Polkadot targets $6 after Binance replaces ETH with DOT on homepage

- The world's largest cryptocurrency exchange placed DOT on the homepage instead of ETH.

- DOT broke the channel resistance with the next target at $6.

The Chinese cryptocurrency and blockchain reporter Colin Wu noticed that Binance, one of the world's largest cryptocurrency exchanges, replaced ETH in three cryptocurrency pairs on Binance APP homepage with Polkadot (DOT). The change took place on December 28, when ETH settled above psychological $700 and tested a new 2020 high at $736.

On December 28, Beijing time, the original Ethereum (ETH) in the three major currency data information on the Binance APP homepage was replaced with a new Polkadot (DOT). On December 24, Binance announced the establishment of a US$10 million fund to invest in Polkadot projects. pic.twitter.com/7xxI8KsX12

— Wu Blockchain (@WuBlockchain) December 28, 2020

While the decision to remove ETH raises eyebrows, Polkadot, one of the potential ETH rivals, has enjoyed Binance investments and support for some time now. Thus, on December 24, the cryptocurrency exchange established a $10 million development fund to support Polkadot-based projects. Earlier this month, Binance Labs participated in the B round of financing of MathWallet, the leading Polkadot project.

Polkadot targets at $6 after breaking the channel resistance

Meanwhile, Polkadot (DOT), the 7th largest digital asset, has been gaining ground rapidly. The token's price jumped by 11% in a matter of hours and tested $5.93, the highest level since November 24. At the time of writing, DOT is changing hands at $5.7 with strong bullish momentum.

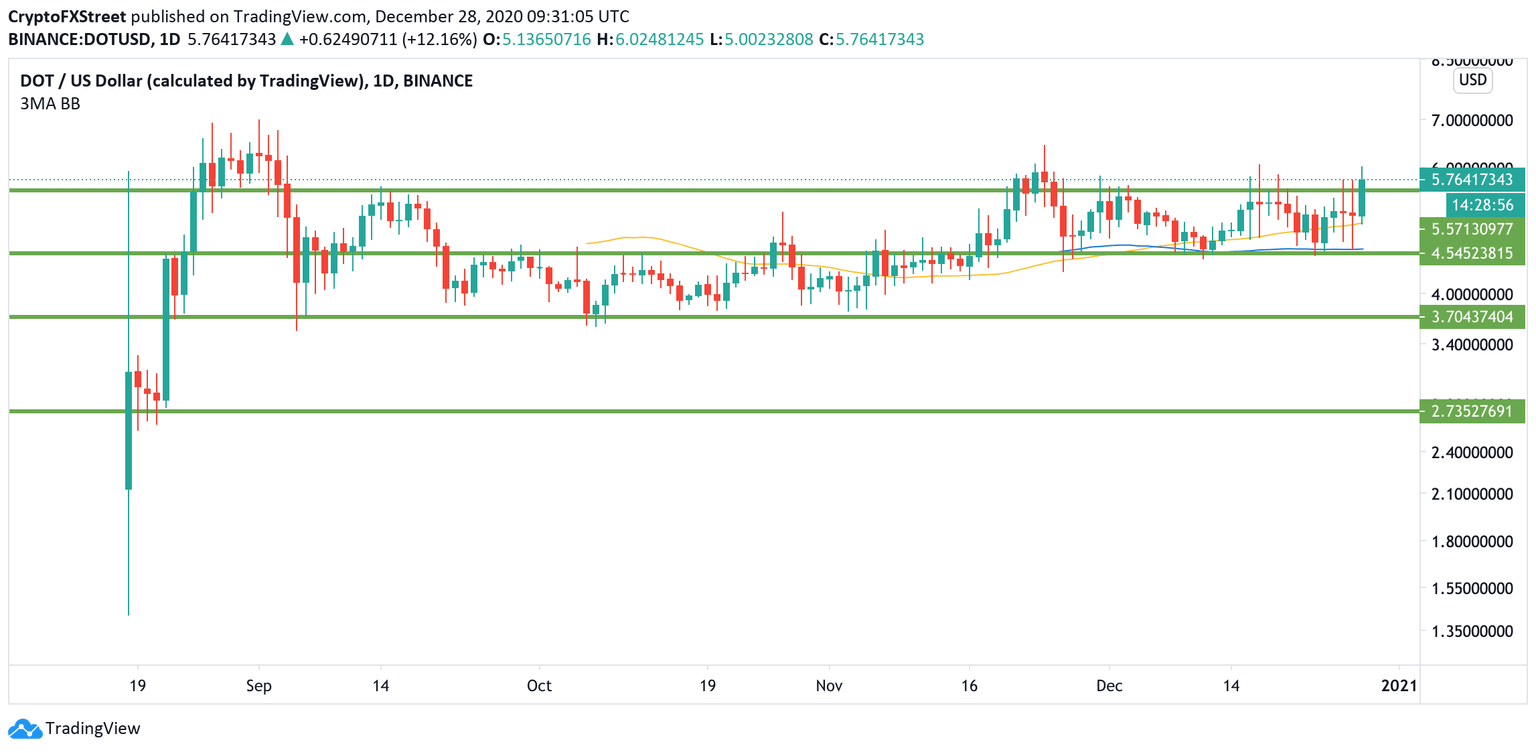

From the technical point of view, DOT broke above the channel resistance of $5.5. If the upside momentum is sustained, the price may retest $6.0, followed by the recent recovery high of $6.1. Once it is out of the way, the upside is likely to gain traction with the next focus on $6.9 (September 2020 high) and psychological $7.

DOT, daily chart

On the other hand, a failure to settle above $5.5 will increase selling pressure with the first bearish target at $5. This psychological barrier is reinforced by the daily EMA50 that has the potential to slow down the sell-off and trigger the recovery. Once it is cleared, the channel support of $4.5 will come into focus.

Author

Tanya Abrosimova

Independent Analyst