Polygon's MATIC price ready to pull back as selling pressure mounts

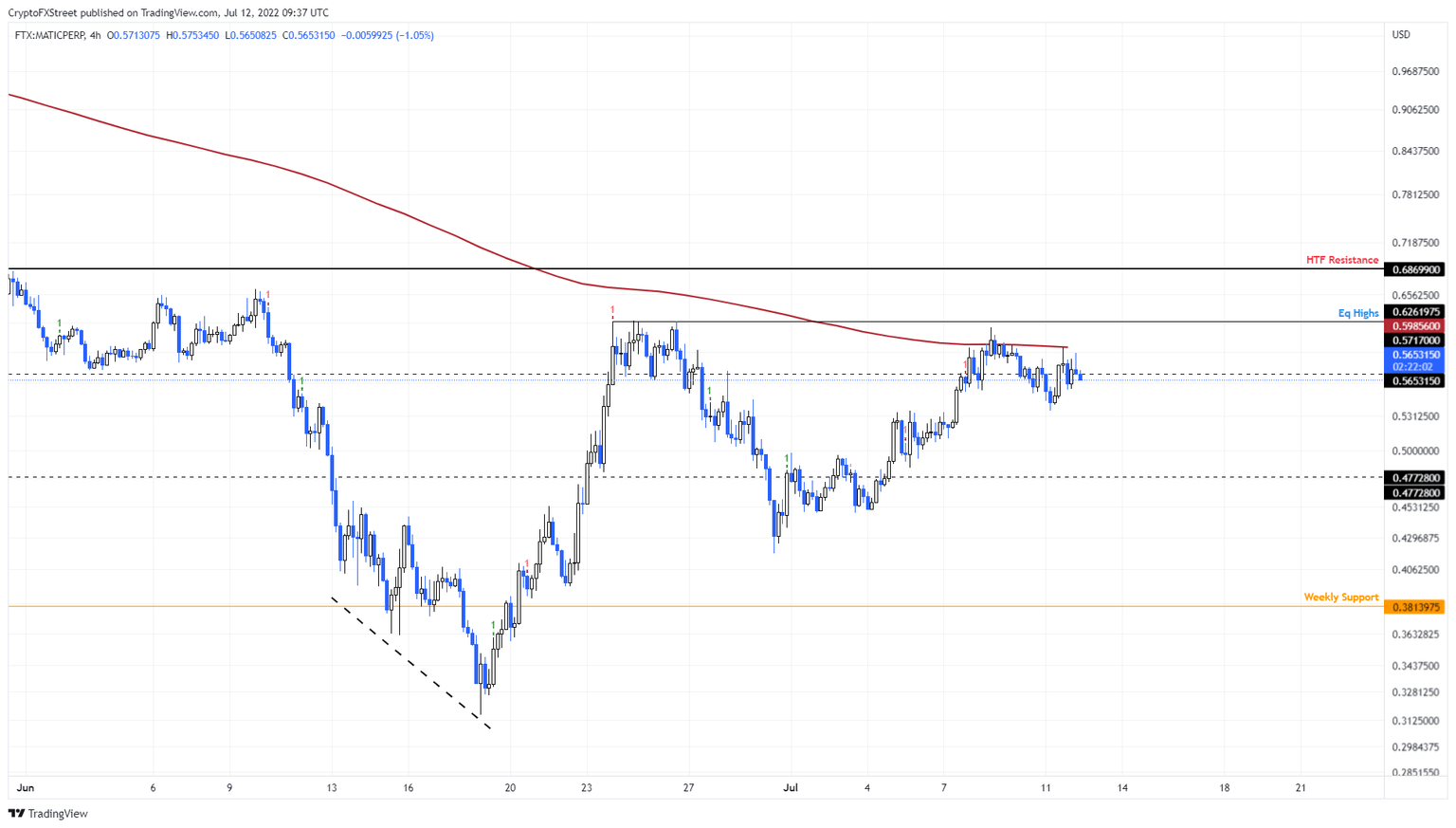

- MATIC price is looking to collect liquidity above an existing equal high at $0.686.

- However, a rejection at the 50-day EMA at $0.598 could result in a 20% downswing.

- A four-hour candlestick close above $0.686 will invalidate the bearish thesis.

MATIC price recovery run has been impressive, but the momentum seems to be running out as it gets hammered out by profit-taking investors. As a result, market participants can expect Polygon bulls to step aside and let the bears take control.

MATIC price ready for a pullback

MATIC price doubled between June 18 and June 24 as buyers scooped up the crashing altcoin. However, the recovery rally set a swing high at $0.626 and retraced 33% after. However, the said pullback arrive after failed attempts from the buyers to keep the rally going.

As a result, MATIC price set up three equal highs at roughly $0.626, suggesting the presence of liquidity above it. While the bulls tried to trigger a second leg-up, they failed due to the presence of the 50-day Exponential Moving Average (EMA).

Combined with market participants looking to book profits and the 50-day EMA, the rally looks capped and ready to reverse. Therefore, investors can expect MATIC price to retrace 20% to the $0.477 support level.

MATIC/USDT 4-hour chart

On the other hand, if the buyers step in and the Bitcoin price flips bullish, things could change for the better. In such a case, MATIC price could swing high and sweep the buy-stop liquidity resting above $0.626.

However, only a four-hour candlestick close above $0.686 will invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.