceed $325m against market expectations of $489.21m.”

“The revenue was very much affected by the decline in cryptocurrency transaction revenue ($233m in Q2 versus $51m in Q3). It is also worth noting that 111m shares were unlocked in November and there was pressure on growth stocks (lower IPO ETFs), which also continued the pressure on the company's shares.”

Robinhood has made no secret of its dependence on cryptocurrency trading - and, in particular - the buying and selling of meme-based token, Dogecoin. In the wake of the Q3 report, CNBC noted that just $51 million in transaction-based revenue was gathered from cryptocurrency trading. In contrast, this figure topped $233 million in Q2 of 2021 amidst a surge in Dogecoin trading.

Doubling down on crypto

It’s likely that addressing its declining stock is a priority for the company as we head towards 2022, and early signs suggest that Robinhood’s solution revolves around further optimizing its crypto-based features.

Recently, Bloomberg reported that a beta version of the platform’s iPhone app revealed that Robinhood had been considering adding a feature enabling users to send each other cryptocurrency via digital gift cards.

These online cards enabled the user to add messages that could be up to 180 characters long and the offer could be retracted at any time prior to the tokens being accepted.

This indicates that the app is intent on boosting its social framework whilst banking on a cryptocurrency revival on the platform.

Although the cryptocurrency market has been particularly volatile of late, the fact that Bitcoin had broken its all-time high value already in Q4 of 2021 may indicate that Robinhood’s gamble on crypto could yet come to fruition as more trading volume is likely to accompany future bull runs.

Catching the Knife

Could Robinhood’s dwindling stock represent an opportunity for investors to catch the falling knife and take up a discounted long position in HOOD?

“Recovery should be expected in the timeline of 3-6 months as the company launches a cryptocurrency wallet (more than 1m customers are awaiting the launch and access for all customers is expected in Q1 2022),” Manturov noted. “Also, the changing regulatory environment for new cryptocurrencies could help the company add new cryptocurrencies to trading, which could have an impact on cryptocurrency transaction revenues in the future.”

Despite a torrid debut on Wall Street, Robinhood remains one of the world’s most exciting investment platforms. However, a full recovery for HOOD may be dependent on more external forces. The company has become wholly dependent on the world of crypto - with new features constantly being added to support the buying, selling and trading of cryptocurrencies.

Whilst it can be dangerous to bank on such a volatile market, a crypto revival in 2022 is likely to galvanize Robinhood - giving the stock plenty of buying potential for investors who are bullish on the future of crypto.

All views and opinions expressed in this article are the opinions of the author and not FXStreet. Trading cryptocurrencies or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?