- Polygon price is set to drop below Saturday’s low.

- Expect to see MATIC tank further until it nears a target turnaround point.

- Price action still needs to be treated with care as the current environment is far from normal.

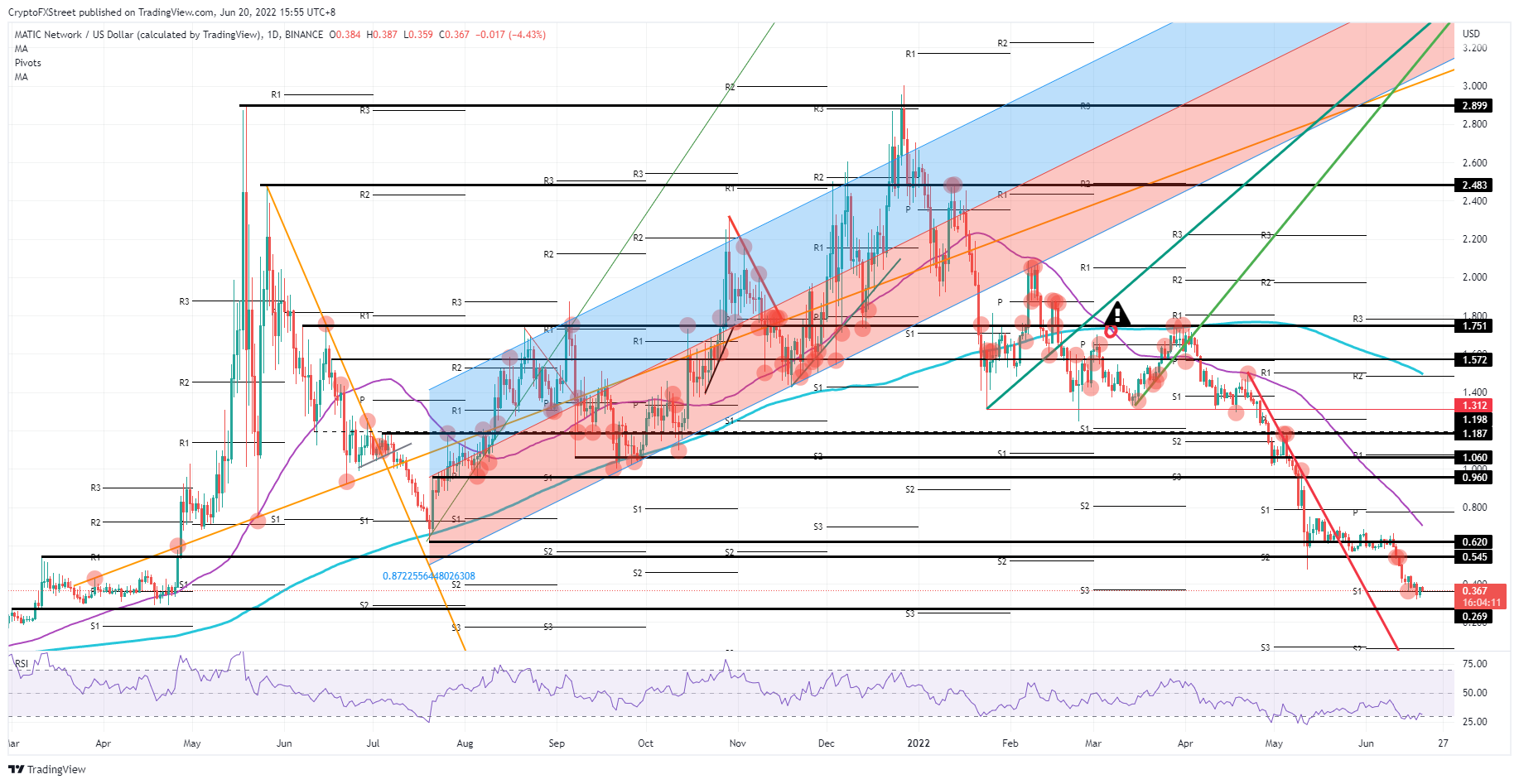

Polygon (MATIC) price is set to fall to a historically important low projected at $0.269. In the aftermath of the seismic shock which sent Bitcoin tanking massively over the weekend, MATIC price could be next to suffer from the spillover effect. Buying the dip must be done cautiously, with clear stop losses and good trade management, or otherwise, the position will be at risk of getting burned.

MATIC price should carry a ‘handle with care’ badge

Polygon price remained relatively calm and, all in all, quite good order over the weekend, when cryptocurrencies got rattled by the falling knife that was Bitcoin price as it took out some significant historic hurdles. Despite cash being pulled out of the major cryptocurrency, alt-currencies remained reasonably stable, nevertheless, in spite of the calm, some cryptocurrencies are bleeding and seeing investors pulling out their cash.

MATIC price is thus still at risk of dropping another 27% from where it currently trades, at the monthly S1 pivot level near $0.367, towards $0.269. With cash flowing out of MATIC, the so far well-underpinned price action could start to wobble, see screws loosen and then tumble. Buying the dip needs to be done with solid trade management, where an apparent stop loss is defined, with a risk-reward of at least a 1-to-2 – preferably a 1-to-3 risk-to-reward ratio.

MATIC/USD daily chart

There will, of course, be some buying of Bitcoin price action, and a rebound rally back above $20,000 could spark some broader buying among all cryptocurrencies. That could see price action perform some knee-jerk reactions and quickly rally towards the first available ceiling. For MATIC price that would mean roughly $0.545. A bounce off the monthly S1 support will likely aid the recovery, as will the Relative Strength Index ricocheting from the ‘oversold’ level. All in all, said rally could book a quick 53% return for traders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.