Polygon’s MATIC breaking up its summer love?

- Polygon price withstands backdrop this morning in ASIA PAC and European session.

- MATIC price is in the red crosshairs with EU and US futures.

- Expect to see a possible break lower, ending the summer-loving relationship.

Polygon (MATIC) price is on the back foot this morning as equities are taking a step back. Both equity futures in the ASIA PAC session and the handover, the EU and US futures are all pointing to a red painted day, with the VIX index higher. This bearish sentiment could end the underpinned price action in MATIC and make it say goodbye to its summer rally as the summer love looks to be over.

MATIC is breaking up its summer relationship

Polygon price has been enjoying the summer with a renewed love between itself and the bulls. During the hot summer, not only did temperatures shoot higher, but MATIC’s price action also returned quite some profit to bulls. With September luring around the corner, that summer-loving affair looks to be ending with no happy ending, as seen in the movie Grease.

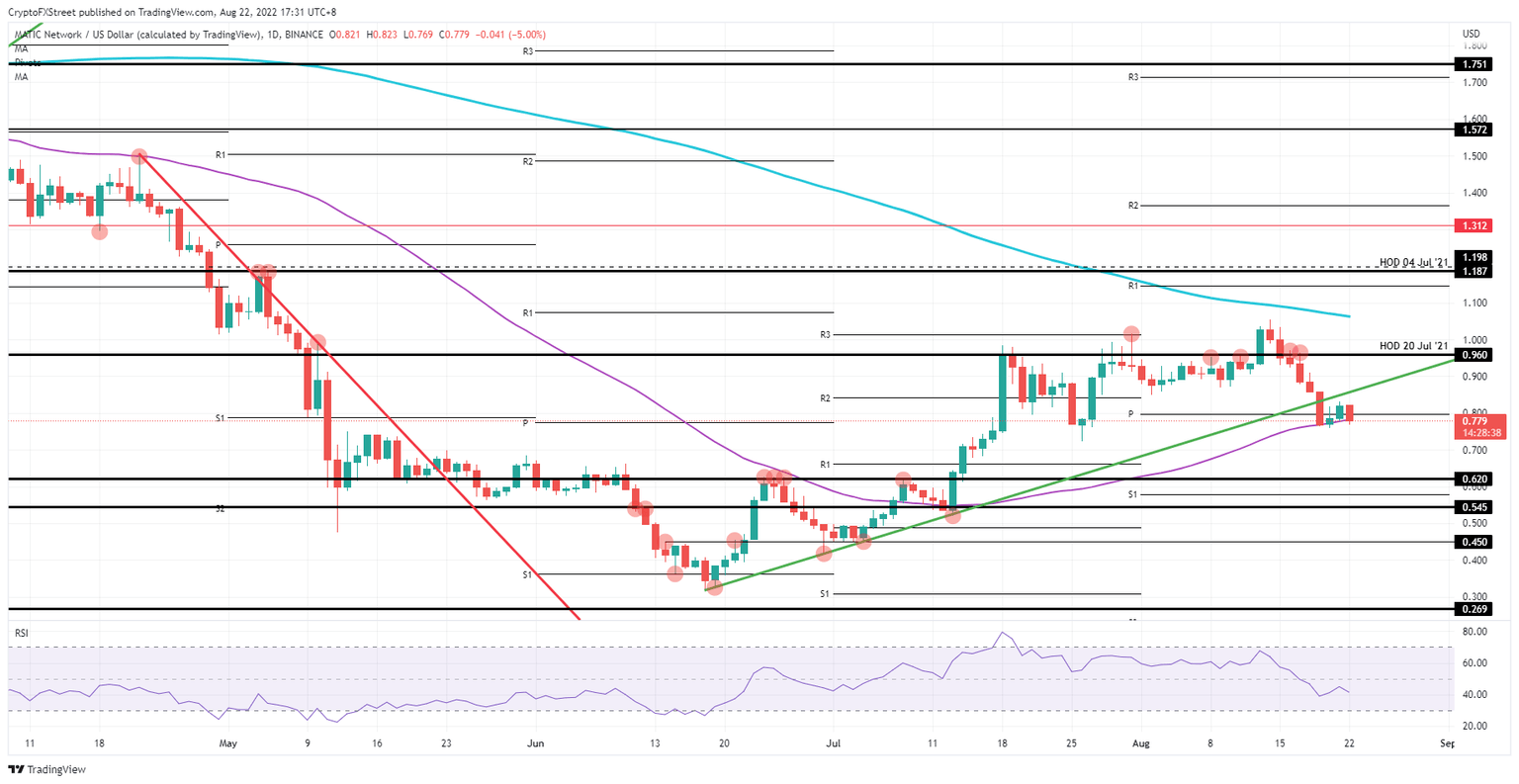

MATIC price will start to accelerate its descent once it firmly trades below the 55-day Simple Moving Average (SMA) and the monthly pivot as the underpinning of the price action breaks down. Because of that, MATIC price hangs over a deep pit that only sees the floor at $0.62 as the first support element. Potential losses might vary between 20% and 30%, as $0.545 may need to step in to catch the falling knife.

MATIC/USD Daily chart

With a desperate need for some relief, more support could be just around the corner as September nears. With the new month, more economic data could point to a slowdown in inflation and price increases, creating a bigger possibility of a goldilocks scenario with equities and cryptocurrencies rallying on the back of the idea that the Fed could be done tightening, opening up more room for spending and investing. In that scenario, expect to see MATIC price pierce through the 200-day SMA at $1.065 and hit $1.20 near the high of July 4, 2021.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.