Polkadot price to double within a month despite resistance ahead of DOT

- Polkadot price is moving sideways for a couple of days after a significant correction.

- DOT has some more room to go higher, but there are a few hurdles.

- The global recovery story is underway, and Polkadot offers the chance to get in.

Polkadot price shows promising signs of its price going higher, but there are a few resistances to be aware of.

Polkadot price can go to $30, but three things to keep in mind

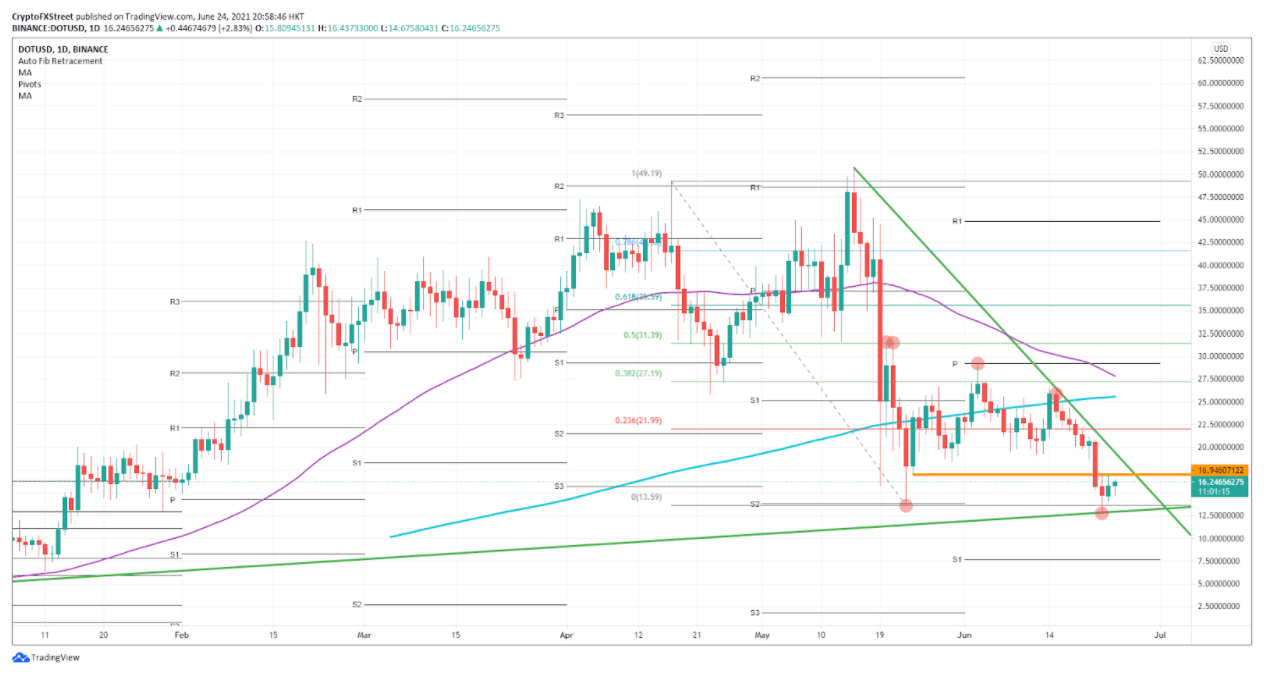

Polkadot price dipped lower with the general correction in other cryptocurrencies. But the correction was not that violent for DOT, and the ascending trend line from December was nicely tested at $12.50 before it rebounded back up.

To the upside, Polkadot price hit $16.95 and tested that level twice. As we get higher lows, DOT is getting squeezed against that top. Once this cryptocurrency goes above that level, we have the descending trend line left. But that does not have to be an issue, because the upward trend is there.

The 55 and 200-day Simple Moving Averages (SMAs) have not made a death cross yet, and the squeeze in Polkadot price is to the upside.

DOT can push up toward $30, which is around the monthly pivot. This level is of crucial importance as at the beginning of this month, we tested that level and could not get above it. It triggered the sell-off the market saw since then.

Polkadot price looks ready to complete the cycle and reclaim $30.

DOT/USD daily chart

Expect the rise to be slow due to the hurdles discussed with the $16.95 level, the descending trend line and the pivot. Any rejection of one of the above hurdles will push Polkadot price back to the ascending lower trend line around $12.50.

Author

FXStreet Team

FXStreet